Business hours

Monday to Friday (8.30AM - 5PM)

Weekend (Closed)

When you're looking for the best superannuation fund in Australia, it’s easy to get drawn in by performance league tables. But here’s a hard-earned truth from years in the industry: last year’s top-performing fund is almost never the best one for your financial future.

Real value comes from finding the right mix of investment options, fees, and features that actually line up with your personal goals. The "best" fund isn't about chasing past returns; it's about choosing the one that fits your needs.

Why Performance Tables Can Be Misleading

Chasing the top spot on a super fund performance table is a common—and often costly—mistake. Past returns are obviously a piece of the puzzle, but they give you a very narrow view of what makes a fund a good long-term home for your money. Relying on those rankings alone can send you down a path that doesn't fit your goals, risk tolerance, or stage of life.

The Limits of Official Benchmarks

The Australian Prudential Regulation Authority (APRA) runs an annual performance test, which is great for flagging consistently poor-performing funds. However, it’s a blunt instrument if you’re using it to pick a winner. The test usually only looks at a fund's default 'MySuper' option or a handful of their most popular choices.

This narrow focus is a problem because:

- Many funds offer over 300 different investment options, including direct shares, ETFs, and ethical portfolios. Most of these are not covered by the APRA test.

- The test has no idea about your personal risk profile or whether a different strategy within the very same fund would be a much better fit for you.

A fund might "fail" the test on its default option but have fantastic, low-cost index options that are perfect for your strategy. On the flip side, a fund that "passes" with flying colours might not offer the flexibility you'll need as you approach retirement.

Comparing Apples with Oranges

Performance 'ratings tables' often compare funds side-by-side that seem similar but are completely different under the hood. A classic example is the 'Balanced' investment option. Take a fund like Hostplus; its 'Balanced' option has nearly 90% exposure to growth assets.

That allocation is far more aggressive than what most people would consider "balanced" and it comes with much higher volatility. An investor looking for a genuinely balanced portfolio could be taking on a huge amount of risk without even knowing it.

This highlights a critical point: fund labels aren't standardised. If you don't dig into the underlying asset allocation, you simply can't make a meaningful comparison. Many industry funds also hold significant amounts of unlisted assets—things like private equity and infrastructure. These can pump up returns, but they often lack the transparency and liquidity that many of our clients value.

At Wealth Collective, our Guided Growth process is all about looking past these misleading labels. A financial adviser has a plethora of tools to compare options, get the right balance between fees, investment options and performance, and match your preferred product features to a suitable fund.

To see how we can find the right fit for your super, book a complimentary initial call with our team.

