Business hours

Monday to Friday (8.30AM - 5PM)

Weekend (Closed)

Protection Plus

Your Financial Safety Net

Life can be unpredictable, but your financial future doesn’t have to be

Protection Plus

Protection Plus by Wealth Collective is designed to give you confidence and peace of mind by reviewing and optimizing your personal insurance and superannuation.

Whether you’re securing your family’s future, protecting your income, or planning for retirement, our expert Financial Advisers are here to make it simple and stress-free.

Protect what matters most

Personal insurance

Life insurance, TPD, Traum and Income Protection aren’t just policies—they’re safety nets for your loved ones and your lifestyle.

With Protection Plus, we’ll help you:

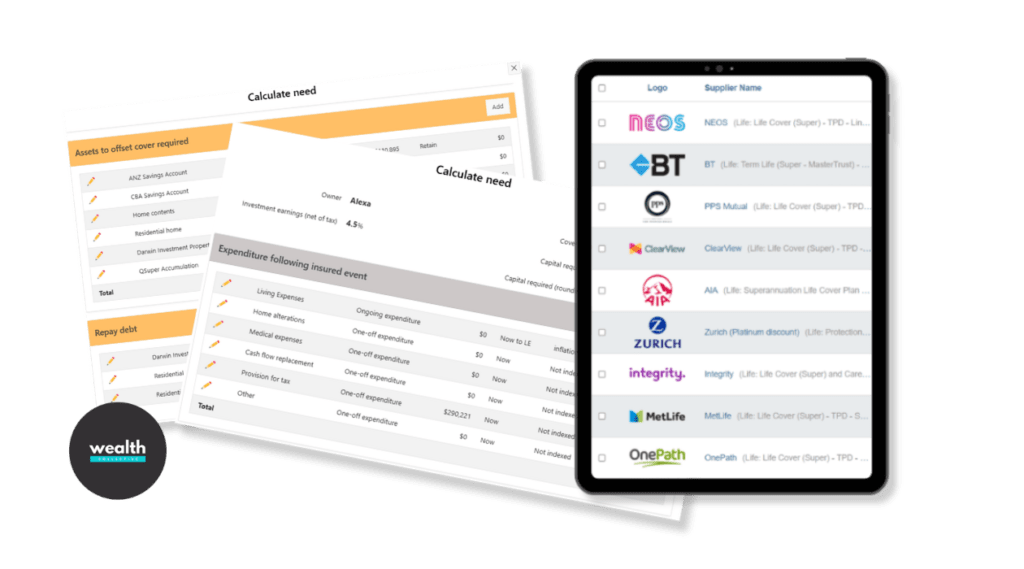

Find your perfect fit

Work out the right level of cover for your unique needs and goals.

Compare the best options

Evaluate insurers based on price, product features, and policy terms to ensure you get the best value.

Smart strategies

Get advice on structuring policies inside or outside super to reduce the impact on your personal budget.

Stress-free support

Let us handle the research, recommendations, and application process from start to finish.

Stay prepared

Enjoy ongoing reviews and claims support as your circumstances evolve.

Optimise your retirement savings

Superannuation

Your super is one of the most powerful tools for building long-term wealth.

We make sure it’s working as hard as you are. With Protection Plus, you’ll get:

