Business hours

Monday to Friday (8.30AM - 5PM)

Weekend (Closed)

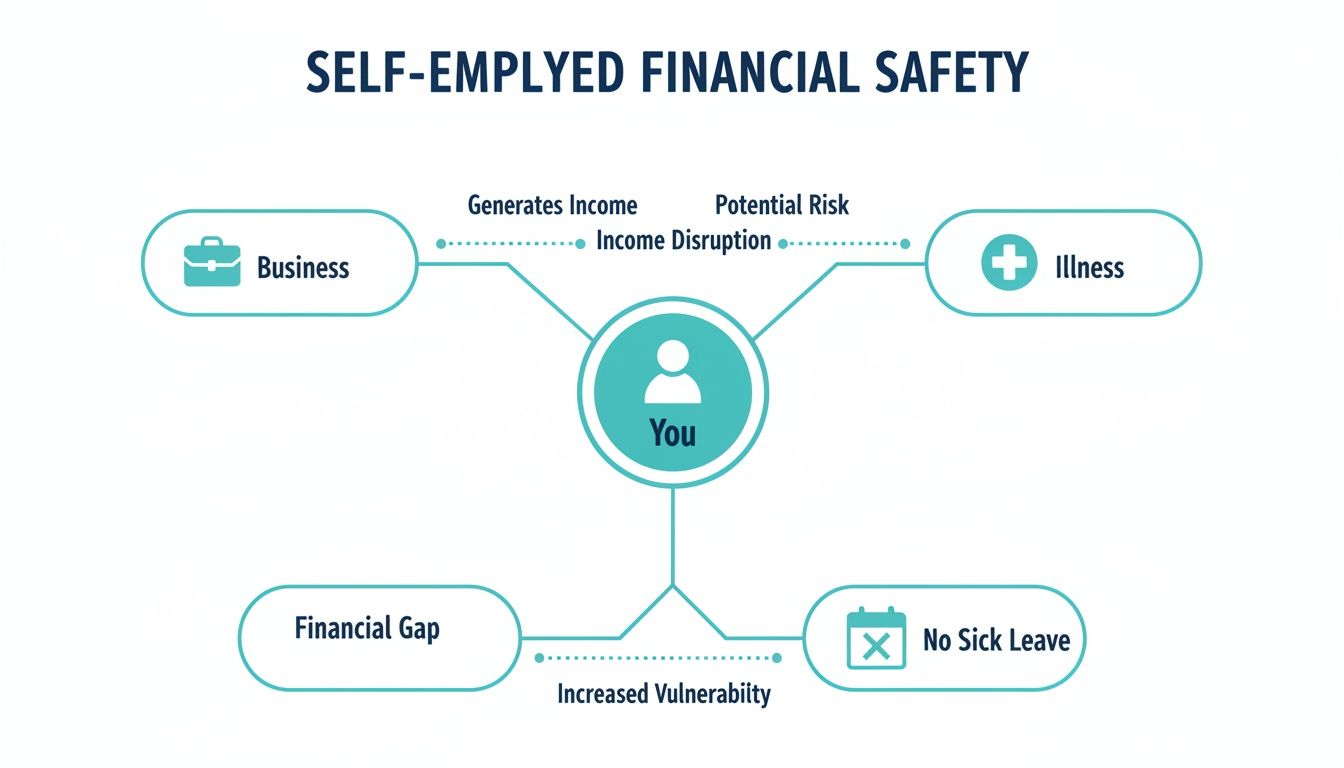

Picture this: you're running your business, whether it's in the heart of Perth or down in Dunsborough, putting your all into it. Then, out of nowhere, an illness or injury stops you cold. What happens next? For self-employed Aussies, this is where income protection insurance becomes your financial backstop.

Without paid sick leave to rely on, it’s the one tool that can replace your income, cover the bills, and look after your family while you can't work.

Your Financial Safety Net When You Are The Boss

When you're the one in charge, your ability to get up and earn a living is your single greatest asset. It's easy to forget that unlike someone in a regular job, you don't have a safety net of sick days or annual leave. The moment you stop working, the income stops too.

That's a pretty vulnerable position to be in. An unexpected accident or a serious health scare can put your personal finances, and the very business you've poured your heart into, at immediate risk. This is exactly why income protection insurance for self employed people isn't just a 'nice-to-have'—it's essential.

Why It Is A Critical Business Tool

It helps to think of this insurance less like an expense and more like a crucial part of your business continuity plan. It’s specifically designed to give you a monthly payment if you're temporarily out of action because you're sick or injured. This means you can keep on top of your commitments without having to raid your savings or take on debt.