Exploring Your Super Fund Investment Options

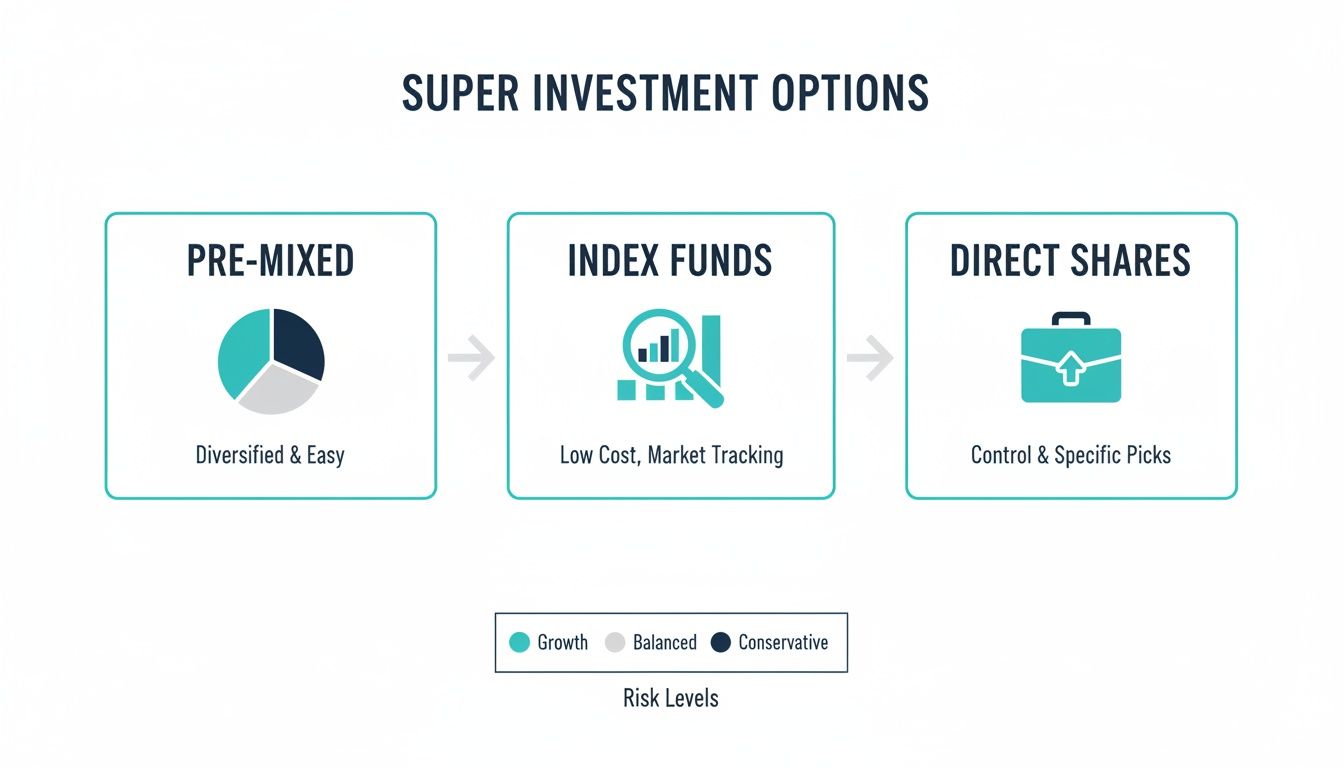

Choosing a super fund isn't just about picking a name; it's about selecting an investment menu that suits your strategy. Do you prefer a simple, pre-mixed option, or do you want a more tailored approach?

The best superannuation funds in Australia give you a range of choices to build a portfolio that truly reflects your financial goals and your comfort with risk. Getting a handle on these options is the first real step towards taking control of your retirement savings.

The Standard Pre-Mixed Options

Most of us start our super journey in a default, pre-mixed investment option. These are designed to be simple, set-and-forget solutions.

- Conservative/Stable: This option is heavy on defensive assets like cash and fixed interest. It’s built for low growth but also low volatility, which often suits people in or very near retirement.

- Balanced: This aims for a mix of growth assets (like shares and property) and defensive assets. It's the most common default option, but as we've already seen, the definition of 'balanced' can vary wildly between funds.

- Growth/High Growth: These are heavily weighted towards growth assets, sometimes up to 90% or more. They have much higher long-term growth potential but also come with significantly more risk and market volatility.

These pre-mixed options are perfectly fine for many, especially if you prefer a hands-off approach. The downside? They offer very little customisation and might not be the most cost-effective or strategically aligned choice for your specific situation.

At Wealth Collective, our Guided Growth process involves looking beyond these basic labels. We help clients figure out if a standard option is right for them, or if a more personalised portfolio could deliver better outcomes based on where they are in life.

Tailoring Your Portfolio with Member-Direct Options

For those who want more control, many funds now offer member-direct or "choice" investment platforms. These open up a world of possibilities far beyond the standard pre-mixed funds, allowing you to construct a portfolio with real precision. This level of control can be powerful, but it definitely requires a deeper understanding of investing. For those seeking even greater autonomy, you can learn more about the pros and cons of a self-managed super fund in our detailed guide.

Some of the key options you’ll find on these platforms include:

- Low-Cost Index Funds: These funds simply track a specific market index, like the ASX 200. They’re incredibly popular because their fees are rock-bottom and they offer broad market diversification.

- Exchange-Traded Funds (ETFs): Similar to index funds, ETFs are traded on the stock exchange and give you access to a huge range of markets, sectors, or themes—from global technology to sustainable energy.

- Direct Shares: This option lets you buy and sell individual Australian shares right inside your super fund. An experienced investor might use this to overweight their portfolio towards specific companies they believe have strong growth potential.

