Business hours

Monday to Friday (8.30AM - 5PM)

Weekend (Closed)

An Age Pension eligibility calculator provides a quick snapshot of what you might be entitled to from Centrelink. It translates the government's complex rules around age, income, and assets into a straightforward, preliminary answer. Think of it as an essential first step in building your retirement plan.

Navigating Your Retirement With the Age Pension

Planning for retirement can feel like piecing together a complex puzzle. The Australian Age Pension is a critical piece of that puzzle for many, but figuring out if you qualify can be daunting. This is where an Age Pension eligibility calculator proves its worth.

Instead of seeing it as another complicated government form, view it as a tool that empowers you. Finding out if you're likely to qualify for the pension—and getting a rough idea of how much—is a fundamental part of building financial confidence for your later years. This guide will walk you through the process, putting you back in control of your retirement planning.

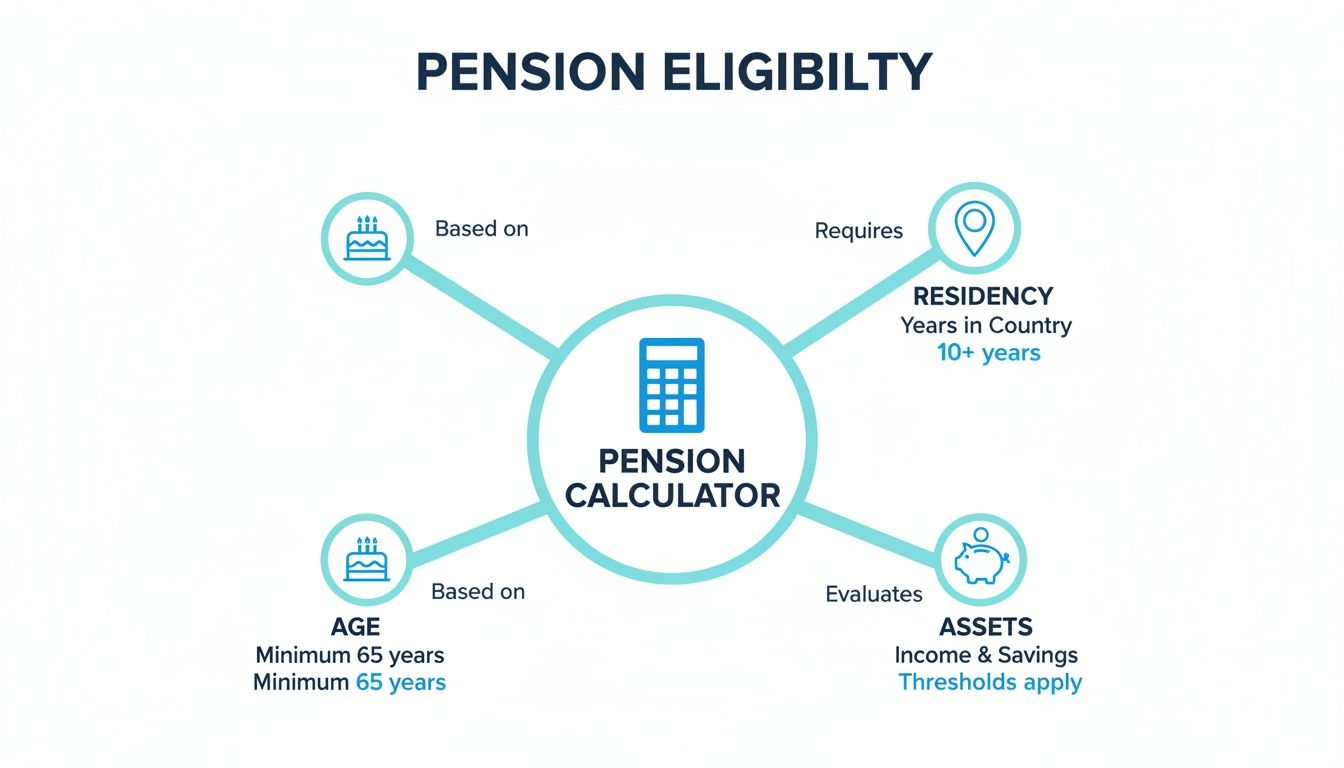

The Four Pillars of Pension Eligibility

Before you can get an estimate, you need to understand the four key areas that Centrelink assesses. Any age pension eligibility calculator will ask for details about these pillars:

- Age: You need to have reached the pension age, which is currently 67.

