Protection plus

Review and compare life insurance, income protection & super funds.

Here’s why it’s the most important insurance you’ll ever own…

Why protection plus is so important

Picture this…

If your income stopped tomorrow, how long would your savings last?

Already covered through your super fund?

Well consider this…

Savings

…the percentage of Australians with less than $1,000 in savings

Life insurance

…how much life insurance the average Australian has in super

Loan required

…the average loan required to build a new home in 2021

The basic insurance cover in your super fund is nowhere near enough…

What protection plus does

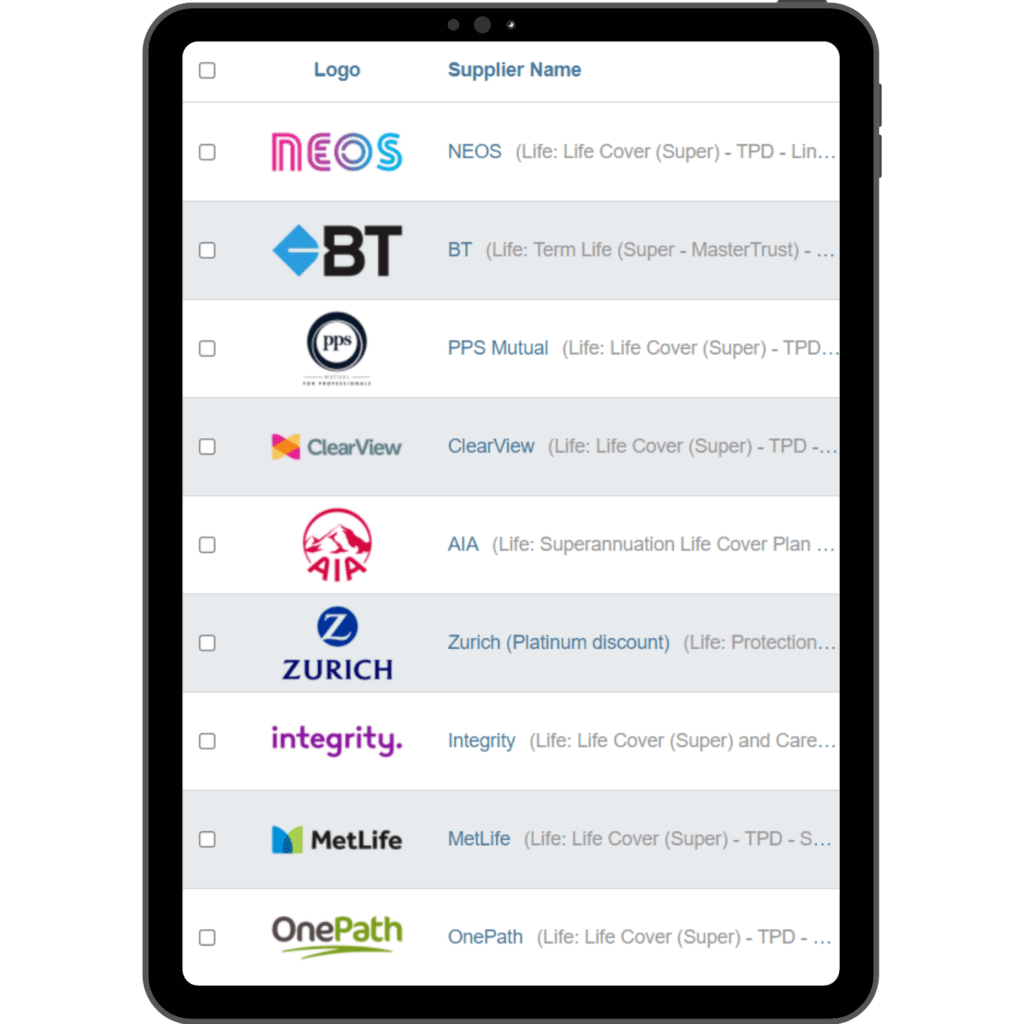

Insurance

Make sure you have the right safety net in place if anything goes wrong.

