Business hours

Monday to Friday (8.30AM - 5PM)

Weekend (Closed)

Choosing the right life insurance can feel like navigating a complex maze. In Australia, it boils down to four main types: Term Life Cover, Total and Permanent Disability (TPD), Trauma Cover, and Income Protection.

Each acts as a different financial safety net, designed to protect you and your loved ones from specific life events. The Wealth Collective process is about finding the right mix to ensure you have a parachute ready for whatever life throws your way, driving you towards your financial goals with confidence.

Your Guide to Navigating Life Insurance

Understanding the different kinds of life insurance is the first step toward building a solid financial backstop. It’s not about finding a single “best” policy; it’s about layering the right protection to match your life stage and financial goals. Think of it like a toolkit – you need different tools for different jobs.

This guide simplifies the main options in Australia, breaking down what each policy does in plain English. Our goal is to replace uncertainty with clarity, empowering you to make smart, confident decisions. For a deeper dive, you might find our article explaining how life insurance works useful.

Why Personalised Cover Matters More Than Ever

The Australian life insurance market is massive and growing, valued at AUD 43.42 billion in 2025 and projected to hit AUD 75.59 billion by 2035. This growth highlights a crucial point: one-size-fits-all cover just doesn’t cut it anymore.

Generic, off-the-shelf policies often leave dangerous gaps or have you paying for things you’ll never need. A properly designed strategy, on the other hand, ensures your cover is just right for you.

At Wealth Collective, our ‘Protection Plus’ service is designed to cut through this complexity. We build a plan that protects your financial world, whether you’re a young professional in Perth or planning for retirement in Dunsborough. Our goal is to move you from confusion to clarity, starting with a simple initial call.

The right advice ensures your insurance strategy works hand-in-glove with your wealth creation goals. By understanding the core life insurance types, you can build a plan that truly protects what you’re building.

Term Life Insurance: The Foundation of Your Protection

Of all the life insurance types, Term Life Insurance is the most straightforward and the cornerstone of a solid protection plan. Also known as Death Cover, its purpose is crystal clear: to pay a one-off, lump sum to your loved ones if you pass away during a specific period—the ‘term’.

Think of it as a financial safety net for the years your family depends on you most. It’s designed to provide maximum protection when your financial responsibilities are at their peak, like paying off a mortgage or raising young kids.

This focused approach makes it one of the most affordable and accessible forms of life insurance. Because it only covers a set period and doesn’t build a cash value, the premiums are much lower than permanent policies. Its simplicity is its strength, offering powerful protection without unnecessary complexity.

How Does Term Life Cover Work in Practice?

The mechanics are refreshingly simple. You choose a cover amount and a policy term—say, 10, 20, or 30 years, or until you hit a certain age like 65. You then pay regular premiums to keep the policy active.

If you pass away within that term, your beneficiaries receive the full, tax-free lump sum. This money provides immediate financial breathing room during a tough time, and they can use it for whatever they need most:

- Paying off the mortgage: Ensuring your family can stay in their home.

- Covering daily living expenses: Replacing your income so bills and school fees can still be paid.

- Funding future goals: Providing for children’s education or other long-term plans.

- Clearing outstanding debts: Settling personal loans so they aren’t passed on.

If you outlive the term, the policy simply expires. There’s no pay-out, which is precisely why it’s so cost-effective—you’re only paying for pure risk protection during that specific window of time.

Who Needs Term Life Insurance the Most?

While almost everyone can benefit from some life cover, it’s critical for certain people. If anyone relies on your income, Term Life Insurance should be a non-negotiable part of your financial plan.

This is especially true for:

- Young families with children: Your income is essential for their upbringing.

- Homeowners with a mortgage: A pay-out can wipe out the largest debt most families have.

- Business owners with financial partners: It can fund a buy-out, ensuring the business survives.

- Anyone with significant personal debt: It stops loved ones from inheriting your financial obligations.

The core idea is to create a financial buffer that stands in for you when you no longer can. This isn’t just about money; it’s about providing stability and the freedom for your loved ones to grieve without immediate financial panic.

