Business hours

Monday to Friday (8.30AM - 5PM)

Weekend (Closed)

When it's time to compare income protection policies, you need to look well beyond the monthly premium. The best policy for you is one that’s built on solid definitions, flexible benefits, and waiting periods that actually work for your situation. It's about finding cover that will be there for you when you need it most.

A Practical Guide to Comparing Income Protection

Choosing the right income protection isn't about snagging the cheapest quote. It’s about securing your financial stability if you're suddenly hit with an illness or injury. Too many people fall into the trap of a price-first comparison, only to find out when it's too late that their "bargain" policy is riddled with gaps, restrictive definitions, or exclusions that make it practically useless.

The only policy worth having is one that truly fits your job, your income, and your life.

This guide is designed to take you past the glossy brochures and headline prices. We want to give you the confidence to look at what really matters in a policy. If you need a refresher on the basics, you can check out our article explaining what income protection insurance is in Australia.

Why a Deeper Comparison Matters

At claim time, the gap between a generic policy and one that's been properly structured can be huge. A surgeon, for instance, absolutely needs a policy with an 'Own Occupation' definition. This protects them if they can no longer perform the specific, highly-skilled duties of their job, even if they could technically work as a university lecturer.

Similarly, a small business owner might need their policy to cover ongoing business expenses, not just their personal salary. These are the kinds of critical details that get missed in a quick online quote comparison.

A policy that seems affordable today could become incredibly costly if it fails to pay out when you need it most. The true value of income protection is revealed not in its premium, but in its reliability during a crisis.

Here at Wealth Collective, our process is designed to handle these complexities. We dig deep, comparing policies from different insurers to make sure the features and fine print line up perfectly with your circumstances.

Whether you're a young professional just starting out, a seasoned business owner, or getting ready for retirement, this guide will give you the essential tools to make a smart decision. Let's break down the key elements you need to compare.

| Comparison Point | Surface-Level Check (Common Mistake) | In-Depth Analysis (What Experts Do) |

|---|---|---|

| Cost | Choosing the lowest monthly premium. | Assessing premium structure (Stepped vs. Level) for long-term affordability. |

| Benefit Period | Assuming "long-term" cover is sufficient. | Matching the benefit period to your retirement age (e.g., to age 65). |

| Occupation Definition | Accepting any standard definition. | Ensuring it's an 'Own Occupation' definition for specialised roles. |

| Waiting Period | Picking the shortest waiting period available. | Aligning the waiting period with your emergency fund and sick leave. |

What to Look for When Comparing Policies

When you start comparing income protection policies, it’s easy to get fixated on the price tag. But the real value—the stuff that determines whether your policy will actually come through for you when you need it—is buried in the details.

Getting to grips with these features is the difference between a policy that acts as a true financial safety net and one that lets you down at claim time. Let's pull back the curtain on the four critical elements that truly define your cover.

Benefit Period: How Long Do the Payments Last?

The benefit period is the maximum length of time an insurer will pay you a monthly benefit if you’re out of action due to illness or injury. This has nothing to do with how long your policy is active; it's all about how long you’ll receive payments for a single claim.

You’ll usually see options for two years, five years, or right up to a specific age like 65 or 70. Sure, a shorter benefit period means a lower premium, but it’s a gamble. If a serious illness or accident keeps you out of work for longer than two years, you could find yourself without an income well before you’re ready to retire.

For most professionals and high earners, the smart move is to align the benefit period with your planned retirement age. It’s the only way to ensure your income is truly protected for the rest of your working life if you suffer a long-term or permanent disability.

Waiting Period: How Long Until Your First Payment?

The waiting period (sometimes called an excess period) is the set amount of time you have to wait after stopping work before your payments kick in. Think of it as the initial gap you agree to cover yourself, using your sick leave, savings, or emergency fund.

Waiting periods typically range from 30, 60, or 90 days, though some can stretch out to a year or two. The longer you’re willing to wait, the lower your premium will be. But there's a catch: choosing a 90-day wait when you only have a month of sick leave and minimal savings creates a massive financial risk you might not be able to afford.

