Business hours

Monday to Friday (8.30AM - 5PM)

Weekend (Closed)

Life insurance is fundamentally about ensuring the people you care about are financially secure if you're no longer around or if your health takes a serious turn. It’s a safety net designed to protect your family's future, no matter what happens to you. A well-structured policy provides a payout to cover debts, everyday living costs, and future goals, so your family isn't left scrambling during an already difficult time.

At Wealth Collective, our process begins with understanding what's most important to you, then building a tailored strategy to protect it.

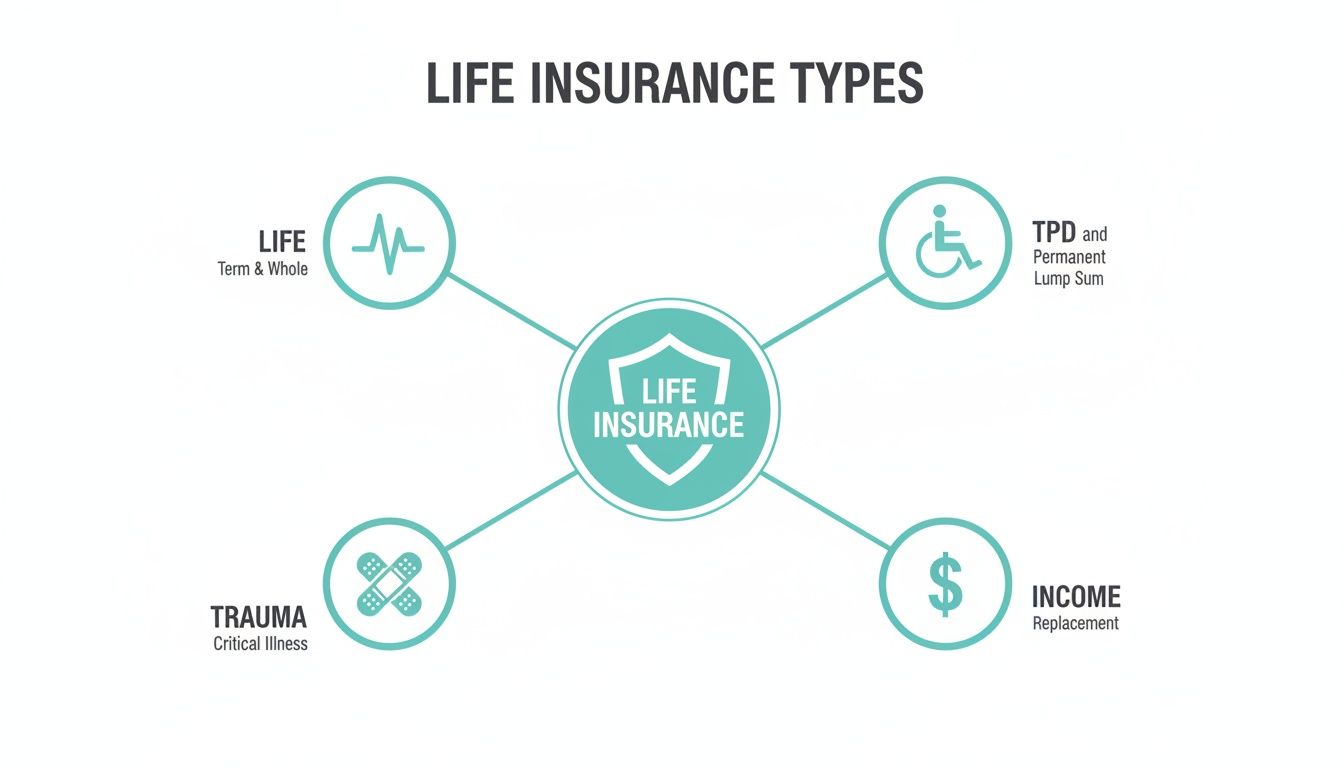

A Clear Snapshot of What Life Insurance Covers

When we talk about 'life insurance' in Australia, it's rarely a single product. It’s a suite of different covers, each designed to protect you against a different life-altering event. Understanding these core components is the first step in our process to build a plan that truly works for you and your family.

This diagram breaks down the main types of personal insurance that form the foundation of a solid financial protection plan.