These regular payments can be a lifeline, helping cover all the non-negotiables like:

- The mortgage on your home or your rent payments

- Groceries, power bills, and day-to-day living costs

- Your kids' school fees

- Repayments on any business loans you might have

In short, it buys you precious time to focus on getting better, without the crippling stress of a financial crisis looming over you. A policy will typically step in to replace up to 70% of your pre-disability monthly income when you're off work. You can find more insights on this for business owners over at Lifebroker.com.au.

At Wealth Collective, we see this as foundational. Protecting your income is the very first step in building a resilient financial future. Without it, even the most carefully crafted plans for wealth creation or retirement can be completely undone by one bad turn of events.

Our process always starts with getting a crystal-clear picture of your unique income structure and personal financial needs. This is the only way to figure out the right level of cover to build a fortress around everything you've worked so hard for. Booking an initial call is a simple, no-obligation first step towards achieving that peace of mind.

How To Decode Your Policy Features

Trying to read an income protection policy can feel like you're learning a new language, filled with jargon that doesn't make a lot of sense at first glance. But it's not as complex as it seems. Once you get your head around a few key terms, you'll be able to compare quotes with confidence and ensure you're getting the right cover for your business.

Let's break down the most important policy features into plain English.

When you're self-employed, your health, your business, and your finances are all tangled together. One unexpected illness can pull the whole thing down because there's no safety net of paid sick leave.

This is why understanding your policy isn't just a box-ticking exercise; it’s about protecting your entire livelihood.

Waiting Period: The Time-Based Excess

Think of the waiting period like the excess on your car insurance, but instead of a dollar amount, it's a period of time. It's the number of days you have to be off work due to illness or injury before your monthly payments from the insurer kick in.

Waiting periods can be as short as 14 days or as long as two years. A shorter waiting period gets you paid sooner, but it comes with a higher premium. On the flip side, a longer waiting period makes your cover cheaper, but you’ll need to have enough cash in the bank to see you through those months.

Choosing the right waiting period is all about aligning it with your personal savings and business cash flow. It’s a crucial step we focus on at Wealth Collective to ensure your policy fits your financial reality, so you're not left high and dry when you need support most.

Benefit Period: The Lifespan Of Your Safety Net

If the waiting period is about when the payments start, the benefit period is about how long they can last. It’s the maximum amount of time your insurer will pay you a monthly benefit for a single claim.

You'll typically see options like two years, five years, or right up until you turn 65 or 70.

A longer benefit period is your ultimate safety net against a serious, long-term illness that could stop you from ever working again. It provides real peace of mind, but it also costs more. This is a classic trade-off between the level of protection you want and what you can comfortably afford, and it’s a key decision we help our clients make.

Agreed Value vs. Indemnity Policies

This is one of the most critical distinctions for any self-employed person, especially since our incomes can swing wildly from one year to the next.

Agreed Value: This is like a 'fixed-price contract'. The insurer locks in your monthly benefit amount when you first sign up. You prove your income at the start, and if you ever need to claim, that's exactly what you'll get, even if your earnings have dropped since you took out the policy.

Indemnity Value: This is more like getting paid by the hour. Your benefit is calculated based on what you earned in the 12-24 months just before you make a claim. If you've had a quiet year or your income has dipped, your payout will be lower as a result.

Heads up: due to regulatory changes in 2020, insurers can no longer offer Agreed Value on new policies. This makes it more important than ever to understand how an Indemnity policy works and to keep good financial records. Knowing what proof you'll need can make or break a claim down the track. Of course, while these policies are designed to replace your income, it's also worth knowing what income protection does not cover to get the full picture.

To make these concepts even clearer, here’s a quick summary of the key features you’ll encounter when looking at policies.

Key Policy Features At A Glance

| Policy Feature | What It Means For You | Wealth Collective Pro Tip |

|---|---|---|

| Waiting Period | The time you wait before payments start (14 days to 2 years). | Match this to your cash savings. If you have 3 months of expenses saved, a 90-day waiting period could be a good fit. |

| Benefit Period | The maximum time you can receive payments (2 years to age 65+). | A longer benefit period (e.g., to age 65) protects you from career-ending events. It costs more but offers the most security. |

| Partial Disability | Pays a partial benefit if you can work some hours but not full-time. | Absolutely essential for a gradual return to work. It bridges the income gap and supports your recovery. |

| Stepped vs. Level Premiums | Stepped starts cheap and increases with age. Level starts higher but stays the same. | Level premiums can save you a huge amount of money over the life of the policy if you plan to hold it long-term. |

Understanding these terms puts you in control. It allows you to move beyond the headline price and assess whether a policy truly fits the unique risks that come with running your own business.