At Wealth Collective, we see Term Life Insurance as the cornerstone of our clients’ strategies. Our detailed needs analysis calculates the exact cover you need to protect your specific goals, ensuring you’re neither underinsured nor overpaying. Understanding the different life insurance types starts here. If you’re ready to lay that first crucial brick, a quick 10-minute chat with our team is the perfect first step.

What If You Can’t Work Again? Protecting Your Livelihood

Term life cover is a vital safety net if you pass away, but what if a serious illness or injury stops you from working permanently? It’s a risk many people overlook.

This is where two other crucial types of cover protect your financial world while you’re still living: Total and Permanent Disability (TPD) Cover and Trauma Cover. They sound similar, but they serve very different purposes. Understanding them is non-negotiable for anyone whose lifestyle relies on their ability to earn an income.

What Is Total and Permanent Disability (TPD) Cover?

TPD insurance is designed to pay a lump sum if an illness or injury leaves you permanently unable to work. It’s your financial backstop for a life-changing event that removes your ability to earn a living.

The key to any TPD policy is its definition of “total and permanent disability,” which comes in two main forms:

- Own Occupation: The gold standard. You receive a pay-out if your disability prevents you from ever working again in your specific job. A surgeon who loses fine motor skills would likely be covered, even if they could work in another field.

- Any Occupation: A much tougher definition, common in default super policies. It only pays if your disability stops you from working in any job suited to your education or experience.

The TPD lump sum provides long-term financial support. It can be used to eliminate the mortgage, cover ongoing medical bills, or be invested to create a lifelong income stream.

How Does Trauma Cover Fill a Different Gap?

Trauma Cover, or Critical Illness Cover, is different. Instead of being linked to your ability to work, it pays a lump sum upon diagnosis of a serious medical condition listed in your policy, like cancer, a heart attack, or a stroke.

The money provides an immediate cash injection, giving you the freedom to focus on recovery without the stress of mounting bills.

The purpose of Trauma Cover isn’t to replace your income forever. It’s to provide a financial cushion to handle the immediate costs of a major health crisis, so you can make decisions based on what’s best for your health, not your bank account.

This pay-out could help you:

- Access the best medical treatments, including those not covered by private health insurance.

- Pay for help around the house while you recover.

- Take extended time off work without financial pressure.

- Reduce debts to lower your monthly expenses.

At Wealth Collective, we view TPD and Trauma cover as non-negotiable components of a robust financial plan. Our comprehensive risk assessment, a key part of our ‘Protection Plus’ service, pinpoints the right amount of cover to protect your specific income and commitments.

TPD vs. Trauma Cover at a Glance

While both pay a lump sum, their triggers and purposes are completely different.

| Feature | Total and Permanent Disability (TPD) Cover | Trauma (Critical Illness) Cover |

|---|---|---|

| Payment Trigger | Being unable to ever work again due to illness or injury. | Getting diagnosed with a specific medical condition (e.g., cancer, stroke). |

| Primary Purpose | To replace your long-term income and fund future living costs. | To cover immediate medical bills and costs associated with recovery. |

| Focus | Your capacity to earn an income. | The diagnosis of a specific illness. |

| Example Scenario | A builder has a severe accident and can never work on a construction site again. | An executive is diagnosed with cancer and needs to take six months off for intensive treatment. |

These policies are highly reliable when set up correctly. Industry data shows that for policies arranged with professional advice, TPD claims have an 82.9% acceptance rate, and Trauma claims are even higher at 86.0%. This highlights the value of expert guidance—a cornerstone of the Wealth Collective process—to ensure your policy is structured properly from day one. You can explore more about these insurance market trends and claim rates to see the difference good advice makes.

Income Protection: Your Monthly Paycheck Safety Net

While lump-sum payments from TPD or Trauma cover are for life-altering events, many health issues are temporary. A serious injury could keep you out of work for months or years, creating a huge financial gap. This is where Income Protection becomes your most critical financial backstop.

Unlike other life insurance types, Income Protection acts as a substitute for your monthly pay check. If you can’t work due to illness or injury, it pays a regular monthly benefit—usually up to 70% of your pre-tax income. This allows you to keep paying the mortgage, cover bills, and maintain your lifestyle while you focus on recovery.