As you can see, a complete strategy often bundles together cover for death (Life Cover), permanent disability (TPD), serious illness (Trauma), and being unable to work (Income Protection).

The Four Pillars of Personal Insurance

To understand what life insurance can do, it helps to break it down into these four key pillars. Each is triggered by a different event and is designed to do a specific job in protecting your financial world.

Here’s a quick summary of how they all fit together.

The Four Pillars of Personal Insurance at a Glance

| Type of Cover | What Triggers a Payout | How It's Paid | What the Payout Supports |

|---|---|---|---|

| Life Cover (Death Benefit) | Your death or the diagnosis of a terminal illness. | A lump sum payment. | Clearing debts like mortgages, covering funeral costs, and providing a long-term income stream for your family. |

| Total & Permanent Disablement (TPD) | A serious injury or illness that means you can likely never work again. | A lump sum payment. | Medical bills, home modifications, ongoing care, and replacing a lifetime of lost income. |

| Trauma Cover (Critical Illness) | Diagnosis of a specified serious medical condition, like cancer or a heart attack. | A lump sum payment. | Covering out-of-pocket medical costs, taking time off to recover, and reducing financial stress during treatment. |

| Income Protection | An injury or illness that temporarily stops you from being able to work. | A monthly benefit, typically up to 70% of your income. | Paying for everyday living expenses like bills, rent, or mortgage payments and groceries while you recover. |

This layered approach ensures you're protected against a range of 'what ifs'.

Think about a young professional in Perth juggling a new mortgage. For them, life insurance isn't a 'nice-to-have'; it's essential. In fact, a 2024 Rice Warner report found that the median life cover for Australian families with children only meets 62% of their basic needs, highlighting a significant underinsurance gap.

At Wealth Collective, our Protection Plus service is our dedicated offering for navigating these options. We help clients across WA structure their cover so their family can stay in their home and maintain their lifestyle. That’s real peace of mind. You can also dive deeper with our guide on the different types of life insurance to learn more.

Understanding Death and Terminal Illness Cover

At its core, every life insurance policy holds one fundamental promise: the death benefit. This isn’t just a clause in a document; it’s a financial safety net for your family, designed to provide stability when they need it most. Think of it as a financial backstop ready to catch life's heaviest burdens.

When the policy pays out, this lump sum gives your beneficiaries immediate options. It’s what could clear the mortgage on the family home in Dunsborough, cover funeral costs without dipping into savings, and replace your income so daily life can continue. It’s all about providing continuity during a time of immense upheaval.

The Invaluable Terminal Illness Benefit

Modern life insurance offers more than just support after you're gone. A crucial feature built into most policies is the Terminal Illness benefit. This allows the death benefit to be paid out early if you're diagnosed with an illness and given a short time to live, usually 12 to 24 months.

This feature is incredibly important, providing financial relief right when it’s needed most. The funds can help pay for medical treatments, make your home more accessible, or simply take financial worries off the table, allowing you to focus on what truly matters: spending precious time with your loved ones.

How a Death Benefit Works in Practice

When you pass away, your nominated beneficiaries—typically your spouse, children, or a trust—will make a claim with the insurance company. This usually involves providing key documents, like a death certificate, to start the process.

Once the claim is approved, the insurer pays the agreed-upon lump sum directly to them. In Australia, this money is generally tax-free when paid to a financial dependant. It gives your family the freedom to handle immediate costs and plan for the future without being forced to sell assets or raid their retirement savings.

A common worry I hear is, "Do these policies actually pay out?" The answer is a resounding yes. That reliability is the whole point—it’s the foundation of the peace of mind you’re paying for.

The data backs this up. Australian insurers pay out on 97-98% of all death claims. This figure holds true across both group policies in super and retail policies, with claims typically processed in just one to two months. That's a crucial timeframe for families in Western Australia facing funeral expenses that now average $12,000 nationally. You can explore more insights on Australian life insurance claim statistics and see how having an adviser in your corner can make a real difference.

Why Expert Guidance Matters

Getting your death and terminal illness cover right is more than picking a number out of thin air. It's about deeply understanding what your family would truly need. This means calculating outstanding debts, future living expenses, and long-term goals like university fees.