Calculating The Right Amount Of Cover

So, how much cover do you actually need? This is where many self-employed people trip up. It’s easy to either pluck a number out of thin air and end up dangerously underinsured, or to over-insure and waste money on premiums for years.

Getting this number right isn't just a box-ticking exercise; it's the absolute foundation of your financial safety net. Think of it like a bridge designed to carry your entire financial load if you can't work. You wouldn't guess its weight capacity. You'd calculate it precisely. Your income protection benefit needs that same level of precision.

Step 1: Get Real About Your Monthly Expenses

First things first, you need to get a crystal-clear picture of where your money goes every month. This means digging into the details of every non-negotiable expense that keeps ticking over, whether you’re working or not.

The best way to tackle this is to split your outgoings into two piles: personal and business. This simple step brings so much clarity and ensures nothing important gets missed.

Your Personal Expense Checklist:

- Mortgage or rent payments

- Council rates and any strata fees

- Groceries and other household essentials

- All your utilities – electricity, gas, water, internet

- Car costs like fuel, rego, and insurance

- Repayments on personal loans or credit cards

- Kids' school fees or activity costs

- Private health insurance premiums

Your Business Expense Checklist:

- Repayments on business loans or equipment leases

- Monthly software subscriptions (think Xero or Adobe)

- Professional insurance premiums (like public liability)

- Rent for your office, workshop, or co-working space

- Regular fees for your accountant or bookkeeper

- Business-related vehicle expenses

Add these two lists up, and you’ve got your magic number: the absolute minimum your insurance benefit needs to cover each month to keep your world turning.

Step 2: Prove Your Income (The Self-Employed Way)

Once you know your monthly expenses, the next piece of the puzzle is your income. Insurers will typically let you cover up to 70% of your pre-tax income. But as a self-employed person, you can’t just show them a payslip. Your income probably fluctuates, so insurers need to see the bigger picture over time.

This is where good record-keeping pays off. You'll need to pull together financial documents that paint a clear and consistent story of your earnings, usually from the last one or two financial years. This evidence is vital when you apply, but it's even more critical if you ever need to make a claim.

An insurer can only cover what you can prove. Meticulous financial records aren't just good business practice—they're the key to unlocking the right income protection insurance for self employed Aussies. Without solid proof, you risk having your benefit slashed right when you need it most.

Here are the documents you'll want to have on hand:

- Your full personal and business tax returns

- Detailed Profit and Loss statements

- Your Business Activity Statements (BAS)

- A supporting letter from your accountant can also be a huge help

Step 3: Aligning Your Cover With Your Life

Now you have the two most important figures: your total monthly expenses and your provable monthly income. The goal is to choose a monthly benefit that covers all your essentials without going over that 70% income cap.

This is the sweet spot where the right advice can make all the difference. At Wealth Collective, our process is designed around this very calculation. We don't guess. We work with you to meticulously calculate your needs, making sure your policy is a perfect fit for your life, with no wasted dollars on cover you don't need.

Taking the time to do this properly gives you the confidence that if you ever have to rely on your policy, it will do exactly what it’s supposed to do. To get clarity on your numbers and start building a robust plan, feel free to book a complimentary initial call with our team.

Understanding Tax and Superannuation Rules

When you're running your own business, tax and super aren't just a compliance headache—they're powerful tools. If you use them smartly, you can make your financial plan work much harder for you. This is especially true when it comes to income protection insurance for self employed people, where understanding the rules can completely change the real-world value of your policy.

It's not just about having cover; it's about setting it up in the most effective way for your specific circumstances. Getting this right is a huge part of what we do at Wealth Collective. We make sure your protection strategy fits seamlessly with your bigger financial goals.

The Power of Tax Deductibility

One of the biggest wins of holding an income protection policy in your own name (outside of super) is how the tax office treats it. The premiums you pay are generally tax-deductible. For someone who is self-employed, this is a game-changer because it directly cuts down your taxable income, meaning you pay less tax.

Think of it this way: every dollar you spend on your premium acts like a discount on your end-of-year tax bill. This makes the real cost of your insurance much lower than the price tag might suggest.

This tax deduction can make a massive difference to your cash flow. It turns what feels like a pure expense into a savvy financial move that protects your income and gives you a tangible tax benefit at the same time.

Many self-employed Aussies are genuinely surprised by how affordable this cover can be. Finder analysed over 170 quotes from 11 of Australia’s top insurers and found the average monthly premium was just $48.06 for a $3,000 monthly benefit. For a female accountant in WA, for example, the cost could be as low as $23.32 per month. It really highlights how accessible this protection is. You can see how they crunched the numbers in Finder's detailed analysis.

