Business hours

Monday to Friday (8.30AM - 5PM)

Weekend (Closed)

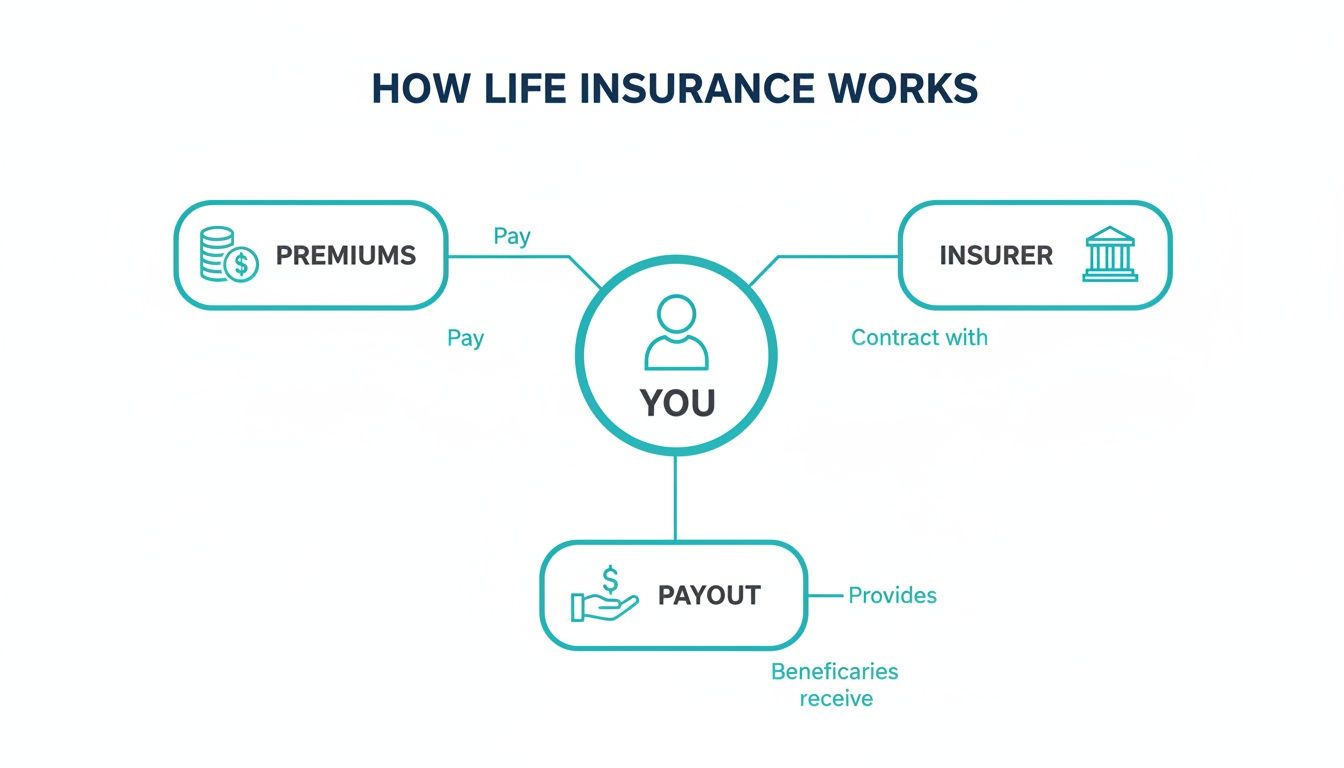

So, how does life insurance actually work?

Think of it less like a complicated financial product and more like a promise. It's a straightforward agreement you make with an insurer to create a financial safety net for the people you care about most.

You pay a regular amount, called a premium, and in exchange, the insurer guarantees a financial payout if you were to pass away or, depending on the policy, suffer a serious illness or injury.

A Financial Back-Up Plan for Your Loved Ones

Life insurance is about protecting the future your family relies on. Take a moment and ask yourself: if you were no longer there to earn an income, how would your family cope financially? Could they keep up with the mortgage repayments, pay for the kids' education, or even just manage the weekly grocery bills?

