Business hours

Monday to Friday (8.30AM - 5PM)

Weekend (Closed)

Finding the best income protection insurance in Australia isn’t a one-size-fits-all exercise. There’s no single “best” policy, only the one that’s best for you. Your ideal cover is deeply personal, hinging on your job, your income, and your financial commitments. That's why a tailored strategy is non-negotiable. At Wealth Collective, we believe the best policy is one an expert has carefully structured to ensure it delivers when it matters most.

Why Income Protection Is Your Most Important Financial Safeguard

Think about it: your ability to earn an income is your single greatest financial asset. It’s the engine that powers your mortgage, your investments, and your daily expenses. An unexpected illness or a serious accident can bring all of that to a screeching halt.

This is where income protection insurance steps in, acting as your financial backstop. It replaces up to 70% of your pre-tax income if you're medically unable to work, allowing you to focus on recovery without the added stress of financial ruin. It ensures you can maintain your lifestyle and meet your commitments.

Protecting More Than Just Your Paycheque

While replacing your salary is the primary function, the real value of a well-structured policy runs much deeper. It's about safeguarding your long-term financial health and providing invaluable peace of mind.

When your income suddenly vanishes, you’re forced into tough decisions. Do you raid your super? Sell off investments you’ve spent years building? A robust income protection policy means you don’t have to. It provides a reliable cash flow to keep your financial plan intact.

| Financial Goal | How Income Protection Safeguards It |

|---|---|

| Paying Your Mortgage | Provides the cash flow to make repayments, keeping the roof over your family's head. |

| Covering Living Costs | Ensures bills, groceries, and school fees are paid without causing financial strain. |

| Maintaining Investments | Allows you to stick to your investment plan without being forced to sell assets at the wrong time. |

| Protecting Retirement Savings | Prevents you from having to tap into your superannuation early just to make ends meet. |

The Wealth Collective Approach

At Wealth Collective, our process starts with a deep dive into your financial world. We don't just "sell" policies; we design a complete protection strategy tailored to your career, income, and goals.

Our 'Protection Plus' service takes the guesswork out of it. We analyse the market to find the best income protection insurance in Australia for your unique situation, ensuring every feature is optimised to work for you.

This level of detail is critical. It’s what separates a policy that provides real security from one that gives a false sense of it. To see how we can build a strategy for you, book a complimentary 10-minute call with one of our advisers today.

Cracking the Code: What to Look for in an Income Protection Policy

To find the right income protection insurance for you, you need to look beyond the monthly premium. The real worth of a policy is hidden in the fine print, where small details can make a world of difference at claim time. Understanding these core features is the first step to building a financial safety net you can count on.

Think of these features as the moving parts of your policy. Getting them all working together in your favour is where professional advice really pays off. At Wealth Collective, our process is about meticulously matching each of these components to your career, your income, and your life, ensuring your cover is a perfect fit.

Comparing Critical Income Protection Features

Getting into the weeds of policy features can feel overwhelming, but this is where the most important decisions are made. A feature that seems minor now could be the very thing that determines whether your claim is approved and how much support you receive.

The table below breaks down the must-know features, what they mean for you, and a few pro tips from our experience.

| Policy Feature | What It Means For You | Wealth Collective's Pro Tip |

|---|---|---|

| Waiting Period | This is how long you wait after stopping work before payments begin. Think of it like the excess on your car insurance. | Match this to your sick leave and emergency savings. If you have 3 months of savings, a 90-day waiting period could lower your premium without leaving you exposed. |

| Benefit Period | This is the maximum time the insurer will pay you for a single claim. It could be a few years or all the way to retirement. | Don't skimp here. A long-term disability can last decades. A benefit period to age 65 offers the ultimate peace of mind and is what we recommend for most clients. |

| Definition of Disability | This defines what 'disabled' means for claim purposes. The difference between 'Own' and 'Any' occupation is massive. | Always push for an 'Own Occupation' definition. It protects your ability to work in your specific career, not just any job. This is non-negotiable for specialists and skilled professionals. |

| Agreed vs. Indemnity | Determines how your benefit is calculated. Is it locked in upfront (Agreed) or based on your recent earnings (Indemnity)? | With Agreed Value policies now rare for new clients, focus on a robust Indemnity policy. This means regularly reviewing your cover level to ensure it keeps up with your income. |

| Partial Disability | This feature pays a partial benefit if you can return to work part-time, topping up your reduced income. | This is essential for a gradual recovery. It provides financial support as you ease back into work, which is a common real-world scenario. |

Understanding these components is the key to building a policy that won’t let you down. It’s about creating a plan that works in the real world, not just on paper.