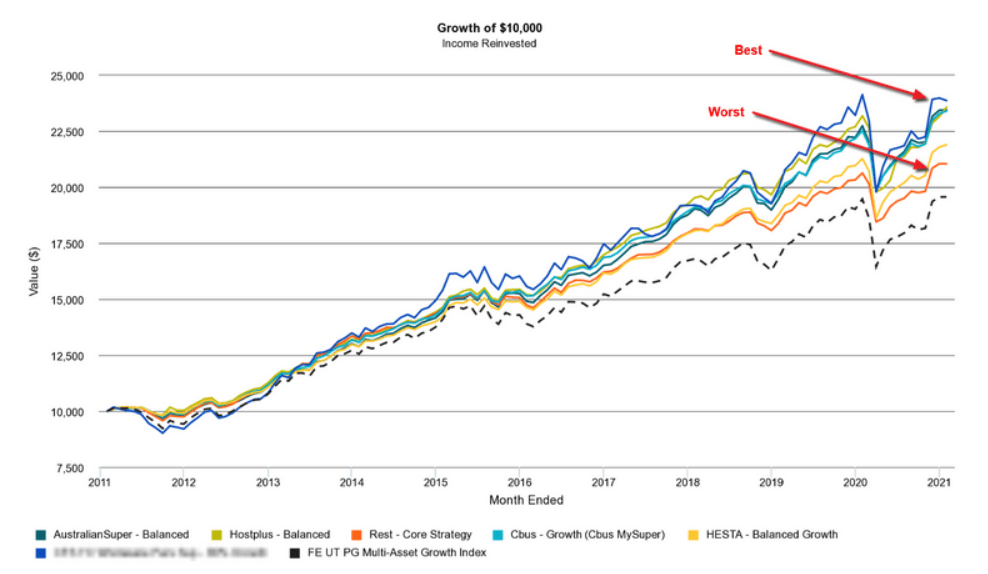

Super

Reduce your fees and get your investments working as hard as possible.

Retirement

Your comfortable retirement modelled to the nearest dollar.

Frequently asked questions

Still have questions about our protection plus service?

Do I really need cover?

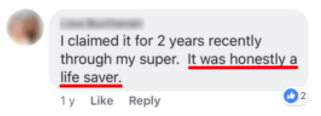

As of August 2018, 26% of Australian households have less than $1,000 in the bank!

Do you or the people you care about rely on your income to cover loan repayments, bills and other expenses?

If the answer is yes, having the right safety net is essential.

Make sure you insure you, not just the stuff you own.

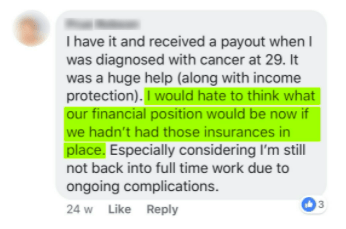

Do insurance companies actually pay claims?

Yes!

Life insurance claims in Australia topped $15 billion last year.

Australian Government data collected by ASIC & APRA in 2020 showed insurance companies:

- Accepted 96.4% of death claims

- Accepted 94% of income protection claims*

*where the policy was placed by a financial adviser.

Don’t I already have cover through my super fund?

Most people have some basic Death & Disability (TPD) cover through their super fund.

However, it’s not enough.

Rice Warner’s 2017 report ‘Underinsurance in Australia’ found the median Death cover held by Australians is $143,500. The average home loan taken out to build a new home in 2021 is $545,000.

Income protection insurance is often only issued on an ‘opt-in’ basis, so if you haven’t applied for cover, you may not have any.

How much will my cover cost?

It depends on:

- Your age

- Your job

- Your smoking status

- Your medical history

In the event of a claim, the last thing you or your loved ones want is to be screwed over by the fine print in a cheap insurance contract.

We’ll help you navigate the good and the bad to help you find cover that strikes the right balance between your needs and your budget.

What if I have a pre-existing medical condition?

Each insurer takes their own view on medical conditions.

Some are hard. Some are more lenient.

We can get a written preassessment from each insurer before we proceed with an application.

We can then come back to you with the best terms available to save you the run-around.

The same goes for ‘high risk’ jobs.

How do you get paid?

We receive a commission paid by the insurer to us.

It is not an additional cost to you.

This is the same way your mortgage broker is paid by your lender.

The amount we receive is the same no matter which insurer we recommend, so we’re not incentivised to recommend one insurer over another.

Our process is all about finding you the best cover at a good price.

Won’t I pay more using a financial adviser?

No.

Your insurance premium (the cost of your cover) is the same whether you approach an insurer directly, or use a financial adviser.

Using a financial adviser means you have ongoing access to professional support, as well as assistance with claims.

We work for you, not the insurance companies.

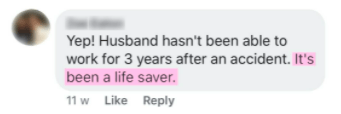

Can you help me if I need to make a claim?

Absolutely.

We’ve made the claims process simple and stress-free for hundreds of clients.

We’ll also work with you to review your cover as your life changes to make sure it’s still appropriate.