A core part of what we do at Wealth Collective is digging into your personal cash flow, leave entitlements, and savings to find a waiting period that actually works for your situation. It's about striking that perfect balance between an affordable premium and genuine, real-world security. It's also crucial to understand what income protection does not cover to avoid any surprises.

Policy Definitions: The Devil is in This Detail

This is, without a doubt, the most critical—and most misunderstood—part of any income protection policy. The definition of disability dictates the exact circumstances under which you can actually make a claim. The two main types are worlds apart.

- Own Occupation: This is the premium standard. It means you're considered disabled if you can’t perform the key duties of your specific job. It’s designed to protect your specialised skills and earning capacity.

- Any Occupation: This is a much weaker definition. It only considers you disabled if you can’t perform the duties of any job you’re reasonably suited for based on your education, training, or experience.

Consider this: A surgeon develops a hand tremor and can no longer operate. With an 'Own Occupation' policy, they can claim their full benefit, even if they can still work as a medical consultant. Under an 'Any Occupation' policy, the insurer could argue they aren't truly disabled because they can still earn an income in a different role, and potentially deny the claim.

For specialists, tradespeople, and anyone in a high-income profession, an ‘Own Occupation’ definition is absolutely non-negotiable.

Premium Structures: Planning for the Long Haul

Finally, you need to understand how your premiums are calculated over time, as this massively impacts long-term affordability. There are two main ways it works:

- Stepped Premiums: These are recalculated every year based on your age. They start out cheap but get more expensive as you get older. Often, they become punishingly expensive in your 50s and 60s—exactly when your risk of claiming is highest.

- Level Premiums: These are locked in based on your age when you take out the policy and stay relatively stable for life (only adjusting for inflation). They cost more upfront but give you complete cost certainty down the track.

Interestingly, advised income protection premiums have actually become more affordable lately, dropping 7% year-on-year. While pricing is competitive, it's vital to look beyond the cost. Advised policies have a much higher claim acceptance rate (94.4%) compared to policies bought directly (86.1%). Through our tailored process, we help you map out these structures to find a solution that fits your financial plan not just for today, but for decades to come.

Why Expert Advice Makes All the Difference

When you're looking for income protection, how you buy the policy is just as important as which policy you choose. You can go directly to an insurer or work with a professional adviser, and the path you take can dramatically change the outcome if you ever need to make a claim. The industry data is crystal clear on this: advised policies consistently deliver better results.

This isn't just a small difference. It's a significant performance gap that starts with how the policy is put together from the very beginning. Trying to select a policy on your own is like navigating a dense legal contract without a guide. It's incredibly easy to miss a crucial detail or make a small mistake that could unfortunately derail a future claim.

The Power of getting it Right from the Start

A financial adviser does so much more than just sell you a product. We're your strategic partner, meticulously aligning every detail of the policy with your specific job, income, and financial commitments. This detailed, upfront work is the secret sauce behind the performance gap.

We make sure the definitions of disability match your occupation, that the waiting and benefit periods are right for your financial situation, and that every disclosure is handled perfectly. This proactive approach drastically reduces the chance of an insurer finding a reason to dispute or deny your claim because of an oversight made when you applied.

The value here isn't just theoretical; it's backed by hard numbers. When you compare income protection policies in Australia, regulatory data tells a compelling story. The latest figures from APRA show that the industry average acceptance rate for advised income protection claims is a very strong 94.4%. By contrast, claims for direct or non-advised policies fall behind at just 86.1%. You can dig deeper into these life insurance claims statistics in Australia.

Let's break down what those statistics really mean when you're the one making a claim.

Advised vs. Direct Income Protection Claims Comparison

| Metric | Advised Policies | Direct (Non-Advised) Policies | What This Means for You |

|---|---|---|---|

| Claim Acceptance Rate | 94.4% | 86.1% | You are significantly more likely to have your claim approved if your policy was set up by a professional adviser. |

| Common Issues | Fewer disputes over definitions or non-disclosure. | Higher rates of denial due to application errors, incorrect definitions, or non-disclosure. | An adviser ensures your application is rock-solid from day one, preventing common pitfalls that lead to claim denials. |

| Claim Process Support | Professional advocacy and management from an adviser. | You are on your own to manage paperwork, chase the insurer, and handle any disputes. | During a stressful time, having an expert handle the entire claims process for you is an invaluable layer of support. |

As you can see, the data points to a clear advantage. The initial advice and structuring of the policy directly influence whether you get paid when you need it most.