The Waiting Period

The waiting period is the time you must support yourself between stopping work and your first benefit payment arriving. It’s a self-insurance period, and the length you choose directly impacts your premium.

Common options are 30, 60, or 90 days. A shorter wait means you get paid sooner, but your premiums will be higher. A longer wait makes the policy more affordable, but you’ll need a larger emergency fund to see you through.

The right choice is a balancing act. How much do you have in savings? How much sick or annual leave could you use? Answering these questions will point you to the right waiting period for your situation.

The Benefit Period

Your benefit period sets the maximum time you can receive payments for any one claim. This is arguably one of the most important decisions you’ll make, as it determines your financial security if you suffer a long-term or permanent disability.

You'll usually see a few standard options:

- Two or Five Years: These shorter-term policies have a lower price tag but leave a significant gap if something more serious happens.

- To Age 65 or 70: This is the gold standard. It provides a potential income stream right up to your planned retirement, covering you for the worst-case scenario.

While it’s tempting to cut costs with a shorter benefit period, imagine being unable to work at age 45 with a policy that runs out at 50. For genuine, long-term security, a benefit period to age 65 is almost always the right call.

Agreed Value vs. Indemnity Policies

This is all about how your monthly benefit is calculated when you claim, and the difference is huge.

An Agreed Value policy locks in your benefit amount on the day you sign up. It’s based on your income at that time and won’t be reduced even if your earnings drop before you claim. This provides incredible certainty, especially for business owners, freelancers, or sales professionals.

An Indemnity Value policy calculates your benefit based on your proven earnings in the 12-24 months before you claim. If your income has dipped in that period, so will your benefit. This is generally fine for PAYG employees with a steady salary but can be a risk for others.

Regulators have largely phased out Agreed Value policies for new applications. If you're taking out a new policy today, it will almost certainly be an Indemnity one. This makes it more important than ever to structure it correctly and review it regularly with an adviser.

The Definition of Disability

This is the heart of your policy—the rulebook the insurer uses to decide if you’re eligible to claim. The two definitions you’ll see are ‘Own Occupation’ and ‘Any Occupation’.

An ‘Own Occupation’ definition is what you want. It means you’re considered disabled if you can’t perform the main duties of your specific job. A surgeon with a hand injury is a classic example; they can claim because they can't perform surgery, even if they could still work as a lecturer. It protects the career you've built.

An ‘Any Occupation’ definition is far more restrictive. You can only claim if you’re unable to do any job for which you’re suited by education, training, or experience, making it much harder to get a claim approved.

Finally, ensure your policy includes a strong partial disability benefit. This critical feature supports you if you return to work at a reduced capacity by topping up your income. It's crucial to understand what is and isn't covered; for a deeper dive, you can learn more about common exclusions in income protection insurance.

How Advised Insurance Delivers Better Claims Outcomes

Does using a financial adviser to set up your income protection insurance actually make a difference? The data gives a clear and resounding answer: yes. Seeking professional advice isn't just about convenience; it’s a strategic move that measurably improves your financial security.

When you’re unable to work, the last thing you want is a stressful and uncertain claims process. Statistics consistently show that policies structured by advisers deliver significantly better results, giving clients greater certainty and faster access to their funds.

The Power of Professional Advocacy

So, why the big difference? It boils down to three key areas where an adviser adds immense value: correct initial setup, full disclosure, and professional advocacy during a claim.

Working with an expert ensures your policy is correctly tailored to your specific occupation and income from day one, dramatically reducing the risk of disputes later. A skilled adviser will also guide you through the application, ensuring all medical and financial details are disclosed accurately. And when it’s time to claim, your adviser becomes your champion, managing the process and advocating on your behalf to ensure a smooth, fair outcome.