- Geared Investment Options: For those with a very high risk tolerance, some funds offer geared options. These strategies use borrowing to amplify investment exposure, which magnifies both potential gains and potential losses. This is a highly aggressive approach and is not suitable for most investors.

Deciding between a simple pre-mixed fund and a more tailored approach comes down to what you need. Are you looking for simplicity, or do you value control and customisation? For a retiree, the priority might be flexibility in how pension payments are drawn down from different parts of a portfolio to manage tax effectively.

A financial adviser has the tools and expertise to cut through all this complexity. With the ability to compare hundreds of options across multiple funds, we can find the right balance of fees, features, and investment choice, making sure your super is perfectly matched to your personal financial journey.

Comparing Funds with Different Risk Profiles

When you’re trying to find the best superannuation fund in Australia, it’s all too easy to just grab onto a label like ‘Balanced’ or ‘Growth’ and assume it means what you think it does. The problem is, these terms aren't standardised. What one fund calls "balanced" might look completely different to another, leading to some serious, often hidden, gaps in your risk exposure.

To really get a grip on a fund's risk profile, you have to look past the label and dig into its strategic asset allocation. This is non-negotiable if you want to make sure your super is actually aligned with your personal comfort for risk and your long-term goals. Without that deeper look, you could be taking on far more—or far less—risk than you realise.

This infographic gives you a good overview of the typical investment options you’ll find, from the simple set-and-forget pre-mixed choices to more hands-on alternatives.

As you can see, while pre-mixed options are straightforward, crafting a more tailored approach with index funds or direct shares can give you much more control over your portfolio's risk and overall direction.

The Aggressive Nature of a 'Balanced' Fund

A perfect real-world example of this labelling headache is the Hostplus ‘Balanced’ option. The name suggests a moderate, steady-as-she-goes approach, right? In reality, its portfolio is heavily skewed towards growth assets, with an allocation sitting close to 90%. That’s a world away from a traditional balanced portfolio, which usually holds around 60-70% in growth assets.

This aggressive tilt means the fund is positioned for higher potential returns, but it also exposes its members to much greater volatility. An investor who picked this option expecting a middle-of-the-road risk level might get a nasty shock when they see how sharply their balance can drop during a market downturn.

Comparing funds based on labels alone is like comparing apples and oranges. It's the underlying asset mix that dictates the fund's behaviour, and this is where many investors get caught out, taking on risk they never intended to.

This isn’t just a one-off issue; it's a common trait among many industry funds chasing those chart-topping returns. They often do it by packing seemingly conservative options with more aggressive asset allocations.

The table below shows just how differently two "Balanced" funds can be structured.

How 'Balanced' Funds Can Differ in Asset Allocation

| Asset Class | Traditional 'Balanced' Fund Allocation | Aggressive 'Balanced' Industry Fund Allocation |

|---|---|---|

| Australian Shares | 25% | 30% |

| International Shares | 25% | 35% |

| Total Growth Assets | 50% | 65% |

| Property & Infra. | 10% | 25% (often unlisted) |

| Fixed Interest | 30% | 5% |

| Cash | 10% | 5% |

| Total Defensive Assets | 40% | 10% |

As you can see, the 'Aggressive' version has a significantly higher allocation to growth and alternative assets, fundamentally changing its risk and return profile despite sharing the same name.

Unlisted Assets: The High-Return, Low-Transparency Factor

Another major point of difference, especially with industry funds, is their heavy investment in unlisted assets. Think infrastructure like airports and toll roads, private equity deals, and direct property. These assets can be absolute powerhouses for returns, often outperforming the listed market.

But this potential for higher growth comes with a couple of key trade-offs:

- Transparency: Unlisted assets aren't traded on public exchanges. This means their valuations happen less often and can be more subjective, making it tough for members to get a clear, up-to-the-minute picture of what their investments are truly worth.

- Liquidity: Because they aren’t publicly traded, you can't just sell them off quickly. This lack of liquidity can become a real issue during times of market stress when lots of members might be looking to switch options or access their funds.