For most of us, the honest answer is that it would be an incredible struggle.

This is exactly the problem life insurance is designed to solve. It steps in to replace your financial contribution, giving your family breathing room and stability during an unimaginably tough time. The lump-sum payout can be used to clear major debts like the mortgage, cover funeral costs, and create a financial foundation for them to rebuild their lives.

The 4 Key Types of Personal Insurance

A truly effective safety net usually isn't just one policy, but a strategic combination of a few different types of cover. Each one is designed to protect you from a different kind of financial shock.

Let's quickly run through the main players:

Table: Quick Guide to Australian Life Insurance Types

| Type of Cover | What It Covers | Who It's For |

|---|---|---|

| Death Cover (Life Insurance) | Pays a lump sum to your beneficiaries when you pass away. This is the classic "life insurance" most people think of. | Anyone with dependents or significant debts (e.g., a mortgage). |

| Total & Permanent Disability (TPD) | Provides a lump sum if you become so seriously ill or injured that you can never work again. | Anyone whose ability to earn an income is crucial to their financial security. |

| Trauma Cover (Critical Illness) | Pays a lump sum if you're diagnosed with a specific major illness like cancer, a heart attack, or a stroke. | Individuals wanting a financial buffer to cover medical bills and recovery costs without stress. |

| Income Protection | Replaces up to 75% of your regular income if you're temporarily unable to work due to sickness or injury. | Essential for anyone who relies on their monthly pay cheque to cover living expenses. |

These four pillars form the basis of a solid personal protection strategy. At Wealth Collective, our process involves figuring out the right mix and level of cover that actually matches your life, your family, and your goals.

Getting this structure right is crucial, as it works hand-in-hand with your broader estate plan. After all, you want to ensure the proceeds end up in the right hands, at the right time. Learn more about what happens if you don't have a will in our detailed guide.

Life insurance isn’t about you. It's about providing security and peace of mind for the people who would be left behind, guaranteeing your financial responsibilities are met even when you can’t meet them yourself.

Life insurance is a major part of Australia’s financial landscape. The industry reached $24.2 billion in revenue by pooling the premiums from millions of Australians to manage the risk of death, disability, and illness. It’s this scale that allows the system to work, providing a critical safety net for families all over the country.

The Four Key Types of Personal Insurance Explained

It’s a common mistake to think of ‘life insurance’ as just one thing. A better way to look at it is as a personal protection toolkit, with four distinct tools designed to shield you from different financial shocks.

The real art of building a solid financial safety net is knowing which of these tools to use—and in what combination—to match your specific life and circumstances.

Let's unpack the four main types of cover and see how they work in the real world.

Death Cover: Securing Your Legacy

This is the one everyone knows. At its core, Death Cover is a simple pact: you pay regular premiums, and in return, the insurer pays a lump sum to your loved ones (your beneficiaries) when you pass away.

Its main job is to replace the income you would have provided, ensuring your family isn't left in a financial lurch. This payout can wipe out major debts like the mortgage, keeping the family home secure. It also covers funeral costs and can create a pool of money to be invested, generating an ongoing income for everyday expenses and future goals, like the kids’ university fees.

Imagine a young professional with a new mortgage and two children. They might take out a $1.5 million policy. This figure isn’t random; it’s calculated to clear their $700,000 mortgage, set aside $100,000 for each child’s education, and leave a $600,000 nest egg for their partner to invest for future living costs.

This diagram shows the basic relationship in a nutshell. Your premiums go into a large pool managed by the insurer, which is then used to provide a significant payout when it's needed most.

The crucial takeaway is the exchange of value: your steady, manageable payments secure access to a much larger, potentially life-changing sum for your family when they are at their most vulnerable.

Total and Permanent Disability (TPD) Cover

What if an accident or illness doesn't kill you but leaves you unable to ever work again? That’s exactly what Total and Permanent Disability (TPD) Cover is for. It provides a lump sum payment if you suffer an injury or illness so severe that it ends your career for good.