A good adviser also helps structure the policy ownership correctly—whether it should be held inside or outside of superannuation—which has big implications for tax and how easily the funds can be accessed. Our job is to build a strategy that works seamlessly, removing any potential for added stress or delays for your family down the line.

Getting this cornerstone of your financial plan sorted is the first step towards genuine security. If you want clarity, booking a complimentary call with our team is the best way to start protecting what matters most.

Protecting Your Ability to Earn an Income

Most people think of life insurance as something that only matters after you're gone, but some of its most powerful features are designed to protect you and your family right here, right now.

Think about it: what’s your single most valuable asset? It's not your house or your investment portfolio. It's your ability to get up every day and earn an income. A serious illness or an unexpected injury can put that in jeopardy, derailing your financial goals and putting your family’s future on shaky ground.

This is where 'living benefits' step in. We're talking about two key types of cover: Total and Permanent Disablement (TPD) and Income Protection. They act as a financial shield for your earning potential, making sure your journey to building wealth doesn't come to a halt, even if your ability to work does.

Total and Permanent Disablement (TPD) Cover Explained

Imagine TPD insurance as a one-off financial reset button. It kicks in if you suffer a life-altering illness or injury that means you can never work again. It pays out a lump sum, giving you the capital to cover huge, long-term costs and replace the future income you've lost.

This money isn't just a number on a page; it's a lifeline. People use their TPD payout for critical needs:

- Wiping out major debts like the mortgage, ensuring your family can stay in their home without financial stress.

- Covering significant medical bills and paying for ongoing rehabilitation, treatment, or in-home care.

- Funding modifications to your home or car to adapt to your new reality.

- Creating an investment pool to generate a passive income to support your living expenses for the rest of your life.

These policies do pay out. Recent Australian data highlights strong claim acceptance rates, especially for advised retail policies, which often pay lump sums well over $500,000. For a pre-retiree in WA, that kind of money can be the difference between security and hardship.

The Critical Difference: Own Occupation vs. Any Occupation

When it comes to TPD, the devil is in the detail—specifically, the policy's definition of "disabled". This is where the distinction between 'own occupation' and 'any occupation' becomes crucial, particularly for specialists and high-income earners.

- Own Occupation TPD: This is the gold standard. It means you can claim if you're permanently unable to work in your specific profession. A surgeon who suffers a hand injury is a classic example. They might be able to work as a medical consultant, but under an 'own occupation' policy, they would likely be paid out because they can no longer perform surgery.

- Any Occupation TPD: This definition is broader and tougher to claim on. It generally states you can only claim if you're unable to work in any job for which you’re reasonably suited by your education, training, or experience.

For an executive in Perth or a skilled business owner, an 'own occupation' policy is usually non-negotiable. It’s designed to protect their highly specialised earning capacity, which is the cornerstone of their financial plan.

Income Protection: Your Replacement Paycheque

If TPD is for a permanent, career-ending event, then Income Protection is its flexible counterpart designed for temporary setbacks. Think of it as your replacement paycheque. It kicks in when an illness or injury benches you for a few months, or even a few years.

This cover provides a regular monthly benefit, typically up to 70% of your pre-tax income. It's the cover that keeps the lights on, pays the mortgage, and covers the grocery bills, allowing you to focus completely on getting better.

Income Protection is the policy that keeps your world turning. It ensures a temporary health issue doesn't spiral into a long-term financial disaster by forcing you to sell assets or drain your savings.

There are two key levers that determine how your income protection works:

- The Waiting Period: This is how long you have to be off work before payments start. It could be 30 days, 90 days, or even up to two years. A longer waiting period usually means a lower premium.

- The Benefit Period: This sets the maximum amount of time you can receive payments for a single claim. Common options range from two years all the way up to retirement age (typically age 65 or 70).

Choosing the right mix of waiting and benefit periods comes down to your personal situation. Our Protection Plus service at Wealth Collective is all about analysing these factors to build a policy that perfectly fills the gaps in your financial safety net. You can also explore how income protection can be structured with your superannuation in our detailed guide.

What Your Policy Won’t Cover: A Look at Common Exclusions and Limits

A good insurance policy is one with no nasty surprises. While it's great to know what your cover includes, it's just as critical to understand what it doesn't. The fine print, found in a document called the Product Disclosure Statement (PDS), lays out the exact situations where your policy won't pay out.