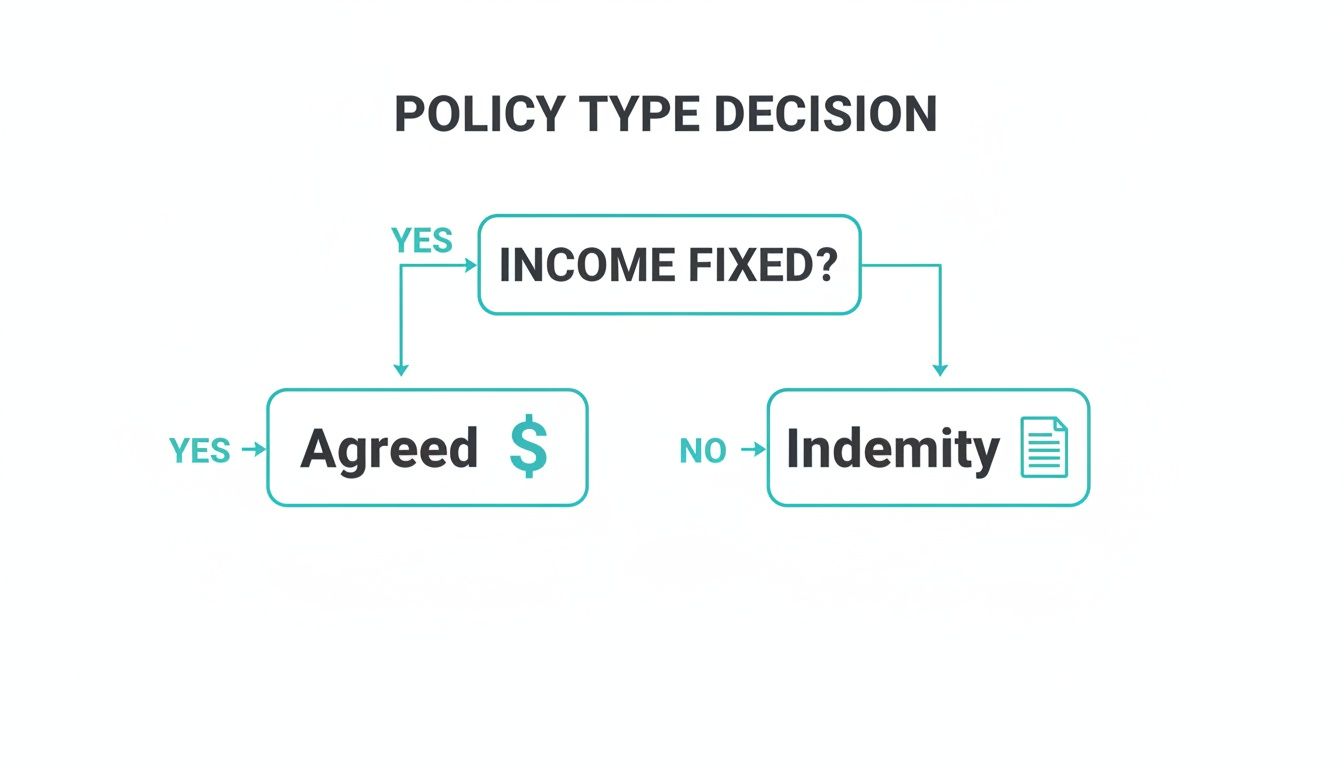

This flowchart shows how something as fundamental as your policy's structure is a key part of the advice process.

This is just one of the many critical choices an adviser helps you navigate to build a policy that truly fits your financial life.

Data-Backed Success Rates

The value of advice isn't just anecdotal; it's reflected in industry-wide data. In Australia, income protection insurance arranged through financial advisers consistently delivers exceptional claims acceptance rates, averaging 94.4%. This is a world away from direct, non-advised policies, which come in at just 86.1%.

This reliability is confirmed by APRA's long-term data, where advised income protection claims have held steady between 95% and 96% annually. For young professionals, dual-income families, and small business owners, this translates to real peace of mind. Payouts are also processed swiftly, with an industry average of just 1.6 months. This data underscores the value of getting tailored guidance from an experienced adviser who can ensure your policy aligns perfectly with your circumstances. You can read more about these life insurance claims statistics.

This isn't a small statistical variance; it represents thousands of Australian families receiving the financial support they paid for, precisely when they needed it most.

The Wealth Collective Protection Plus Service

This data-driven reality is the foundation of our ‘Protection Plus’ service at Wealth Collective. We don’t just find you a policy; we build a comprehensive protection strategy designed to perform under pressure. Our process is built on a deep understanding of the market and a commitment to getting every detail right from day one.

We ensure your policy is structured flawlessly with the correct:

- Benefit and Waiting Periods: Aligned with your savings and available sick leave.

- Definition of Disability: Securing an 'Own Occupation' definition to protect your specific career.

- Income Verification: Making sure your benefit amount is accurate and sustainable.