Holding Insurance Inside Superannuation

Another option you'll come across is holding your income protection inside your super fund. On the surface, it sounds great. The premiums come straight out of your super balance, so you don't see the money leave your bank account.

But that convenience can come with some serious trade-offs, and it's vital for business owners to know what they are. While it might feel like an easy "set-and-forget" solution, the policies inside super are often basic, less flexible, and can be a real headache to claim on when you need them most.

There are a few key reasons for this:

- Stricter Definitions: The definition of disability in a super fund policy is often much tougher. You might have to prove you can't do any job you’re suited for by your training or experience, not just your own specific job. That’s a very high bar to clear.

- Limited Benefit Periods: Most super policies will only pay you for a maximum of two years. That’s simply not enough if you suffer a long-term illness or injury that ends your career.

- Draining Your Nest Egg: Paying premiums from your super directly eats away at your retirement savings. Over decades, the compounding effect of those deductions can leave you with a much smaller nest egg than you were counting on.

At the end of the day, while holding cover in super can seem appealing, it often gives you a false sense of security. The potential downsides usually far outweigh the convenience, especially for a self-employed person who needs solid, dependable protection. For a deeper dive into the specifics, you might be interested in our guide on income protection insurance tax deductions.

Figuring out the right structure is a critical conversation. It demands a clear look at your tax situation, your retirement goals, and the amount of risk you’re willing to take on. That's where we come in—at Wealth Collective, we guide you through these complexities to make sure your choice supports your entire financial world.

How to Navigate the Claims Process

Let's be honest, lodging an insurance claim is the last thing you want to do when you’re sick or injured. The sheer stress of chasing paperwork and sitting on hold with an insurer while you’re trying to recover can feel completely overwhelming. This is your practical roadmap—a guide to give you the clarity and confidence to handle the process if you ever need to.

The claim is the moment of truth for any insurance policy. It's where the promises on paper are meant to turn into real financial support. For a self-employed person, the stakes are even higher because the evidence you need to provide is far more complex than a simple payslip.

Gathering Your Evidence

Being prepared is half the battle. When you kick off a claim, your insurer will need solid proof of both your medical condition and your financial situation before you had to stop working. Having these documents ready can speed things up dramatically.

You’ll typically need two types of evidence:

Medical Proof: This is the cornerstone of your claim. It needs to clearly state that you’re unable to work because of your illness or injury and will usually involve a detailed report from your doctor or specialist.

Financial Proof: This is where it gets a bit more involved for business owners. You need to prove your pre-disability earnings to justify the benefit amount you’re claiming. Expect the insurer to ask for:

- Full personal and business tax returns for the last 1-2 years.

- Detailed Profit and Loss statements.

- Your Business Activity Statements (BAS).

- A supporting letter from your accountant to confirm your income structure.

This is exactly why meticulous record-keeping isn't just good business practice—it's critical for your financial survival.

Understanding Timelines and Delays

Once you’ve submitted all the initial paperwork, the insurer begins their assessment. While every insurer is different, you should expect the process to take several weeks. Unfortunately, delays are common, and they often happen for reasons that are totally avoidable.

The most frequent culprits for a claim dragging on are incomplete paperwork, missing financial details, or medical reports that aren’t specific enough about your capacity to work. Every time the insurer has to come back to you for more information, the clock effectively resets, adding more stress when you least need it.

This is where having a professional on your side can make all the difference.

The claims process can be a minefield of complexity and frustration, especially when your income has stopped. Having an expert manage the entire process for you—liaising with the insurer, chasing up reports, and ensuring everything is submitted correctly—is a game-changer. It allows you to focus purely on your health.

Self-employed Australians are particularly vulnerable here. Data from the Australian Financial Complaints Authority (AFCA) shows that income protection policies were the most complained-about life insurance product in 2020-21, making up over a third of all complaints. As noted in Money Management's report, key issues for business owners revolved around benefit calculations and outright claim denials.

Why a Professional Advocate Is Your Best Asset

At Wealth Collective, managing claims is a core part of what we do. When one of our clients needs to claim, we take over completely. We handle all the back-and-forth with the insurer, coordinate with your doctors and accountant, and make sure every piece of information is presented clearly and correctly from day one.

Given the high complaint rates and the unique complexities for business owners, going it alone is a huge risk. Our expertise ensures your claim has the best possible chance of a smooth and successful outcome, letting you focus on what really matters: your recovery. This hands-on support is fundamental to how we help our clients.

To see how we can help, book a complimentary 10-minute introductory call to discuss your needs.