This isn't about insurers trying to get out of paying claims. It's about setting clear boundaries from the start, so you know precisely what you're covered for. Understanding these details is the key to having real peace of mind, not just a policy number on a piece of paper.

Why Full Disclosure is Non-Negotiable

The single most important thing you can do when applying for insurance is to be completely honest. Insurers calculate your premiums and decide on your cover based on what you tell them about your health, job, and hobbies. Hiding a pre-existing medical condition or a risky pastime might seem harmless, but it could lead to a claim being denied down the track.

This comes down to a legal principle called 'utmost good faith'. It simply means you have a duty to be upfront about everything the insurer asks. It's far better to have a policy with a specific exclusion or a slightly higher premium than to have one that becomes worthless when your family needs it most.

Common Exclusions to Look Out For

Every policy has its own quirks, but you'll find some standard exclusions in most Australian life insurance policies. Knowing these helps you set realistic expectations.

- Self-Inflicted Harm: Almost all policies have a clause excluding payouts for suicide or intentional self-harm, usually within the first 13 months after the policy starts.

- Criminal Activity: If death or injury happens while you're involved in a criminal act, the insurer is very likely to deny the claim.

- Specific Pre-Existing Conditions: If you have a known health issue, the insurer might add an exclusion for that specific condition. For example, if you've had back problems, your TPD cover might not pay out for any future spinal-related claims.

- War and Terrorism: Most policies won't cover claims that arise from acts of war, whether it's officially declared or not.

- High-Risk Activities: Love skydiving or competitive motorsport? These kinds of hazardous activities are often excluded unless you've declared them upfront and potentially paid a higher premium for the extra cover.

Getting to Grips with Policy Limits and Premium Structures

It's not just about what's excluded; it's also about the limits of what's included. For example, Income Protection policies typically cap your monthly benefit at around 70% of your income. They also have waiting periods you have to sit through before a payout begins, and benefit periods that define how long those payments will last.

You also need to understand how you're paying for it.

- Stepped Premiums: These start off cheaper but get more expensive every year as you get older. They're budget-friendly at the beginning but can become a real financial strain later in life.

- Level Premiums: These start at a higher price but are designed to stay much more stable over time, usually only increasing with inflation. They often work out to be better value in the long run.

Making sense of all these exclusions, limits, and premium options is where good advice makes all the difference. As part of our Protection Plus service, a Wealth Collective adviser cuts through the jargon for you. We sweat the details, compare policies, and design a strategy built to work without hidden catches. Book a quick call with us to see how we can secure your family's future.

How Insurance Works in Real Life Scenarios

Knowing the theory behind what life insurance covers is one thing, but seeing it work in the real world is where its value truly clicks. These policies aren't just lines in a financial document; they're a safety net for real people facing tough situations.

To really bring these concepts home, let's walk through three common scenarios. You might even see a bit of your own life in these stories. Each one shows how a well-thought-out insurance plan delivers practical, often life-changing, support when it's needed most.