For some investors, the chance at better returns makes these concerns worthwhile. For others, particularly those nearing or in retirement who need more predictable income and flexibility, the opaque nature and lack of liquidity can be a serious drawback. Choosing the right fund means understanding this balance and deciding what matters most to you.

The Wealth Collective Guided Growth process is designed to cut through this complexity. We don't just glance at fund names or past performance. We dive deep into the nitty-gritty of a fund's asset allocation, its use of unlisted assets, and its true risk profile to make sure it’s the right fit for your unique situation. To see how we can align your super with your personal goals, book a complimentary call with our team today.

Finding the Right Super Fund for Your Stage of Life

Choosing the right super fund isn't a "set and forget" decision. It's a living part of your financial plan that needs to evolve right alongside you. The fund that was perfect for you as a 25-year-old graduate is almost certainly not the best fit for a 55-year-old planning their exit from the workforce.

A smart super strategy is dynamic. It reflects where you are right now—your income, your family, your goals—while keeping an eye on the future. Let’s break down what you should be looking for at different points in your journey.

The Young Professional: Building a Foundation

If you’re in your 20s or early 30s, your biggest advantage is time. With decades of potential growth ahead, your mission is simple: get your money working hard for you in the most cost-effective way possible.

Here’s what really matters at this stage:

- Rock-Bottom Fees: A seemingly small 1% difference in fees can chew up hundreds of thousands of dollars over a 40-year career. A low-cost index option is often the simplest and most powerful choice.

- A Focus on Growth: With a long timeline until you need the money, you can afford to take on more investment risk for potentially higher returns. This usually means a portfolio heavily weighted towards shares.

- Keep It Simple: Life is complicated enough. You don't need a complex super strategy right now. A good "set and forget" option lets your money grow in the background while you focus on your career.

While insurance is important, the basic default cover for Death and Total and Permanent Disablement (TPD) is often enough to start with, keeping your costs down.

The High-Income Earner: Shifting into High Gear

Once your career takes off and your income climbs, a basic default super fund just won't cut it. For high-income earners in their 30s and 40s, super becomes a powerful tool for building serious wealth and managing your tax bill.

You should be looking for a fund that gives you more control:

- Real Investment Choice: You need the freedom to build a portfolio that reflects your own strategy. This means access to direct shares, ETFs, and specific ethical or thematic investments, not just pre-mixed options.

- Smarter Tax Strategies: Your fund should make it easy to manage concessional and non-concessional contributions. Tools that help you execute strategies like salary sacrificing are essential for maximising every dollar.

- Easy Consolidation: By now, you've likely collected a few super accounts from old jobs. A fund with a seamless platform to roll them all into one is non-negotiable. This cuts down on fees and life admin instantly.

For this group, it’s no longer just about growth; it’s about strategic wealth creation. The best fund is one that gives you the flexibility to actively manage your money and leverage Australia’s tax-effective super system.

The Small Business Owner: Protecting Your World

Running your own business presents a unique set of financial pressures. Your income can be lumpy, and your personal and business finances are often intertwined. For you, super isn't just a retirement fund—it's a critical way to build wealth separate from your business and protect your family.

Here’s what you should prioritise:

- Flexible Contributions: Your income doesn't arrive like clockwork, so your super fund needs to be adaptable. The ability to make large, lump-sum contributions when cash flow is strong is a must.

- Comprehensive Insurance: This is absolutely critical. You need access to high-quality, flexible insurance for Income Protection, TPD, and Death. This protects not just your family's future, but potentially the business itself if you’re unable to work.

- Greater Control: Many business owners are naturally hands-on. A fund that offers member-direct options, allowing you to invest in direct shares or even commercial property, can be a game-changer.

The Pre-Retiree: Securing Your Future

As you get within 10-15 years of retirement, your priorities shift dramatically. The focus moves from accumulating wealth to preserving what you've built and turning it into a reliable income stream. The fund that got you here might not be the right one to take you through retirement.

A pre-retiree needs a fund that excels in:

- Top-Tier Pension Products: The fund must offer a flexible and low-cost account-based pension. You need control over how and when you receive payments to manage your cash flow and tax position effectively.