- Residency: Generally, you must be an Australian resident and have lived in the country for at least 10 years.

- The Income Test: Centrelink reviews all your sources of income to determine your payment rate.

- The Assets Test: The value of your assets (excluding your primary home) is the other major factor.

These four pillars are the foundation of the Age Pension system. Understanding where you stand on each one is vital, and it's precisely what a calculator helps you do. This clarity is the first step in the Wealth Collective process of mapping out a comprehensive retirement strategy.

Why a Quick Calculation Matters

For many in Western Australia, the average retirement age of 63.8 arrives well before the pension age of 67. This gap is precisely why planning ahead is so critical.

As of late 2025, the maximum Age Pension is $1,079.70 per fortnight for singles and $1,627.80 for couples combined. Without a quick check, you could unknowingly be leaving thousands of dollars on the table each year.

An initial calculation turns uncertainty into clarity. It provides the solid starting point needed to build a retirement plan that works for you, enabling informed decisions today that secure your financial future.

This is the first step in moving from guesswork to a real strategy. Our guide on how to plan for a successful retirement dives deeper into creating this kind of roadmap. Once you have an initial estimate from a calculator, you can start to see the opportunities and challenges ahead, setting the stage for the detailed, personalised financial advice that follows.

Understanding the Income and Assets Tests

Once you've met the age and residency requirements, Centrelink examines your finances using the income test and the assets test.

Think of them as two separate hurdles. Centrelink assesses you under both and then applies the test that results in a lower pension payment. It’s their way of ensuring the payment fits your specific situation. A good age pension eligibility calculator performs this comparison for you automatically.

This diagram provides a high-level view of how age, residency, and your finances fit together in the eligibility puzzle.

As you can see, your financial position is a central component. Let's explore what these two tests involve.

How the Income Test Works

The income test is a straightforward assessment of the money you receive from various sources, not just employment. Centrelink wants to know how much regular income you have to support yourself.

What do they count as 'income'?

- Wages: Any money earned from part-time or casual work.

- Rental Income: Net profit from investment properties.

- Overseas Pensions: Payments from pension schemes in other countries.

- Investment Income: This is where the concept of "deeming" comes into play.

Many people mistakenly believe Centrelink only looks at the actual dividends or interest their investments earn. Instead, they use deeming to estimate your investment income.

Deeming is a set of rules Centrelink uses to estimate the income your financial assets should be earning, regardless of what they actually earn. They apply a "deeming rate" to your investments to calculate an assumed income figure.

This means even if your savings are in a low-interest bank account, Centrelink assumes they are generating a standard rate of income. It's a method for keeping the assessment process consistent for everyone.

What Is the Assets Test?

While the income test looks at what you earn, the assets test is about what you own. It's a valuation of your total assets to see if you fall within the eligibility limits.

Crucially, your principal place of residence—your family home—is completely exempt from this test. For most Australians, this is their largest asset, so its exclusion is a significant advantage.

Here’s a quick rundown of what’s generally included and excluded:

Assets typically included:

- Investment properties

- Cars, boats, and caravans

- Your superannuation balance (once you reach Age Pension age). Learn more about what superannuation is in our detailed guide.

- Bank accounts, shares, and other financial investments

- Valuables like artwork and antiques

Assets typically excluded:

- Your primary home and up to two hectares of the land it's on

- Funeral bonds (up to a certain limit)

- An accommodation bond paid for a place in an aged care facility

The government sets thresholds for the assets test. If your assessable assets are below a certain limit, you may get a full pension. If they fall between the lower and upper limits, you may receive a part pension. If you exceed the upper threshold, you won't be eligible.