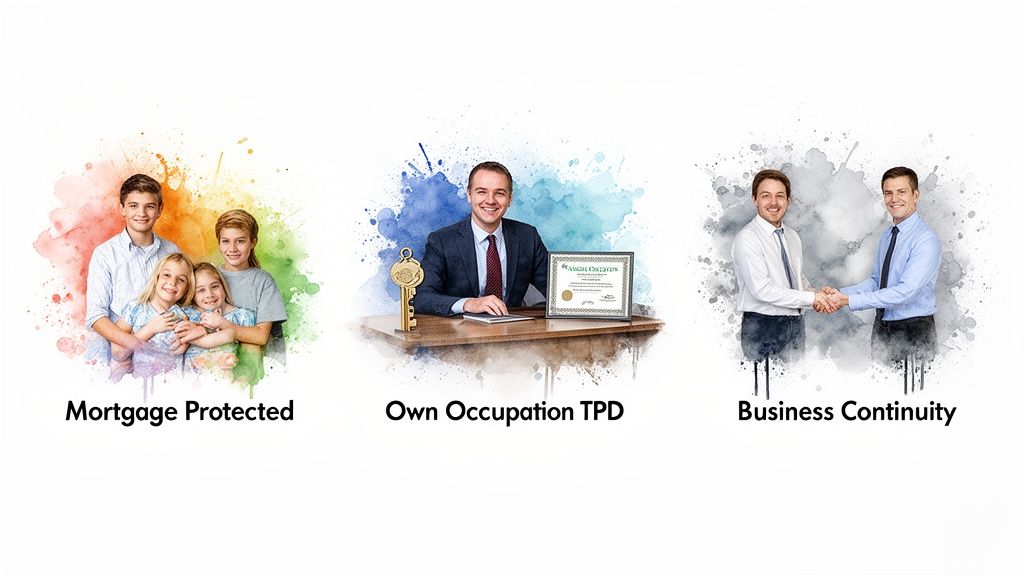

Scenario One: The Young Family in Dunsborough

Let's meet Ben and Chloe. They're in their mid-30s with two young kids and just bought their dream home in Dunsborough, taking on a pretty hefty mortgage to do it. Both have good jobs, but they're keenly aware that their family’s financial world rests on both of them being able to earn an income.

Their biggest worry? What would happen if one of them were to pass away unexpectedly. The surviving partner would be left holding a huge mortgage and raising the kids on one income. It's a daunting thought, and one that would almost certainly mean selling the family home.

The Solution:

Ben and Chloe sat down with an adviser and put a smart, straightforward plan in place. Their life insurance policies were structured to pay out a lump sum that would:

- Wipe out their mortgage entirely, getting rid of their single biggest financial headache.

- Create an ongoing income stream for several years, giving the surviving partner the option to work less and focus on the kids.

- Fund future education costs, making sure their children’s opportunities are never compromised.

This plan gives them genuine peace of mind. They know that no matter what, their family can stay in their home and the kids’ futures are secure.

Scenario Two: The High-Income Perth Executive

Now, let's look at Sarah, a 45-year-old surgeon in Perth. Her income is significant, but it's directly tied to her very specialised skill set—specifically, her hands. An injury or illness that took away her manual dexterity could end her career overnight, even if she was perfectly healthy otherwise.

For Sarah, a standard 'any occupation' TPD policy just doesn't cut it. If she could no longer operate but was still able to work as a medical consultant, a basic policy might not pay out. That would leave her with a catastrophic drop in income.

The Solution:

Sarah’s financial adviser was adamant about getting an 'own occupation' TPD policy. This definition is crucial. It means her cover pays out if she is permanently unable to work as a surgeon, no matter if she could technically do another job.

For a specialist like Sarah, this distinction is non-negotiable. It protects her unique, high-value earning capacity, which is the engine for her entire financial life.

Her policy ensures that if the unthinkable happens, she gets a substantial lump sum. This would let her clear debts, invest for a new source of income, and move into the next chapter of her life without financial panic.

Scenario Three: The Small Business Owner

Finally, let's talk about Mark and Dave, co-owners of a thriving small business. They’ve built their company from scratch and work brilliantly together. But they had to face a critical question: what would happen to the business if one of them died or became totally disabled?

Without a plan, the surviving partner could find themselves in business with the deceased partner’s family, who might know nothing about the company. They could be forced into a quick sale or have to take on massive debt to buy out the family's share.

The Solution:

Mark and Dave put a buy-sell agreement in place, funded by life insurance. It’s a clean and effective strategy. Here's how it works:

- Each partner takes out a life and TPD insurance policy on the other.

- If one of them passes away or is disabled, the insurance payout goes directly to the surviving partner.

- The buy-sell agreement legally requires the survivor to use those funds to purchase the other's share of the business from their family at a pre-agreed price.

This simple structure creates a smooth and fair transition. The family gets the full cash value of their share in the business, and the surviving partner gets full control without crippling the company with debt. It protects the business, the partners, and their families.

These scenarios show just how flexible and vital personal insurance can be. Each plan was designed to solve a specific problem, turning a potential financial catastrophe into a manageable situation. This is the core of what we do at Wealth Collective through our Protection Plus service—we build plans that work in the real world. If you'd like to learn more, our guide on how life insurance works is an excellent resource.