It’s the one policy designed purely to protect your cash flow. Without it, you could be forced to burn through savings, sell assets, or raid your super just to stay afloat.

Understanding the Key Levers of Your Policy

To ensure your Income Protection works when you need it most, you must understand three core components. Nailing these details is a crucial part of the strategic advice we provide at Wealth Collective.

- Waiting Period: The time you must be off work before payments begin, ranging from 30 days to two years. A shorter wait means higher premiums; it’s a trade-off between cost and how quickly you need support.

- Benefit Period: The maximum length of time you can receive payments for a single claim, typically two years, five years, or through to age 65. A longer period provides greater security against long-term illnesses.

- Definition of Disability: The make-or-break clause. An ‘Own Occupation’ definition pays if you can’t perform the duties of your specific job. The less comprehensive ‘Any Occupation’ definition only pays if you can’t work in any job you’re reasonably suited for.

Why the Policy Details Matter

Imagine a specialist tradesperson injures their hand and can no longer perform their skilled work. Under an ‘Own Occupation’ policy, their claim is likely paid. With an ‘Any Occupation’ policy, the insurer might argue they can still work in another role, like retail, and potentially deny the claim.

This distinction is fundamental. It determines whether your policy truly protects your hard-earned income and specialised skills, or if it contains loopholes that could leave you exposed.

This is why generic policies, especially those bundled in super funds, can be risky. Our detailed guide on superannuation income protection explores these nuances further. The Wealth Collective process involves a deep dive into these definitions to ensure your cover is watertight and reflects the work you do. Structuring your policy correctly ensures your wealth-building journey continues, even when your health temporarily puts your career on hold.

Deciding Between Super and Personal Insurance Policies

Once you understand the different life insurance types, the next big question is how to own the cover. It comes down to two main paths: holding insurance inside your superannuation fund or buying a personal policy directly from an insurer.

Each option has significant consequences for cost, flexibility, and tax, so it’s a decision worth getting right.

Many people’s only experience with life insurance is the ‘default’ cover in their super fund. It’s convenient because premiums are paid from your super balance, but this convenience can come at a cost. Insurance inside super is like an off-the-rack suit—a decent starting point, but rarely a perfect fit.

Insurance Inside Super: The Pros and Cons

Holding insurance in super has real advantages, primarily around cost and convenience, but you must weigh them against serious limitations.

Key Advantages:

- Affordable Premiums: Paid from your pre-tax super balance, so it doesn’t impact your daily cash flow.

- Automatic Acceptance: Default cover often requires no medical underwriting, a huge benefit if you have pre-existing health conditions.

- Tax-Effective Payments: Premiums are paid with pre-tax dollars, a more tax-efficient way to fund your cover.

However, the downsides can be a deal-breaker. The cover is often basic, with low payout amounts and restrictive definitions that may not protect you when needed. To learn more, check our guide on what superannuation is and how it works in Australia.

Personal Policies: The Case for Control

Owning an insurance policy personally—outside of super—puts you in the driver’s seat. You get maximum control and flexibility. Instead of a one-size-fits-all product, you get cover built specifically for your situation, which is central to our ‘Protection Plus’ service at Wealth Collective.

This tailored approach means you can secure higher levels of cover with far better features. For example, ‘Own Occupation’ TPD or Income Protection, vital for specialised professionals, is almost exclusively available through personal policies. Trauma Cover, one of the most critical life insurance types, generally can’t be held in super at all.

The market reflects this shift. More people are seeking expert advice to structure protection outside the limitations of super, as shown in reports on Australia’s evolving life insurance market.

The biggest advantage of personal policies often comes at claim time. The money is paid directly to you or your family, tax-free, without the delays of meeting a superannuation ‘condition of release’.