This table breaks down the current asset limits for homeowners.

Current Age Pension Assets Test Thresholds (Homeowners)

This table shows the asset value limits for receiving a full or part Age Pension for homeowners as of the latest update. Values above the full pension limit reduce your payment, and exceeding the part pension limit means you are ineligible.

| Your Situation | Full Pension Asset Limit | Part Pension Asset Limit (Cut-off Point) |

|---|---|---|

| Single | $301,750 | $674,000 |

| Couple (Combined) | $451,500 | $1,012,500 |

The limits vary significantly based on your relationship status, which is why accurate inputs are essential when using a calculator.

Bringing It All Together

An age pension eligibility calculator is designed to run your numbers through both the income and assets tests simultaneously. It then automatically shows you the result from whichever test leads to the lower pension payment.

This dual-test system highlights why effective retirement planning is about more than just saving a lump sum. It's about structuring your finances to work with the Centrelink rules. At Wealth Collective, our Retirement Roadmap service is built around this principle. We help you understand how your assets and income will be assessed so you can make smarter decisions before you retire.

By understanding how these tests work now, you're in a much better position to prepare. The next logical step is to see these rules in action with a calculator.

How to Use an Age Pension Eligibility Calculator

Knowing the rules is one thing, but applying them to your life is what truly matters. An Age Pension eligibility calculator bridges this gap, turning abstract concepts like asset thresholds and deeming rates into a clear, personalised estimate.

To see how it works, let’s follow a couple, John and Mary. They are homeowners approaching retirement and want a preliminary assessment of their Centrelink eligibility. By walking through their experience, you’ll see how straightforward it is to get your own initial snapshot.

Gathering Your Financial Puzzle Pieces

Before John and Mary use a calculator, they gather some basic information. Having these details ready makes the process faster and more accurate.

Here’s a quick checklist of what they prepared:

- Proof of Age: Their birth dates.

- Relationship Status: They are a couple living together.

- Homeownership Status: They own their home.

- Superannuation Balances: The latest statements for both.

- Bank Account Balances: A summary of their savings.

- Other Investments: Details of any shares or managed funds.

- Additional Assets: An estimated value for their car and caravan.

- Income Details: Information on any part-time work.

With these documents handy, John and Mary are ready to get their estimate.

A Step-by-Step Walkthrough

Using an age pension eligibility calculator is essentially a guided questionnaire. Let's follow John and Mary as they input their details.

Basic Details: They start by confirming their ages, relationship status (couple), and that they are homeowners. This sets the foundation for the calculation.

Entering Assets: They enter the combined value of their superannuation, bank accounts, and shares. Next, they add the estimated market value of their car and caravan. The calculator automatically exempts their family home.

Inputting Income: Mary works a casual job, so they enter her fortnightly pay. The calculator will automatically apply income test rules, including the work bonus.

Once all the numbers are in, they hit 'calculate'. The tool instantly processes their figures against both the income and assets tests, applying current thresholds and deeming rates.

The result isn't just a 'yes' or 'no'; it's an estimated fortnightly payment. For John and Mary, the calculator indicates they are likely eligible for a part pension.

This single number changes their retirement outlook. What was a vague question is now a tangible figure they can plan with. It gives them a baseline for their total retirement income when combined with their own super and savings. This quick calculation is the first, empowering step on their retirement journey, giving them the clarity to ask the right questions: Is this enough? Can we improve this figure? What should we do next?

This is precisely where a generic calculation ends and a personalised strategy begins. At Wealth Collective, we use this starting point to build a detailed plan, helping you understand not just what you might get, but how to structure your finances to achieve the best possible outcome.

What Your Calculator Results Really Mean

After using an Age Pension eligibility calculator, you have an answer: ‘full pension,’ ‘part pension,’ or ‘ineligible.’ This is a fantastic first step, but the real value lies in understanding what that result means for your retirement plan.