Building Your Personalised Protection Plan

Knowing what life insurance covers is one thing, but turning that knowledge into a real-world plan is where the magic happens. Think of life insurance less as a single product and more as a personal toolkit. You get to pick and choose the right tools to build a financial fortress around the people you love. Your strategy has to be a mirror of your life, your debts, and your dreams.

So, how do you move from theory to action? It all starts by asking the right questions. This isn't about finding all the answers yourself, but about starting to map out your own financial landscape. It’s the groundwork you need to lay before you can build a protection plan that actually fits your life.

Your Starting Checklist

To get the ball rolling, grab a pen and paper and spend a few minutes thinking through these key questions. Your answers will start to paint a picture of exactly what your life insurance needs to do for you.

- How much debt do I have? Tally up everything – the mortgage, car loans, credit card balances, and any personal or business loans. Your insurance needs to be able to wipe these clean.

- What would my family need to live on? Think about the day-to-day costs, future school fees, and everything else needed to maintain their lifestyle if your income suddenly disappeared.

- Who depends on my income? Is it your spouse, your kids, or maybe even ageing parents who rely on you for financial support?

- What are our biggest future goals? This could be anything from funding university for the kids to making sure your partner can retire comfortably without financial stress.

These questions can feel a bit heavy, which is exactly why you shouldn't have to figure it all out on your own. This is where getting some professional guidance can make all the difference.

Turning Questions Into a Clear Plan

At Wealth Collective, our entire process is built to turn these big, complicated questions into a simple, actionable strategy. Through our Protection Plus service, we do the heavy lifting for you. We’ll dive into your situation, run the numbers to figure out your precise needs, and then scan the market to find the right policies to build your personalised fortress.

The goal is to move from uncertainty to confidence. A proper plan removes the guesswork, ensuring every dollar of your premium is working hard to protect what matters most to you and your family.

We get into the weeds of policy details, definitions, and premium structures so you don’t have to. You can get on with your life, feeling secure in the knowledge that a solid safety net is firmly in place. It's all about giving you clarity and control over your financial future.

Your next step is simple. Book a complimentary 10-minute introductory call with our team. It’s a no-obligation chat to see how we can help you build the financial protection your family deserves.

Your Life Insurance Questions Answered

When you start digging into life insurance, a few key questions always come up. Getting clear on these from the get-go is the best way to make sure you're building a financial safety net that actually works for you and your family.

Is the Insurance in My Super Fund Enough?

For many Australians, the default life insurance tucked away inside their super fund is their only form of cover. While it’s certainly a good start and better than nothing, it's rarely enough to do the job properly.

Think of it as an 'off-the-rack' solution. It’s designed to provide a basic level of protection for a broad audience, not to cover your specific mortgage, your family's living expenses, or your kids' future education costs. Relying on it alone can leave you dangerously underinsured, creating a false sense of security. The only way to know for sure is to compare what you have with what you actually need.

How Do You Figure Out the Right Amount of Cover?

This is where the real work begins, and it’s something a simple online calculator can't quite capture. It's about building a complete picture of your life and what it would take to keep things on track if you were no longer around.

Our advisers look at several key areas:

- Wiping the Slate Clean: First, we calculate what’s needed to clear all debts – the mortgage, car loans, credit cards, everything.

- Keeping the Lights On: Next, we figure out the capital required to replace your income, ensuring your family can maintain their lifestyle without financial stress.

- Securing Their Future: Finally, we factor in those big-ticket future expenses. This could be anything from private school and university fees to making sure your partner has enough to retire comfortably.

We use our Protection Plus service to map all this out. It’s a detailed process designed to land on a precise figure, so you’re not paying a cent more than you need to for the protection your family deserves.

Is a Life Insurance Payout Taxed in Australia?

This is a great question, and the answer is usually a welcome one. In most situations, when the lump sum benefit is paid to a financial dependant (like a spouse, partner, or child), it is received completely tax-free.

Where it can get a bit tricky is if the payout goes to a non-dependant or is funnelled through a complex will or estate plan. Getting the ownership structure right from the start is critical to make sure the money goes to your loved ones efficiently and without any unexpected tax bills. This is exactly where professional advice makes all the difference.

Getting across these details is what we live and breathe. The team at Wealth Collective is here to give you clear, straightforward guidance so you can put a plan in place with total confidence.