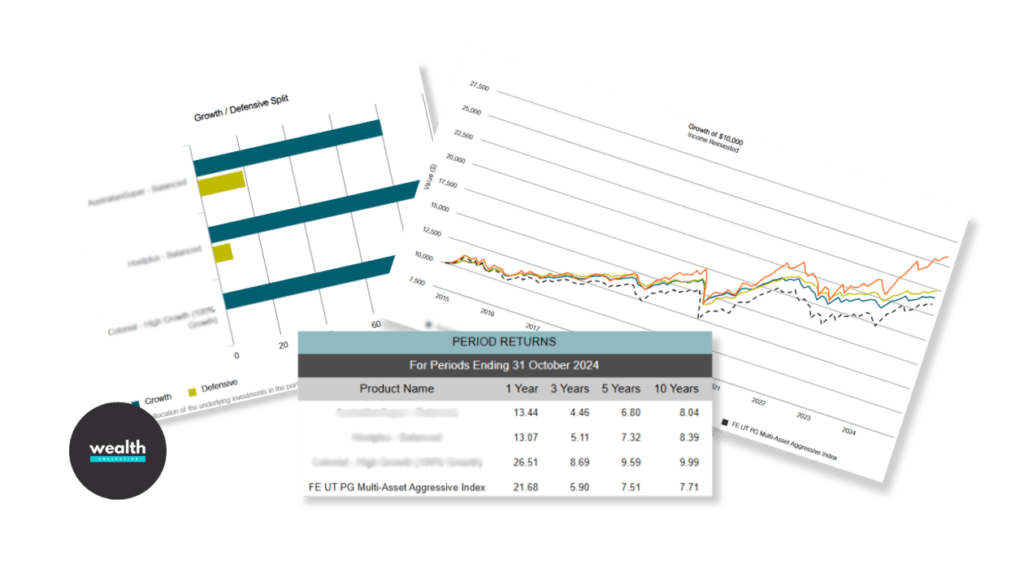

Comprehensive comparisons

Review hundreds of super fund options to find the best fit for you.

Low fees, higher growth

Reduce fees by over 40% on average, leaving more in your pocket.

Strong investments

Ensure your chosen investment option is performing effectively with expert comparisons across funds.

Track your progress

Understand if your super balance is on track for your retirement goals.

Visualise your future

See detailed modelling on the recommended changes, often leading to tens or even hundreds of thousands of dollars more at retirement.

Secure your future with confidence

Why choose Protection Plus?

Personalised recommendations

Every client’s situation is unique, and so are our solutions.

Expert team

With more than 50 years of combined experience, our qualified Financial Advisers are here to guide you every step of the way.

Satisfaction guaranteed

If you’re not happy, we’ll work with you until you are—or refund your money, no questions asked.

Protection Plus FAQ

What does Protection Plus cover?

Protection Plus is focused on two key areas:

- Personal Insurance: We review your Life, TPD, Trauma and Income Protection to ensure you have the right level of cover for your needs, compare insurers for value and quality, and help structure policies to minimize the impact on your budget.

- Superannuation: We compare super funds to reduce fees (often by 40% or more), improve investment performance, and show you if your retirement savings are on track.

How will you compare my insurance and super options?

For personal insurance, we assess insurers based on price, product features, and policy terms.

For superannuation, we compare hundreds of funds, analyzing fees, performance, and investment options.

Our recommendations are backed by detailed data and tailored to your unique situation.

What if I already have insurance through super?

That’s exactly where we can help.

We’ll review your existing arrangements to identify any gaps, ensure you’re not overpaying, and suggest changes that align with your goals.

Even if you’re happy with your current setup, a second opinion can often uncover hidden opportunities.

How is my insurance structured through Protection Plus?

We’ll help you decide whether to hold insurance inside or outside of super, balancing cost and coverage to suit your needs.

This ensures you get the protection you need while managing the impact on your personal cash flow.

How does the free initial strategy session work?

In the session, you’ll meet with one of our expert Financial Advisers.

They’ll take the time to understand your needs, answer your questions, and explain how we can help.

There’s no obligation, just clarity on what’s possible for you.

Will this cost me a lot?

Not at all.

The initial strategy session is completely free.

If you choose to proceed, we’ll work with you to create a plan that delivers maximum value, often saving clients thousands in fees and boosting their retirement savings significantly.

How long will it take to see results?

The full review and optimization process typically takes 3-4 weeks.

From the first strategy session, you’ll gain immediate clarity on your current situation and the steps to improve it.

After your free strategy session, you’ll sign an authority form, and we’ll handle the rest—gathering details on your current super and insurance policies, comparing options, and presenting clear recommendations.

You can sit back while we do the heavy lifting.

What happens if my situation changes in the future?

With Protection Plus, you’re not left on your own.

We provide ongoing reviews and claims support, ensuring your coverage stays relevant as your life evolves.

Whether you experience a big life change or just want to check in, we’re here to help.

Start securing your future today

Your journey to financial security starts with a single step

Book your free 10 minute intro call today, and let us show you how Protection Plus can help you protect your future, grow your wealth, and live with confidence

Start securing your future today

Your journey to financial security starts with a single step

Book your free 10 minute intro call today, and let us show you how Protection Plus can help you protect your future, grow your wealth, and live with confidence