Insurance in Super vs Personal Policy: A Comparison

This table breaks down the key differences between holding insurance inside your super fund versus owning it personally.

| Feature | Inside Superannuation | Personal Policy (Outside Super) |

|---|---|---|

| Premium Payments | Paid from your super balance (pre-tax). Doesn’t impact your cash flow. | Paid from your bank account (post-tax). Premiums for Income Protection are generally tax-deductible. |

| Policy Features | Generally basic cover. Definitions can be restrictive (e.g., ‘Any Occupation’ TPD). Trauma Cover is unavailable. | Comprehensive and customisable. Can include ‘Own Occupation’ definitions and a wider range of benefits. |

| Cover Levels | Often capped at lower amounts, which may not be sufficient for high-income earners or large mortgages. | Flexible and can be tailored to your exact needs, allowing for much higher levels of cover. |

| Tax on Payouts | TPD and Death benefits may be taxed depending on the beneficiary’s status (e.g., a non-dependent adult child). | All benefits (Death, TPD, Trauma) are paid completely tax-free to the policy owner or nominated beneficiary. |

| Claim Process | Payout goes to the super fund trustee first, who then assesses it against ‘conditions of release’ before paying you. | The benefit is paid directly to you or your nominated beneficiaries, providing faster access to funds. |

For many of our clients, the best strategy isn’t an either/or choice—it’s a blended approach. You might keep a baseline level of Death and TPD cover inside super for cost-effectiveness, then add a high-quality personal policy for Income Protection and Trauma cover. This hybrid strategy delivers the best of both worlds: affordability and comprehensive protection.

Building Your Personalised Protection Plan

Knowing the different life insurance types is one thing, but applying them to your life is what truly matters. It’s about building a practical plan that protects what you’ve worked so hard for.

The smartest strategies layer different policies to create a complete safety net. One layer might protect against your death, another against a serious illness, and a third if you can’t work. It all starts with a clear-eyed look at your life stage, debts, and future goals.