This payout is all about funding the massive life adjustments that come with permanent disability. Take a construction manager who suffers a severe back injury and can never return to their profession. A TPD payout could help them:

- Wipe out their mortgage, instantly removing their biggest monthly bill.

- Fund home modifications like wheelchair ramps or an accessible bathroom.

- Cover ongoing medical bills, specialist care, and rehabilitation that private health might not touch.

- Provide the capital to retrain for a new line of work or invest to create a long-term income stream.

TPD is your financial backstop, protecting your quality of life and independence if your ability to earn an income is suddenly and permanently lost.

Trauma Cover: Your Financial Breathing Room

Getting a diagnosis for cancer, a heart attack, or a stroke is devastating enough without having to worry about money. Trauma Cover (sometimes called Critical Illness Cover) is designed to take that financial stress off the table. It pays a lump sum as soon as you're diagnosed with one of the specific conditions listed in the policy.

The key difference here is that the payout is triggered by the diagnosis itself—not by your inability to work. This gives you immediate cash and, more importantly, options.

A Trauma payout gives you the freedom to step back from work without financial penalty, pay for treatments not fully covered by Medicare, or even access specialist care overseas. It buys you time and choice when you need them most.

For example, a small business owner diagnosed with cancer could use their trauma payout to hire a temporary manager. This lets them focus 100% on getting better, knowing the business—and their family's income—is in safe hands.

Income Protection: The Day-to-Day Bill Payer

While the other covers usually pay a large lump sum for a major event, Income Protection is different. Think of it as a substitute for your monthly pay cheque when you're temporarily out of action due to sickness or injury.

After a set waiting period (which you choose, typically 30, 60, or 90 days), the policy starts paying you a monthly benefit, usually up to 75% of your pre-tax income. These payments continue until you’re well enough to return to work or until the benefit period on your policy runs out (which could be for a few years, or all the way to age 65). It’s the cover that keeps the lights on and ensures the mortgage, groceries, and school fees get paid, stopping you from having to burn through your savings while you recover.

As part of the Wealth Collective process, our Protection Plus service is designed to craft a strategy that blends these four covers in the right way for you. We help you build a financial safety net that’s robust, comprehensive, and perfectly suited to your life, your family, and your goals.

How Premiums and Underwriting Shape Your Policy

Ever wondered how an insurer comes up with the specific dollar figure for your premium? It’s not just a number pulled from thin air. It’s the result of a careful, personalised risk assessment called underwriting.

Think of underwriting as the insurer's due diligence. It's their way of getting to know you—your health, your job, your lifestyle—to work out a fair price for the cover you need. This process is the engine room of the insurance world, ensuring the cost of your policy accurately reflects the likelihood you'll need to make a claim.

The underwriter's job is to build a complete picture of you, focusing on anything that might impact your long-term health. It might feel a bit intrusive, but it's a crucial step that keeps the entire insurance system fair and financially stable for everyone who relies on it.

Key Factors That Influence Your Premium

Insurers look at a range of factors to build your risk profile. While every insurer has its own specific criteria, these are the heavy hitters you can always expect to see.

- Age: This is arguably the biggest one. Statistically, the older we get, the higher the risk of health issues, so premiums naturally rise with age.

- Health and Medical History: Expect a deep dive here. They'll ask about your personal health, any pre-existing conditions like asthma or high blood pressure, and your family's medical history too.

- Smoking Status: This is a major red flag for insurers. Being a smoker automatically puts you in a higher risk category, and you can expect to pay premiums that are often double what a non-smoker would pay.

- Occupation: What you do for a living matters. An accountant sitting at a desk all day faces very different risks to a FIFO worker on a mine site or a commercial diver. Your premiums will reflect that.

- Hobbies and Lifestyle: Are you a weekend skydiver or a competitive race car driver? High-risk hobbies can lead to higher premiums or even specific exclusions written into your policy.

The golden rule is simple: the lower your overall risk, the more affordable your cover will be. It’s exactly why getting life insurance sorted when you're young and healthy is one of the smartest financial moves you can make.