Common Mistakes and How to Avoid Them

Getting your head around personal insurance can be a minefield, and a few simple missteps can end up costing you dearly. When you’re self-employed and looking at income protection, knowing the common traps is the best way to make sure you're not left exposed when you can least afford it.

Many business owners make honest mistakes that can seriously weaken their financial safety net. These aren't complicated errors, just simple oversights that are easy to sidestep with a bit of know-how. Let's walk through them so you can make smarter, more secure decisions.

Mismatched Waiting Periods and Cash Flow

One of the most frequent slip-ups we see is picking a waiting period that has no connection to your actual cash reserves. Sure, a short 30-day waiting period sounds great in theory, but the higher premiums can become a real drag on your cash flow. On the flip side, choosing a 90-day period to save a few dollars is a huge gamble if you've only got one month of savings in the bank.

A policy's waiting period needs to be a direct reflection of your financial reality. Getting this wrong means you either overpay for years or face a massive, stressful cash gap right when you need support the most.

The fix is simple: take a hard, honest look at your emergency fund. This makes sure your policy is both affordable day-to-day and practical when you need it, kicking in just as your own savings are about to run dry.

The Set-And-Forget Policy Trap

Another classic mistake is treating your policy like a crockpot – set it and forget it. The income you were earning five years ago probably looks very different from what you're bringing in today. If your policy is still based on that old figure, you could be in for a nasty shock at claim time, receiving a monthly benefit that barely scratches the surface of your current expenses.

Think of your policy as a living document that should grow alongside your business. We suggest a quick check-in every 12-18 months, or whenever your income changes significantly, just to make sure the benefit amount still makes sense for you.

Building a Complete Safety Net

Finally, it’s a mistake to think income protection is the be-all and end-all. It's a hugely important piece of the puzzle, but it doesn't cover everything. A truly solid protection plan usually brings a few other specialised types of cover into the mix.

- Business Expenses Insurance: This is what keeps the lights on at your business if you can't work. It handles fixed costs like rent, bills, and staff wages, keeping things running while you recover.

- Key Person Insurance: This protects your business from the financial fallout if a crucial team member (and that includes you!) is out of action for a long time.

- Trauma Insurance: This one provides a tax-free lump sum payment if you’re diagnosed with a serious illness. It gives you immediate financial breathing room to focus on treatment and getting better without worrying about money.

At Wealth Collective, our process is designed to look at your whole world. We don't just put a policy in place for your income; we build a complete strategy to protect your business, your health, and your family. Booking an initial call is the first step toward building that comprehensive security.

Taking the Next Step to Secure Your Income

Getting your head around the theory of income protection insurance for the self-employed is a great start. But let's be honest, turning that knowledge into a real-world safety net is what actually counts. You've now got the core concepts down, but the real work of protecting your income begins now.

Going from research to having a rock-solid policy in your hands can feel like a huge task. The trick is to break it down into simple, manageable steps. This isn't just about ticking boxes; it's about carefully building a plan that fits your life, your business, and your family.

Your Simple Action Checklist

To move forward with confidence, here’s a straightforward checklist. Working through these points will get you ready for a productive chat about your insurance needs and make sure nothing important gets missed.

Here’s what you need to do:

- Calculate Your Monthly Expenses: Add up all your essential personal and business costs. This gives you the bare minimum monthly benefit you'd need to keep things running.

- Gather Your Financials: Get your last two years of tax returns, Profit & Loss statements, and BAS together. This paperwork is essential for proving your income to an insurer.

- Review Your Savings: Have an honest look at your cash buffer. How long could you realistically support yourself without any income? This will help you decide on the right waiting period.

- Define Your Goals: Think about how long you'd want the cover to last if you needed it. Are you looking for a short-term buffer for a few years, or do you need protection right through to retirement?

How We Make It Simple

Trying to navigate all of this on your own can be complex and pretty time-consuming. That’s exactly where the Wealth Collective process steps in. We take the guesswork and the heavy lifting off your plate, handling everything from figuring out your needs and comparing policies to managing the application right to the end.

Our job is to translate your unique situation into a smart protection strategy. We make sure you get the right cover at a competitive price, without the headache of trying to decipher confusing policy documents.

Your next move is simple and comes with no strings attached. We invite you to book a complimentary 10-minute call with one of our advisers. It’s just a quick chat to run through your situation, answer your questions, and start building the financial security your hard work deserves.

If you'd like to do a bit more digging yourself, you can also learn how to compare income protection policies with our detailed guide.

Ready to protect your most valuable asset—your ability to earn an income? The team at Wealth Collective is here to help you build a clear, effective plan. Book your complimentary call today.