Your Advocate When it Matters Most

Beyond the initial setup, one of the biggest benefits of an advised policy is having a professional in your corner when you need to claim. You're usually lodging a claim during a period of intense personal stress. The last thing you want to be doing is battling complex paperwork and chasing an insurance company.

This is a central part of our service at Wealth Collective. We don't just set up your policy and wish you luck. If you need to make a claim, we manage the whole process for you.

Here’s what our advocacy looks like in practice:

- Liaising with the Insurer: We handle all the back-and-forth, making sure your claim is processed efficiently and fairly.

- Managing Paperwork: We help you pull together and submit all the necessary medical and financial documents correctly the first time.

- Challenging Decisions: If there are any delays or pushback from the insurer, we step in to challenge them and fight for your best interests.

This hands-on support takes a huge weight off your shoulders. It lets you focus on your health and recovery while we get to work securing your payout.

An advised policy isn't just a product; it’s an ongoing service. Having an expert manage your claim ensures the process is smoother, faster, and far more likely to end in a successful outcome.

Ultimately, an adviser makes sure your policy is not only built correctly but also works correctly when you need it to. This double advantage of expert setup and claims support is precisely why advised policies deliver far better results. It turns your insurance from a simple purchase into a reliable financial safety net, backed by a professional who's committed to making sure it pays out as promised.

Matching Policy Features to Your Life Stage

When you're comparing income protection policies, context is king. A policy that’s a perfect fit for a 25-year-old just starting out will almost certainly miss the mark for a 55-year-old business owner. The features that matter most depend entirely on your income, your responsibilities, and where you're headed.

This is exactly why a “one-size-fits-all” policy just doesn’t cut it. Real financial security comes from carefully matching specific policy features to where you are in life. When you understand how your needs evolve over the years, you can focus on what's truly important and build a safety net that grows right alongside you.

This decision-making process is at the heart of how we approach personal insurance at Wealth Collective. To give you a clearer picture, we've sketched out four common scenarios below, showing how different priorities shape the ideal policy.