Stepped vs Level Premiums: Understanding Your Options

After your risk has been assessed, you’ll typically be offered two ways to pay for your cover: stepped or level premiums. Getting your head around the difference is absolutely critical for your long-term budget.

Stepped Premiums:

These premiums start out relatively cheap but are recalculated every year as you get older. So, your premium ‘steps up’ at each policy anniversary. This can be great for cash flow when you’re just starting out, but you have to be prepared for those costs to climb significantly down the track.

Level Premiums:

A level premium is calculated based on your age when you take out the policy and then ‘locked in’. It stays the same year after year, usually until you turn 65 or 70. While it costs more upfront than a stepped premium, it provides total certainty for your budget and can save you an enormous amount of money over the life of the policy.

The choice between stepped and level premiums isn't just about cost—it's about strategy. A level premium can save you tens of thousands of dollars over the life of your policy, making it a powerful tool for long-term financial stability.

Deciding which structure is right for you depends on your age, your budget, and how long you intend to keep the cover. Honestly, this is one of the key areas where getting professional advice can make all the difference.

At Wealth Collective, our Protection Plus service is designed to guide you through this. We don’t just find a policy; we manage the entire underwriting process for you, presenting your situation to the insurer in the best possible light to secure fair terms and affordable premiums that work for you now and in the future.

Navigating the Claims Process When You Need It Most

A life insurance policy is really just a promise. It's a promise that your family will have a financial safety net when they need it most. But how does that promise actually turn into real support? Understanding the claims process helps pull back the curtain, showing you how it all works in practice.

For a family grieving or reeling from a serious medical diagnosis, the last thing they want to face is a mountain of confusing paperwork. While the process itself is designed to be straightforward, the emotional weight can make it feel overwhelming. This is where having a professional guide in your corner makes all the difference.

The Core Steps of Making a Claim

Every insurer has its own specific procedures, but the journey from lodging a claim to receiving a payment generally follows the same path. It’s built to be thorough enough to prevent fraud, yet efficient enough to get the money to the people who desperately need it.

Here’s what you can typically expect:

- Initial Notification: It all starts when your beneficiaries (or you, for a TPD or Trauma claim) get in touch with the insurer to let them know a claimable event has happened.

- Forms and Documentation: The insurer will send over the claim forms. These need to be filled out and sent back with all the supporting documents.

- Providing Proof: This is the most crucial part. The insurer will require official evidence, which could be:

- A certified copy of the death certificate.

- Detailed medical reports from specialists for TPD, Trauma, or Income Protection claims.

- Proof of identity for both the policyholder and the beneficiaries.

- Assessment: The insurer's claims team will then carefully review everything you’ve submitted to make sure it aligns with the policy's terms and conditions.

- Payment: Once the claim gets the green light, the benefit is paid out to the nominated beneficiaries, either as a lump sum or an ongoing income stream, depending on how the policy was set up.

You Don’t Have to Do This Alone

This is exactly where having an adviser from Wealth Collective becomes your family’s greatest asset. Instead of your loved ones trying to manage complex forms and chase up insurers during an incredibly stressful time, we do it all for them.

We step in to handle the entire process. From lodging the first piece of paperwork to liaising with the insurer and making sure every document is correct and on time, we lift that administrative burden completely. It turns a daunting task into a supported, straightforward process. This is one of the most important ways our advice delivers real value, long after the ink on your policy has dried. It’s also vital to know that your choice of beneficiaries has a huge impact here, particularly when super is involved. You can check out our guide on what happens to your super when you die for more detail on this important topic.

It’s a common myth that insurers are always looking for loopholes to avoid paying. The reality couldn't be more different. The statistics show that legitimate claims get paid.

The Australian life insurance industry has an incredibly strong track record of honouring its commitments. Life insurers pay out claims at an industry-average acceptance rate of 97-98% for death cover, with most payouts finalised in just one to two months. Other policy types also have high approval rates, with Income Protection at 94-96% and advised Trauma claims at 86%. This data shows that policies arranged through expert advisers, like those at Wealth Collective, tend to perform better because they’re structured correctly from day one. You can learn more about these claim payment statistics and gain further insights.