Your Path to a Tailored Strategy

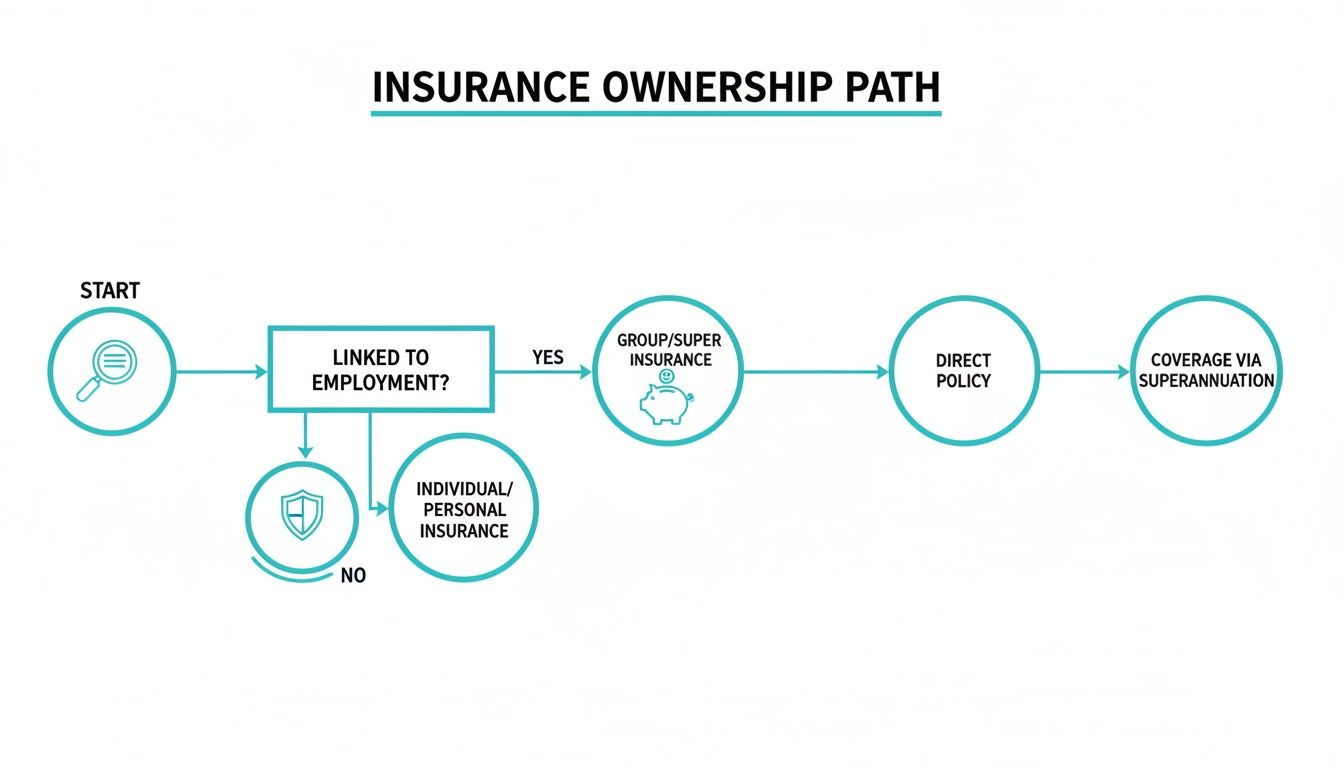

Just as important as what you’re covered for is where you hold that cover. The flowchart below breaks down the key decision: holding your insurance inside your superannuation fund versus owning it personally.

This decision tree lays out the two main ownership paths. It’s a great starting point for weighing up the convenience of cover in super against the control of a personal policy.

How Wealth Collective Simplifies Your Journey

Piecing this all together on your own is daunting. That’s why we created our ‘Protection Plus’ service at Wealth Collective. We cut through the noise with clear, straightforward advice to protect your family and your wealth.

It all starts with a no-obligation 10-minute discovery call. This informal chat helps us understand your situation and allows you to see if we’re the right fit. From there, we build a plan that provides the right protection without you paying for cover you don’t need.

Protecting your financial future is one of the most important steps you can take. A well-designed insurance plan provides peace of mind, allowing you to focus on your wealth creation goals, knowing a robust safety net is firmly in place.

Our goal is to give you the clarity and confidence to make informed decisions that secure your family’s future. Ready to put the right plan in place? Book your complimentary 10-minute discovery call today and take the first step towards securing your financial wellbeing.

Your Life Insurance Questions Answered

When exploring life insurance, questions naturally arise. Here are clear answers to the questions we hear most often from our clients.

So, How Much Cover Do I Actually Need?

There’s no magic number. The right amount of cover is unique to you. It needs to account for your mortgage, other debts, your family’s living costs, and future goals like your children’s education.

A common rule of thumb is 10 to 12 times your annual salary, but this is often just a starting point. The only way to get a number you can rely on is through a proper needs analysis.

At Wealth Collective, our process is about precision. As part of our ‘Protection Plus’ service, we calculate the exact amount of cover required to ensure your family is secure, without you spending a dollar more than necessary on premiums. We analyse your entire financial situation to arrive at a figure that provides genuine peace of mind.

Can I Have More Than One Type of Life Insurance?

Absolutely. In fact, a robust protection plan strategically layers different types of cover to protect you from a range of “what if” scenarios.

A comprehensive strategy might look like this:

- Term Life Cover to eliminate the mortgage if you were to pass away.

- TPD Cover in case a serious disability meant you could never work again.

- Income Protection to provide a monthly income if you were temporarily unable to work.

Our advisers are experts at building these multi-layered plans, creating a complete safety net that is both cost-effective and tailored to your risks.

What if My Life Changes? Does My Insurance Need to Change Too?

Yes, one hundred percent. Your insurance needs evolve with your life. It’s crucial to review your policies at major life milestones to ensure your cover remains adequate.

Key moments that should prompt a review with your adviser include:

- Getting married or divorced

- Having a child

- Buying a new home or increasing your mortgage

- Getting a significant pay rise

- Changing careers or starting a business

For instance, a bigger mortgage usually means you need more Term Life cover. If your income grows, your old Income Protection policy might no longer be sufficient. We recommend an annual review with your adviser to ensure your plan keeps up with your life. This is a core part of the ongoing service we provide to our clients.

Understanding the different types of life insurance is the first step towards securing your financial future. At Wealth Collective, our ‘Protection Plus’ service is designed to make this process simple, providing clear, practical advice from the start. Book your complimentary 10-minute discovery call today and let’s start building a plan that protects everything you’re working for.