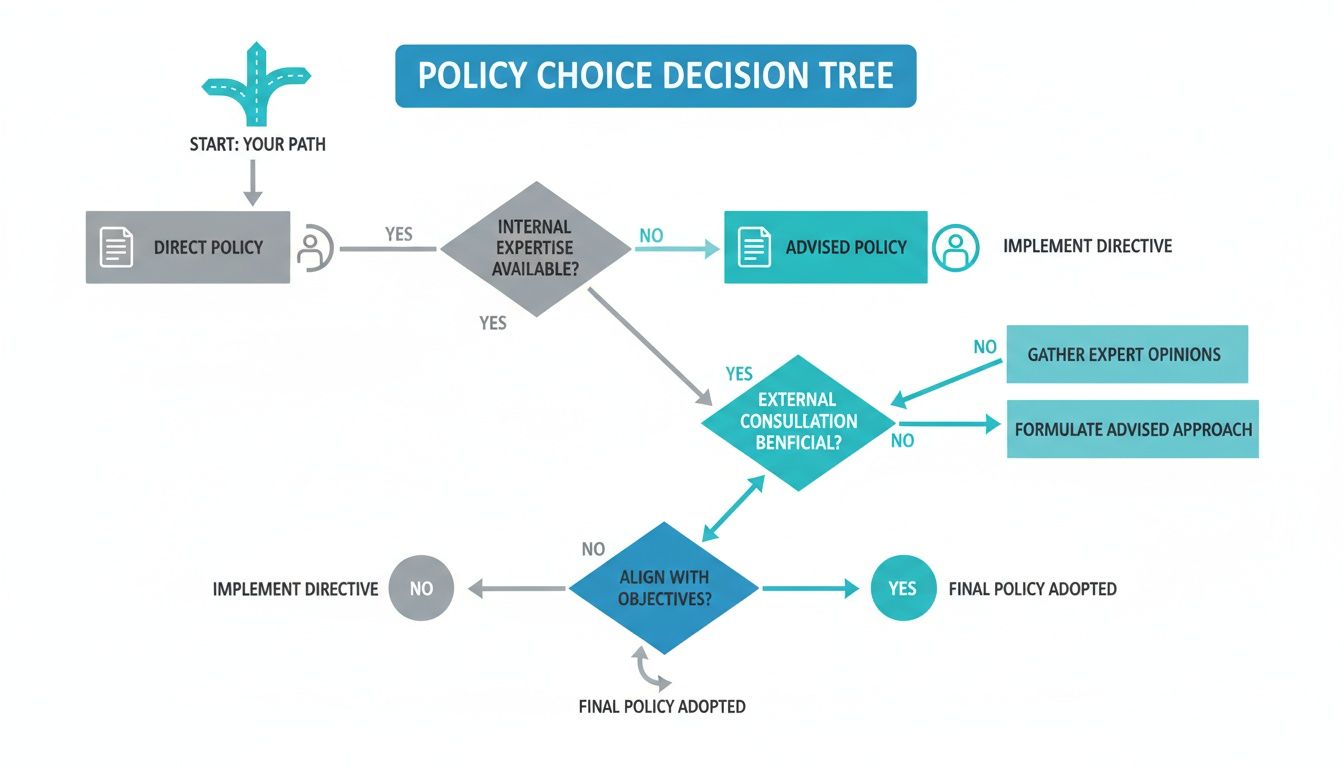

This decision tree illustrates the two main paths people take to get covered. It really highlights how getting professional advice leads to a more robust, tailored outcome.

As you can see, while you can go it alone, the advised path brings a much deeper level of personalisation and support to the table—which is crucial for making sure the features align with your life stage.

The Young Professional Building a Career

If you're in your late 20s or early 30s, your main goal is to lock in fantastic cover while it’s still affordable and you’re in peak health. Right now, your greatest asset is your future earning potential, which could easily span another 30 to 40 years.

You should be thinking about long-term value and certainty.

- Top Priority Feature: Level Premiums: It might feel a bit more expensive at the start, but a level premium structure delivers incredible savings over the long haul and gives you predictable costs. It’s your best defence against the steep, age-based premium hikes that come with stepped policies down the track.

- Secondary Priority: Future Insurability: Look for a policy that includes a guaranteed future insurability option. This is a game-changer. It lets you increase your cover later on—say, after a big pay rise or when you buy a home—without having to go through another medical assessment.

For young professionals, the smartest play is to secure a high-quality policy early. You lock in your good health and lay a foundation for affordable, lifelong protection that can scale with your career.

The High-Income Earner at Peak Potential

Picture a medical specialist, a C-suite executive, or a successful consultant in their 40s. Your income is significant, but so are your financial commitments. The mortgage, private school fees, and investment portfolios all hinge on your ability to keep working.

For this group, the fine print—specifically, the policy's definitions—is absolutely non-negotiable.

- Top Priority Feature: ‘Own Occupation’ Definition: This is the most critical feature you can have. It ensures your policy pays out if you can no longer perform the specific duties of your highly specialised role, even if you could technically work in a different, lower-paying job.

- Secondary Priority: Generous Benefit Amount: You need to be sure the policy covers the highest possible percentage of your income (usually up to 70%) to maintain your family’s lifestyle and meet every financial obligation. We also help structure cover to protect your ongoing super contributions. You can find out more about how income protection and superannuation work together in our detailed guide.

The Small Business Owner with Unique Liabilities

As a small business owner, your personal and business finances are often deeply intertwined. If you're out of action, it's not just your personal income that grinds to a halt; the business itself could be in jeopardy. Your policy needs to protect both.

This means you need to look beyond simple salary replacement.