Insurance Inside Super vs. Outside: Where Should You Hold Your Cover?

For most Aussies, the first time they even realise they have life insurance is when they spot it tucked away inside their superannuation fund. It's usually a default feature, a basic level of cover that gets put in place with zero paperwork. But just because it’s the easy option, is it the best option for you?

The convenience is definitely the main appeal. Premiums get paid straight from your super balance, so you don't see the cash leaving your bank account. This "set and forget" nature means millions of Australians have at least some cover, which is a whole lot better than having none.

But here’s the catch: relying only on this default cover can leave you and your family dangerously exposed. Getting your head around the trade-offs between holding insurance inside your super versus outside is one of the most important steps in making sure your safety net will actually hold up when you need it.

The Good and Bad of Insurance in Super

Insurance held within your super is what we call 'group' insurance. Think of it as a one-size-fits-many product. It has some real pluses, but it also comes with some pretty serious limitations you need to know about.

The Upsides:

- Easy Setup: The automatic nature of it all makes getting basic protection incredibly simple.

- Tax-Effective Premiums: Because premiums are paid with pre-tax dollars from your super contributions, it can feel like a cheaper way to fund your cover.

The Downsides:

- Limited Cover: The default amounts are often quite low—nowhere near enough to pay off a mortgage and provide for a young family.

- Strict Definitions: The definitions for what constitutes a TPD or income protection claim can be much tougher than standalone policies, which can make it harder to get a payout approved.

- Surprise Tax Bills: A lump-sum death or TPD benefit paid from super to a non-financial dependant (like an adult child) can be taxed, shrinking the amount your family actually receives.

The Control You Get With a Retail Policy

A 'retail' policy is one you arrange yourself, typically with an adviser, and hold completely separate from your superannuation. It takes a bit more effort to set up, but the difference in quality, control, and flexibility is massive.

Retail policies simply offer more. You get access to better policy definitions, much higher cover amounts, and a whole suite of optional benefits you can add on. Most importantly, they are fully underwritten from day one, which means the insurer assesses your personal health and history right at the start. This gives you far more certainty that the policy will actually pay out when it matters most.

When you hold your insurance outside of super, you're in the driver's seat. It gives you the power to build a plan with the exact definitions, ownership structures, and benefit amounts your family truly needs, without compromise.

This is exactly where getting expert advice can be a game-changer. As part of the Wealth Collective process, a dedicated adviser will put your current super-based insurance under the microscope. We’ll compare it to top-tier retail policies to figure out the smartest structure for you—one that gives you maximum protection in the most cost-effective way.

Sometimes, a blended approach using both is the right answer. To get a better feel for how your super works, check out our guide on how to switch super funds. We can help you build a strategy that gives you and your family complete peace of mind, knowing you’re properly protected.

Calculating How Much Life Insurance You Really Need

Figuring out how much life insurance you actually need is one of the most critical financial questions you’ll ever face. This is where the theory stops, and you start making a tangible plan for your family’s future. While those online calculators can give you a ballpark figure, they often miss the nuances and unique details of your life.

A proper calculation is about much more than just multiplying your salary by ten. It's about building a specific, lump-sum amount designed to clear every financial hurdle your family would face without you. Think of it as creating a bespoke financial safety net, woven from your specific debts, future goals, and ongoing living expenses.

A Framework for Your Financial Needs

To land on a number that makes sense, you need to add up every single financial responsibility you want your policy to handle. This isn't just about covering the big-ticket items; it's about making sure your family can continue their life without money worries compounding their grief.

Your calculation should create a pool of capital large enough to:

- Clear All Debts: This is the absolute starting point. Tally up your mortgage, car loans, credit card balances, and any personal loans to wipe the slate clean for your loved ones.

- Cover Final Expenses: These are the immediate costs, like funeral arrangements, outstanding medical bills, and estate administration fees. Setting aside $20,000 to $30,000 is a realistic baseline.