- Capital Preservation: You can’t afford a major market hit right before you retire. Look for funds with excellent lower-risk investment options and the tools to easily de-risk your portfolio as you get closer to your retirement date.

- Access to Quality Advice: This is the time when professional guidance becomes invaluable. A fund that has integrated financial planners who can help you with retirement projections, Centrelink, and income strategies offers a huge advantage.

At Wealth Collective, our Guided Growth service is specifically designed to match your super strategy to your life stage. We dig into your unique situation to find the fund with the right mix of features, performance, and fees, ensuring your super is always working towards your goals.

To see how we can build a plan tailored for you, book your complimentary initial call today.

Looking Beyond the Obvious: Hidden Costs and Overlooked Features

When you're trying to find the best superannuation fund in Australia, it's easy to get fixated on the headline investment fee. But the real cost of a fund is often tucked away in the fine print, with a whole range of other charges quietly chipping away at your balance over the years.

What I've learned from years of experience is that the cheapest option on paper is rarely the best. Sometimes, a slightly higher fee is a small price to pay for the kind of flexibility and features that will actually help you build long-term wealth. The trick is to understand the total impact of all costs combined, not just the one they put in the brochure.

Uncovering the Total Cost of Your Super

To protect your retirement savings, you need to be aware of all the fees that make up the total expense of your super fund. These are the big three that often fly under the radar:

- Administration Fees: These cover the basic running costs of the fund. You'll see them charged as either a flat annual fee, a percentage of your balance, or sometimes a mix of both.

- Indirect Cost Ratio (ICR): This is a really important one that many people miss. The ICR covers expenses that aren't taken directly from your account, like the fees paid to external investment managers. A high ICR can seriously dent your net returns without you even realising it.

- Insurance Premiums: If you hold Death, Total and Permanent Disablement (TPD), or Income Protection cover through your super, the premiums are paid straight from your balance. These costs can vary wildly between funds for the exact same level of cover.

It’s so easy to be drawn to a fund advertising a low investment fee, only to discover that sky-high administration fees and a hefty ICR make it one of the most expensive options out there. You have to look at the whole picture to know what you’re really paying.

Essential Features Are More Than Just a Number

While keeping costs down is vital, a laser focus on fees can mean you miss out on features that provide real, tangible value. As your financial life gets more complex, paying a little extra for flexibility and security can be one of the smartest moves you make.

A perfect example is the insurance offered within the fund. Is the default cover they give you actually enough for your family's needs? Can you easily increase it later on without going through a mountain of paperwork and medical checks? Getting this right is critical, and you can learn more about how to evaluate insurance within your superannuation to make sure you're properly protected.

Other features that are often worth their weight in gold include:

- A User-Friendly Platform: A clean, modern online portal or app makes managing your super so much easier. When you can quickly check your balance, make changes, and find information, you feel more in control of your financial future.

- Pension Phase Flexibility: This is a big one for anyone nearing retirement. A fund's account-based pension needs to be top-notch. The ability to choose which specific assets you sell down to create your income can have a massive impact on your tax bill and how long your money lasts.

- Access to Advice: Some of the better funds have integrated financial advice services. This can be incredibly valuable when you're facing big decisions about your contributions, investment strategy, or how to structure your retirement income.

At Wealth Collective, our Guided Growth process involves a deep dive into both costs and features. We look past the marketing noise to find a fund that delivers genuine value—balancing competitive fees with the specific tools and flexibility you need to hit your goals.

How a Financial Adviser Chooses the Right Super Fund for You

Trying to find the best super fund in Australia can feel like you're lost in a maze. You're faced with hundreds of funds and thousands of investment options. Comparing them with basic online tools often just leaves you with more questions than answers. This is where getting a financial adviser involved really changes things. It moves you from guesswork to a clear, evidence-backed strategy.

An adviser’s job isn't to chase last year's top performer—that's a rookie mistake. Think of us as your personal research team and strategist. We use sophisticated tools that dig much deeper than anything you can find on Google, allowing us to compare hundreds of funds across dozens of critical data points all at once.

A Much Deeper Dive

Our process begins by filtering the entire market down to a shortlist that genuinely matches what you need. That could be access to low-cost index options, the ability to invest in direct shares, specific ethical screens, or flexible pension features for when you retire. We look at the whole picture.