By partnering with Wealth Collective, you are not just buying an insurance policy. You are investing in a process that is proven to deliver better outcomes, providing a reliable safety net that protects your ability to live a wildly successful financial life.

To experience the confidence that comes with expert guidance, book a complimentary 10-minute call with our team today. We’ll show you how a properly structured strategy can secure your financial future.

Understanding the Cost of Income Protection Insurance

Understanding income protection insurance costs doesn't have to be guesswork. Your premium isn’t an arbitrary number; it’s a reflection of your unique circumstances and the specific cover you choose. Getting a handle on what drives the price is key to finding the sweet spot between robust protection and a premium that fits your budget.

At Wealth Collective, our process includes pulling back the curtain on these cost drivers. We show you exactly how tweaking your policy can move the needle on price, so you’re only paying for the cover you genuinely need. It’s about building a financial safety net that’s both effective and efficient.

Key Factors That Influence Your Premiums

Insurers weigh the odds of you needing to make a claim by looking at a handful of personal and policy-related factors that create your risk profile.

Here’s what they’re looking at:

- Your Age: The younger and healthier you are when you take out a policy, the lower your premiums will be, as the statistical risk of illness or injury is lower.

- Your Occupation: An accountant working behind a desk will almost always pay less than a tradie on a construction site, simply because the on-the-job risks are vastly different.

- Your Health and Lifestyle: Your medical history, any pre-existing conditions, and habits like smoking have a direct impact. Honesty here is crucial to ensure your policy is watertight at claim time.

- Policy Structure: This is where you have the most control. The waiting period, benefit period, and any additional features you add will all affect the final cost.

This is where good advice pays off. A financial adviser can model different scenarios, showing you precisely how changing your waiting period from 30 to 90 days impacts your premium. It's about finding the perfect balance for your situation.

How Policy Choices Affect the Price Tag

The levers you can pull to manage your premium are all found in the policy's features. For instance, a policy with a 30-day waiting period will cost more than one with a 90-day period because the insurer is on the hook to start paying you sooner.

The same logic applies to the benefit period. A policy that pays you until age 65 offers incredible long-term security but will come with a higher price tag than a policy that only covers you for a couple of years.

This is why we connect these choices to your bigger financial picture. If you've built up a solid emergency fund, opting for a longer waiting period is a smart way to lower your premiums without leaving yourself exposed. It’s about structuring your cover strategically.

The Tax-Deductible Advantage

In Australia, the premiums you pay for income protection insurance are generally tax-deductible. This means you can claim the full cost on your tax return each year, which can significantly reduce the real, after-tax cost of your cover. For a deeper dive, check out our article exploring if income protection is worth the investment.

This tax break makes protecting your income far more affordable and is a critical piece of the puzzle when you're weighing up costs and benefits.

The good news is that premiums for quality income protection have been on a downward trend in Australia. Advised policies, in particular, have become more affordable, meaning better cover is more accessible than ever for our clients. And even with falling prices, the industry's ability to pay out has remained solid, with a 94.4% acceptance rate for advised income protection claims. You can read more on how life and income protection premiums are falling.

Structuring Your Policy for Different Life Stages

There’s no universal template for the best income protection insurance in Australia. The right policy isn’t a static product you set and forget; it's a dynamic strategy that needs to evolve with you. Your needs as a young professional with a mortgage are worlds away from those of a high-income executive or a business owner nearing retirement.

A one-size-fits-all policy is a recipe for disaster. You’ll either pay for features you don’t need or, far worse, discover critical gaps in your cover when you can least afford them. Real financial protection comes from a policy meticulously structured for your life right now, yet flexible enough to adapt as things change.

This is where personalised advice proves its worth. At Wealth Collective, our process always starts by understanding your story—your career, your family, your goals. Only then can we build a protection plan that’s a perfect fit.

Scenario 1: The Young Professional Family in Perth

Meet Chloe and Ben, both 35, with two young kids and a mortgage. Chloe is a marketing manager on a steady salary, while Ben is a self-employed graphic designer with a variable income. Their biggest worry is keeping up with the mortgage if one of them couldn't work.

For them, a robust and long-term policy structure is key.

- Waiting Period: With about two months of savings, a 60-day waiting period lines up perfectly with their financial buffer, making their premiums more affordable.

- Benefit Period: With decades of working life ahead, a long-term disability would be devastating. A benefit period to age 65 is non-negotiable for both of them.

- Definition of Disability: As a skilled professional, Chloe needs an 'Own Occupation' definition to protect her specific career.