- Top Priority Feature: Business Expenses Cover: This is a specific add-on designed to cover fixed business costs like rent, staff wages, and utility bills if you’re unable to work. It’s the key to keeping the lights on while you recover, stopping a personal health crisis from becoming a business catastrophe.

- Secondary Priority: Shorter Waiting Period: Unlike employees, business owners rarely have access to months of paid sick leave. It’s vital to align your waiting period—often 30 or 60 days—with your business’s cash flow reserves to avoid financial stress right when you're most vulnerable.

The Pre-Retiree Protecting Their Final Years

For those in their late 50s or early 60s, income protection plays a different but equally crucial role. The objective here is to shield your nest egg and make sure a health issue doesn’t derail your retirement plans right at the finish line.

The focus shifts from replacing decades of income to protecting your super balance and that final savings push.

- Top Priority Feature: Benefit Period to Age 65: Having your benefit period extend to your planned retirement age is essential. It ensures that a long-term disability won't force you to start chipping away at your superannuation years before you intended to.

- Secondary Priority: Superannuation Contribution Cover: Some policies offer an extra benefit that pays your super contributions while you're on a claim. This is a powerful feature that keeps your retirement savings compounding, even when you aren't earning an income.

At Wealth Collective, our process is designed to address these distinct needs. We don't just find you a policy; we build a personalised protection strategy that aligns with where you are now and where you want to go.

Ready to see how a policy can be structured for your unique life stage? Book a complimentary 15-minute call with our team today to get started.

Your Ultimate Income Protection Comparison Checklist

Trying to compare income protection policies can feel like you're drowning in details. To help you cut through the noise, we've put together a practical checklist that focuses on what truly matters. This isn't just about ticking boxes; it's about asking the right questions to find out if a policy is genuinely going to stand up when you need it most.

Think of this as your roadmap. It forces you to look beyond the monthly premium and scrutinise the core features that will make or break your cover at claim time. By using this, you can be confident you've covered all the bases.

The Comparison Checklist: Digging Deeper Than the Quote

To make this really straightforward, we've broken down the key comparison points into a simple table. Use this as you review policy documents to ensure you're making a true like-for-like comparison.

A quick note before you dive in: The goal here is to understand the quality of the cover, not just the price. A cheaper policy with a weak definition of disability or poor terms is a false economy.

Income Protection Policy Comparison Checklist

A step-by-step checklist to guide your evaluation of different income protection policies, ensuring no critical feature is overlooked.

| Feature to Compare | Questions to Ask Yourself | Why It Matters |

|---|---|---|

| Definition of Disability | Does it offer a true ‘Own Occupation’ definition? Or is it a weaker ‘Any Occupation’ or ‘Suited Occupation’ definition? | This is the most crucial part. ‘Own Occupation’ protects your specific career, while others may force you back into any job you’re qualified for. |

| Waiting Period | How long can I realistically go without an income? Have I matched this to my savings, sick leave, and annual leave? | A shorter waiting period costs more but provides faster support. A longer one saves money but requires a bigger emergency fund to bridge the gap. |

| Benefit Period | How long will the insurer pay me for a single claim? Does it cover me right up to my planned retirement age (65 or 70)? | A short benefit period (e.g., 2 or 5 years) leaves you exposed to long-term illness. A policy that pays to retirement age offers complete peace of mind. |

| Premium Structure | Are the premiums Stepped (cheaper now, rising with age) or Level (consistent over time)? Which fits my long-term budget? | Stepped premiums can become unaffordable later in life. Level premiums require a higher initial investment but offer long-term certainty. |

| Benefit Indexation | Does the policy automatically increase my monthly benefit each year to keep pace with inflation (CPI)? | Without this, the purchasing power of your benefit will shrink every year. What seems like enough today won't be in 10 or 20 years. |

| Guaranteed Renewability | Is the insurer legally obligated to renew my policy on the same terms each year, no matter what happens to my health? | This is non-negotiable. It prevents an insurer from dropping you or adding new exclusions after you develop a health condition. |

| Exclusions & Limitations | Are there any exclusions for my specific job duties, hobbies (like motorsport), or pre-existing health conditions? | The fine print is where the traps lie. You need to know exactly what isn't covered before you need to claim. |

| Offsets & Reductions | Could my monthly benefit be reduced by other payments I receive, like WorkCover or Centrelink benefits? | Some policies will reduce your payout dollar-for-dollar if you receive other income, severely limiting the benefit you actually get. |

This checklist gives you a solid framework for your research. But let's be honest, applying it to your own life and understanding the nuances in the fine print is where it gets tricky. That’s where expert guidance comes in.