Think of it as a snapshot of your finances through the eyes of Centrelink. It boils down the complex rules into a single figure, which becomes the baseline for building a realistic retirement strategy. This number clarifies how much government support you might receive, allowing you to see the complete picture when added to your super and other savings.

Getting this initial estimate helps you move from hoping you'll have enough to knowing where you stand. From here, you can start making genuinely informed decisions about your future.

Decoding Different Scenarios

Your pension amount is always determined by whichever test—income or assets—results in the lower payment. Let's look at two common scenarios to see how this works.

Scenario 1: High Assets, Low Income

David and Sarah are a retired couple with $800,000 in super and investments. They draw a small income, easily passing the income test. However, their assets are well over the threshold for a full pension. The assets test is their limiting factor, reducing them to a part pension. Their result clearly shows that the structure of their wealth is impacting their eligibility.Scenario 2: Modest Assets, Part-Time Income

Helen is a single homeowner with $250,000 in super. Her assets are comfortably below the full pension threshold. However, she still works two days a week. In her case, the income test is the key factor. The calculator will show she's eligible for a part pension, but the payment is reduced due to her earnings. Her result tells her that her income is the variable she needs to manage.

These examples show that an age pension eligibility calculator does more than provide a number; it highlights which test is having the biggest impact on your potential payment.

The Nuance Behind the Numbers

A calculator gives a black-and-white answer based on your data today. It cannot account for the nuances of your personal situation or predict future life changes.

A generic result is a powerful starting point, not the final destination. It identifies opportunities and flags potential issues, but it doesn't create the plan to address them.

For instance, David and Sarah might have strategic options to restructure their finances to improve their eligibility. Helen could potentially adjust her work hours or make contributions to her super to optimise her position. These are moves a simple calculator isn't designed to suggest.

This is where professional guidance makes all the difference. At Wealth Collective, our Retirement Roadmap service is designed to pick up where the calculator leaves off. We dive into the story behind your numbers to build a personalised strategy that fits your life.

Connecting the Result to Your Retirement Plan

Your calculator result is a crucial piece of the retirement puzzle, but it's just one piece. The next step is to fit it into the bigger picture of your financial resources and life goals.

Here's how that result helps shape your strategy:

- If you get a full pension: Your plan will focus on ensuring your income and assets stay within the thresholds.

- If you get a part pension: The focus shifts to identifying which test is limiting you and exploring strategies to improve your entitlement.

- If you're ineligible: Your strategy will be about making your existing assets work efficiently to fund your retirement independently.

Ultimately, an age pension eligibility calculator is your first step toward clarity. It answers the question, "Where do I stand right now?" Once you understand that answer, you're empowered to take the next, more important step: building a retirement plan that secures the future you deserve.

Why a Calculator Is Only the First Step

Using an Age Pension eligibility calculator is an excellent starting point. It provides a quick, clear snapshot of your current situation. But that’s all it is—a snapshot. Retirement is a journey that could last for decades.

The calculator answers one question: "Based on my finances today, what might I be entitled to?" It can't predict the future, understand your personal goals, or suggest smart, legal ways to improve your position. Your financial life is full of complexities that a simple online form cannot grasp. It's a diagnostic tool, not a strategic one.

Beyond the Numbers: The Value of a Roadmap

This is where personalised financial advice becomes crucial. At Wealth Collective, our Retirement Roadmap service is designed to pick up precisely where the calculator leaves off. A great adviser doesn't just analyse your current numbers; they help you build a dynamic plan that can adapt as your life changes.

An adviser helps you explore the critical questions a calculator can't answer:

- Is my superannuation structured effectively for both growth and my future pension eligibility?

- Are there strategies I could use to reduce my assessable assets or income before I apply?

- How can I prepare for major life events, like selling a property or receiving an inheritance, without jeopardising my pension?