- Income Type: For Ben's fluctuating income, we’d structure his Indemnity policy carefully and review it annually to keep it accurate.

For a young family, the goal is maximum security for the long haul. It's about protecting the family home, the kids' future, and the financial foundation they're working so hard to build.

Scenario 2: The High-Income Executive

Now, let's look at David, a 52-year-old CFO with a significant salary. His mortgage is almost paid off and his kids have left home. His goal is to protect his high income to aggressively build his retirement nest egg.

David's policy needs a different focus.

- Monthly Benefit: His priority is insuring the maximum amount possible—typically 70% of his pre-tax income—to ensure his savings strategy isn’t derailed.

- Superannuation Contribution: Many modern policies offer an add-on that pays an extra benefit directly into your super fund. For David, this is a critical feature to keep his retirement savings on track. You can learn more in our guide on how income protection and superannuation work together.

- Claims Escalation Benefit: This feature increases the monthly payout each year you're on a claim by CPI, protecting his purchasing power against inflation.

Scenario 3: The Small Business Owner

Sarah, 45, owns a successful café. Her personal income is tied to the business's health, and she has ongoing business expenses like rent and wages that don't stop just because she has to.

Sarah’s situation calls for more than a personal policy.

- Personal Policy: She needs a standard income protection policy to cover her personal living expenses, with an 'Own Occupation' definition vital to her role.

- Business Expenses Insurance: This separate policy is designed to cover the fixed running costs of the business for up to 12 months if she can't work. This keeps the doors open and protects the business's value.

This dual-policy approach separates her personal financial security from the business's survival, creating a complete solution.

Scenario 4: Nearing Retirement

Finally, there’s Mark, a 62-year-old engineer planning to retire at 67. His financial goals are now short-term: clear the mortgage and make final contributions to his super.

Mark’s policy can be fine-tuned to reflect this.

- Benefit Period: A full benefit period to age 65 is no longer necessary. A five-year benefit period provides enough cover to get him to his planned retirement date and significantly reduces his premiums.

- Waiting Period: With substantial savings, he could push his waiting period out to 90 days, further optimising the cost of his cover for these final years.

As these scenarios show, the "best" income protection insurance is never an off-the-shelf product. It requires a strategic approach, thoughtfully aligning every feature with your unique financial life. At Wealth Collective, this is the core of our 'Protection Plus' service—we take a generic product and transform it into your personalised financial shield.

Partner with Wealth Collective to Secure Your Future

Navigating the world of income protection insurance can feel complex, but securing your financial safety net is more straightforward than you might think. We've shown what makes a policy genuinely work for you—from the nuts and bolts of waiting periods to how the right cover protects you at every stage of your career.

The main takeaway? The best income protection insurance in Australia isn’t an off-the-shelf product you click and buy. It’s a carefully considered strategy, built around your life, your work, and your goals.

Protecting your ability to earn is the single most important financial move you can make. Your income is the engine that drives your home, your investments, and your family's future. Getting this right isn't just about receiving a payment if you're sick; it’s about having the confidence to live your life knowing you’re properly protected.

Our Simple Process for Your Peace of Mind

At Wealth Collective, we believe that locking in powerful financial protection shouldn’t be a headache. Our process is designed to give you clarity and confidence, taking the heavy lifting and fine print off your plate.

Our approach is built on three simple steps:

- Discovery Call: It all starts with a complimentary 10-minute chat. This is our chance to understand your situation, what you’re looking to achieve, and ensure we’re the right team to help.

- Strategy Session: We take a proper look at your financial world—your income, your occupation, and your long-term goals. From there, we map out a personalised protection strategy and explain our recommendations in plain English. No jargon.

- Implementation and Review: Once you're happy to proceed, we handle the entire application process. But our partnership doesn't stop there. We touch base regularly to review your cover and make sure it continues to be the perfect fit as your life and career evolve.

This is more than finding an insurance policy. It's about building a genuine, long-term partnership with an award-winning team dedicated to helping you live a wildly successful financial life, backed by the certainty that you're ready for anything.

Your Next Step Towards Confidence

You now understand how valuable a well-structured income protection policy is and how professional advice leads to far better outcomes. The next step is to put that knowledge into practice.

Let our experienced advisers cut through the market complexity and deliver a clear, actionable plan that protects everything you’ve worked so hard for. It’s time to stop wondering if you’re covered and start knowing you are.

Take the first easy step towards securing your income and your future. Book a complimentary, no-obligation 10-minute call with the Wealth Collective team today.