At Wealth Collective, our process is designed to walk you through every one of these questions. We use our experience to analyse the policy documents, highlight the hidden risks, and match you with cover that offers real, dependable security.

Ready to apply this checklist with an expert by your side? Book a complimentary 15-minute call with us to see how we can build a protection plan that’s right for you.

Got Questions? We've Got Answers

When you start digging into income protection policies, a few questions always seem to pop up. It's only natural. Getting these details right is key to feeling confident that you've made the right choice for your financial safety net.

Let's walk through some of the most common questions we hear from clients, breaking down the answers in plain English.

Is Income Protection Insurance Tax Deductible in Australia?

Yes, it absolutely is. In Australia, the premiums you pay for an income protection policy held outside your super fund are almost always fully tax-deductible. This is a huge benefit, as it significantly lowers the actual cost of your cover over the year.

The logic behind it is pretty simple. The Australian Taxation Office (ATO) sees the policy as a way to protect your ability to earn an income. Since that income would be taxed, the cost of protecting it becomes a deductible expense. If you ever need to claim, the monthly payments you receive are treated just like your regular salary and are taxed accordingly.

Think of it this way: the government recognises that you're proactively securing your future earning capacity. By making the premiums deductible, high-quality cover becomes much more accessible.

When we work with clients at Wealth Collective, we make sure they understand this perk and have all the right paperwork ready to go for tax time. No fuss.

How Much Income Protection Do I Actually Need?

This is the million-dollar question, and there's no one-size-fits-all answer. The goal is to strike a balance—you need enough cover to keep your life on track, but you don't want to be paying for more than you need.

Insurers will typically let you cover up to 70% of your pre-tax income, but the right figure for you comes down to your specific financial situation. To get to that number, we need to look closely at your life.

We'll help you map out:

- Your non-negotiables: This is everything from your mortgage or rent payments to groceries, bills, and school fees.

- Your lifestyle costs: You shouldn't have to put your entire life on hold. We'll account for things like hobbies, family outings, and whatever else makes up your normal routine.

- Any outstanding debts: Car loans, credit cards, or personal loans all need to be factored in so you don't fall behind while you're unable to work.

- Your future plans: A serious injury shouldn't derail your retirement. We can structure your policy to keep your super contributions ticking over, protecting your long-term goals.

It's a detailed process, but it's the only way to move past guesswork and land on a figure that gives you genuine peace of mind.

Can I Switch Income Protection Policies Easily?

Switching policies is definitely possible, but it's something that needs to be handled with extreme care. It's not as simple as cancelling one policy and starting another; doing it wrong can leave you dangerously exposed.

Before you even think about changing, there are a few critical things to consider. A new insurer will want to do a full medical assessment. Any health issues that have come up since you took out your first policy—even minor ones—will be put under the microscope. This could easily lead to new exclusions or a more expensive premium.

You also need to be aware that older policies often have more generous definitions and features that simply aren't offered anymore due to industry-wide changes. You could unknowingly trade away a far superior policy for something that looks cheaper on the surface but offers much less protection.

The only safe way to do this is to get the new policy fully approved and in place before you cancel your old one. This way, you're never left without cover. At Wealth Collective, we manage this entire transition. We'll put your current policy side-by-side with new options and only recommend a switch if it’s a clear win for you. We handle the paperwork and make sure the change is seamless.

At Wealth Collective, our job is to bring clarity to complex financial decisions. We cut through the jargon to build a protection strategy that fits your life perfectly.

If you’re ready to get advice that's built just for you, book a complimentary 15-minute call with our team today.