Thinking about your retirement savings is a massive piece of the puzzle. Our guide on how much super you might need to retire offers more perspective on this. An adviser's job is to connect all these pieces, ensuring every dollar works as hard as possible to fund the retirement you envision.

An eligibility calculator provides information. A personalised retirement plan provides a strategy. The first tells you where you are; the second shows you how to get where you want to go.

Your Personalised Strategy Awaits

Your vision for retirement is unique. A generic calculation can't map out the specific steps needed to make your dreams a reality. Building a solid retirement income is about optimising all your resources—super, investments, and potential government support—so they work together seamlessly.

The real benefit of professional guidance is having a partner who knows the rules inside and out and can apply them to your unique situation. We can help you navigate the complexities and build a plan that not only aims to maximise your entitlements but also aligns perfectly with your vision for the future.

Ready to move beyond a simple calculation and start building a real strategy? Let's discuss what's possible.

Book a complimentary 15-minute call with one of our advisers today to discuss your circumstances and see how our Retirement Roadmap can provide the clarity and confidence you need.

Got Questions About the Age Pension? We've Got Answers

Digging into the Age Pension rules can leave you with more questions than answers, even after using an eligibility calculator. That’s completely normal.

To provide more clarity, we've answered some of the most common questions we hear from pre-retirees in Western Australia. Understanding these key points is the next step in turning a rough estimate into a reliable retirement plan.

Is My Family Home Included in the Assets Test?

This is a major concern for many, but the answer is usually a relief. Your principal place of residence—the home you live in—is exempt from the Age Pension assets test. This includes up to two hectares of land it’s on.

However, be aware that if you sell your home, the proceeds will be counted as an asset unless you use them to purchase a new home within a timeframe set by Centrelink. Proactive planning around your property can make a significant difference to your eligibility.

Can I Still Do a Bit of Work and Get the Pension?

Absolutely. The government encourages it through a system called the Work Bonus, which allows you to earn a certain amount of income from work before it affects your pension payments.

Essentially, the Work Bonus lets Centrelink disregard a portion of your earnings, increasing your total income. The rules can change, so it's wise to check the latest figures. While a calculator factors in the basics, expert advice can show you how to structure your work to make the most of the bonus, maximising your income without unintentionally reducing your pension.

Think of your retirement income as a blend of sources: your super, part-time work, and the pension. The goal is to make them work together as efficiently as possible.

This is where smart planning really pays off. It’s not just about qualifying; it’s about optimising.

What on Earth is Deeming and How Does It Affect Me?

Deeming is Centrelink jargon that sounds more complex than it is. Simply put, deeming is the method Services Australia uses to estimate the income your financial assets are earning, including bank accounts, shares, and superannuation funds.

Centrelink applies a set 'deeming rate' to the value of these assets to calculate an assumed income, regardless of what your investments actually earn.

Even if your investments have a poor year, Centrelink still assumes they are generating income based on the official deeming rates. The goal is to create a consistent assessment for everyone. Understanding deeming is crucial for structuring your investments in a way that aligns with the pension rules.

What Happens if My Situation Changes?

Life changes, and you are obligated to inform Services Australia of any significant changes to your circumstances, typically within 14 days.

This includes a wide range of events:

- Financial changes: Receiving an inheritance, selling an investment, or starting a new job.

- Living situation changes: Moving house, taking an extended overseas trip, or entering aged care.

- Relationship changes: Getting married, separating, or starting a new partnership, which changes your assessment status.

Forgetting to report these changes can lead to overpayment, which you will have to pay back. Having a Wealth Collective financial adviser in your corner means we can help you manage these events proactively. We’ll ensure you remain compliant while adjusting your strategy to fit your new reality, giving you one less thing to worry about.

Navigating these complexities is where professional guidance truly shines. An age pension eligibility calculator provides a vital starting point, but a personalised strategy from Wealth Collective ensures you have a clear and confident path for the years ahead. Ready to transform your calculator result into a robust retirement plan?

Book a complimentary 15-minute call with our team today to start building your Retirement Roadmap.