- Replace Your Income: How many years of your salary would your family need to maintain their lifestyle? Multiply your after-tax income by the number of years you want to support them.

- Fund Future Goals: What big-picture dreams are on the horizon? This is where you factor in costs like your kids’ university fees, a wedding fund, or even helping them get a foot on the property ladder.

Tailoring Your Cover to Your Life Stage

As you move through life, your insurance needs will shift and evolve. A young professional with a new mortgage has a vastly different set of requirements compared to an established business owner focused on their legacy. This is precisely why generic advice just doesn't cut it.

The Australian life insurance market is forecast to hit AUD 150.78 billion by 2034, and Western Australia holds a significant 16.4% of that market. This local context matters. For instance, with WA home approvals recently jumping 19.5%, the need for robust mortgage protection is more relevant than ever for local families. These figures show why a one-size-fits-all approach is inadequate for WA residents and business owners who need advice that mirrors their economic reality. Discover more insights about the Australian insurance market.

To help you start thinking about this, we've put together a simple checklist outlining common financial considerations at different points in your life.

Needs Analysis Checklist for Different Life Stages

| Financial Consideration | Young Professional | High-Income Earner | Business Owner | Pre-Retiree |

|---|---|---|---|---|

| Mortgage Repayment | ✅ | ✅ | ✅ | ☑️ |

| Income Replacement (10+ Years) | ✅ | ✅ | ✅ | ☑️ |

| Children's Education Fund | ☑️ | ✅ | ✅ | ☑️ |

| Business Debt Clearance | ✅ | |||

| Key Person Protection | ✅ | |||

| Investment Portfolio Protection | ✅ | ✅ | ✅ | |

| Estate Equalisation | ☑️ | ✅ | ✅ | |

| Final Expenses & Legal Fees | ✅ | ✅ | ✅ | ✅ |

This checklist is just a starting point, but it illustrates how your priorities change over time, requiring a strategy that can adapt with you.

Calculating your insurance needs is the first step toward true peace of mind. It transforms a vague worry into a concrete plan, ensuring the promises you've made to your family are financially guaranteed, no matter what.

Getting this number right is far too important to leave to an online form or guesswork. At Wealth Collective, our process is designed to bring you absolute clarity. We sit down with you to carefully map out your debts, income, and your family's biggest dreams to arrive at a precise figure. From there, we build a Protection Plus strategy that delivers exactly what you need—nothing more, nothing less.

Ready to find your number? Book a complimentary initial call with us today.

Where to From Here? Taking the Next Step

We’ve covered a lot of ground in this guide, from how life insurance actually works to the different ways it can protect the people and goals you hold dear. We've untangled the factors that shape your premiums and walked through what happens if your family ever needs to make a claim. With these foundations in place, the next move is turning what you now know into a plan that works for you.

But let’s be honest, going from understanding the theory to putting a real-world plan in place can feel like a huge leap. Rather than trying to piece it all together yourself—navigating the fine print and the underwriting process alone—it makes sense to have an expert in your corner. This is the best way to ensure the strategy you build is solid, affordable, and actually fits your life.

Let's Make This Simple

At Wealth Collective, our job is to make securing your family’s future feel straightforward and even empowering. We're firm believers that good advice cuts through the complexity, leaving you with clarity and the confidence to make the right call. We don’t start with products; we start with you—your life, your goals, and your budget.

Protecting your family's future is one of the most important financial commitments you will ever make. Partnering with an adviser ensures it's done right, providing peace of mind that your loved ones will be cared for, no matter what happens.

We’re here to help you build a plan that isn't just 'good enough', but genuinely right for you. That means finding the perfect mix of cover, structuring your policies in the most tax-effective way, and making sure every detail is handled correctly from day one.

It all starts with a simple chat about what's most important to you. Let's take that crucial step together.

Ready to secure your financial future? The team at Wealth Collective is here to help. Book a complimentary 10-minute introductory call to discuss your personal situation and discover how we can build a protection plan for you. Start your journey with us today.