- The Fund's Core Philosophy: Does the way they manage money and risk actually line up with your long-term goals?

- Consistent Long-Term Performance: We're looking for funds that have delivered solid results over many years, not just a flash-in-the-pan return over the last 12 months.

- The True Cost: We analyse the total fee structure, including administration fees, investment fees, and the often-hidden Indirect Cost Ratio (ICR) that can eat away at your balance.

- Features and Flexibility: This covers everything from the quality of their insurance policies to how easy their online portal is to use and how much control you have over pension payments.

This kind of detailed due diligence means we're comparing apples with apples, homing in on the funds that are truly a cut above the rest.

Making Sure Your Super Fits Your Financial Plan

Finding a technically solid fund is only half the battle. The most important step in our Wealth Collective Guided Growth process is making sure your super strategy fits seamlessly into your overall financial plan. Your super is one of your biggest assets, so it needs to work together with your other goals, like paying down debt, investing outside of super, and planning for the retirement you want.

The long-term data really drives this home. Over 10 years, some of the top-performing growth super funds have returned 8.7% per year. That's a world away from the 6.2% from more balanced options. This difference shows just how critical it is to match the fund's investment strategy to your personal risk tolerance and timeline. You can explore more data on superannuation performance in this detailed report about superannuation statistics.

An adviser’s real value is connecting the dots between a fund’s features and your life’s ambitions. We make sure your investment choice doesn’t just suit your risk profile, but actively supports how you want to build wealth and eventually draw an income in retirement.

Ultimately, working with an expert brings clarity and confidence to a huge financial decision. It turns the complicated task of picking a super fund into a clear, logical choice. You can rest easy knowing your fund was chosen based on exhaustive research and is perfectly aligned with what you want to achieve.

If you’re thinking about making a change, our guide on how to switch super funds is a great place to start.

Ready to see how a personalised process can build a stronger financial future for you?

Book a complimentary initial call with our team to get started.

Common Questions We Hear About Super Funds

Diving into the world of super can feel like learning a new language. To help you get your bearings, we've answered some of the questions we hear most often from our clients.

How Often Should I Review My Superannuation Fund?

As a rule of thumb, it's a good idea to give your super a check-up once a year, usually when your annual statement arrives.

But life events are the real trigger for a deeper look. Starting a new job, welcoming a child, or getting within ten years of retirement are all critical moments to reassess. We recommend a comprehensive review with a financial adviser every two to three years to make sure your fund and strategy are still pulling their weight and working towards your goals.

Is Switching Super Funds Hard?

The admin side of switching is usually pretty simple and can often be done online. The real challenge isn't the paperwork; it's making sure the switch is actually the right move for you.

Before you jump, you absolutely must consider:

- Your existing insurance: Switching could mean losing valuable life, TPD, or income protection insurance. Getting that same level of cover again might be difficult or more expensive, especially if your health has changed.

- Hidden fees and costs: Are there exit fees? More importantly, do you fully understand the fee structure of the new fund you’re considering?

- Tax implications: Moving your super can sometimes crystallise a capital gains tax event. It's crucial to understand what this could mean for your balance.

Working with an adviser can help you navigate these potential pitfalls, ensuring a smooth transition without any nasty surprises.

What’s the Difference Between an Industry and a Retail Fund?

Historically, the distinction was clear. Industry funds were run purely for member profits and often had lower fees. Retail funds, on the other hand, were owned by big financial companies, run for profit, and tended to offer more bells and whistles in terms of investment and insurance choices.

Today, those lines are much blurrier. Many industry funds have expanded their offerings, and retail funds have become more competitive on fees. The "best" type of fund is no longer about the label; it's about finding the specific fund that delivers the right mix of performance, fees, features, and insurance for your personal situation.

At Wealth Collective, our job is to cut through the noise and answer these questions with your unique circumstances in mind. We're here to be your dedicated partner, finding the super fund that is genuinely the best fit for you.

Ready to get clear on your super strategy? Book a complimentary initial call and discover how our Guided Growth process can make a real difference.