Business hours

Monday to Friday (8.30AM - 5PM)

Weekend (Closed)

When you pass away without a valid will in Australia, you don't just leave your assets behind—you leave your family with a serious problem. The legal term for this is dying 'intestate', and it means the government steps in to divide everything you own according to a strict, impersonal formula.

For the people you care about most, this process can be an absolute nightmare. It often leads to stressful delays, hefty legal costs, and can even spark painful family conflicts at a time when they're already grieving.

Why Leaving Your Legacy to Chance Is a Mistake

Not having a will means giving up control. Your wishes, your relationships, and the unique needs of your family simply don't factor in. Instead, a legal script—in Western Australia, it’s the Administration Act 1903—makes all the decisions for you.

This isn't just a bit of administrative hassle; the consequences for your loved ones can be immediate and severe.

- Loss of Control: You won't have a trusted executor managing your affairs. Instead, a court-appointed administrator, who could be a complete stranger, takes charge of your life's work.

- Financial Drain: The process of sorting out an intestate estate is far more complicated. This means higher legal fees, which are paid directly from the inheritance meant for your family.

- Stressful Delays: Your assets can be frozen for months, sometimes even years, while the courts work through the intestacy rules. This can leave your family in a difficult financial position, unable to access funds they might desperately need.

The Scale of the Problem in Australia

You might be surprised by how common this is. Recent statistics show that a staggering 58-60% of eligible Australians—that’s around 12 million people—don't have a valid will. The numbers are often higher for busy professionals and small business owners who are understandably focused on building their wealth, not planning for the worst.

When you die intestate, you force your family to deal with a confusing and emotionally draining legal system right when they're at their most vulnerable.

At Wealth Collective, our process starts by understanding that estate planning isn't something you do at the end of your life. It's a crucial part of your overall financial strategy. It’s about protecting your family, preserving your wealth, and making sure your legacy brings them security, not stress.

The only way to guarantee your wishes are followed is to plan ahead. The alternative is a costly, drawn-out process that almost never reflects what you would have wanted. A solid estate plan, integrated into your complete financial picture, gives everyone clarity and peace of mind. It’s one of the most important steps you can take to protect the future you're working so hard to build.

So, How Does the Law Divide Your Assets in WA?

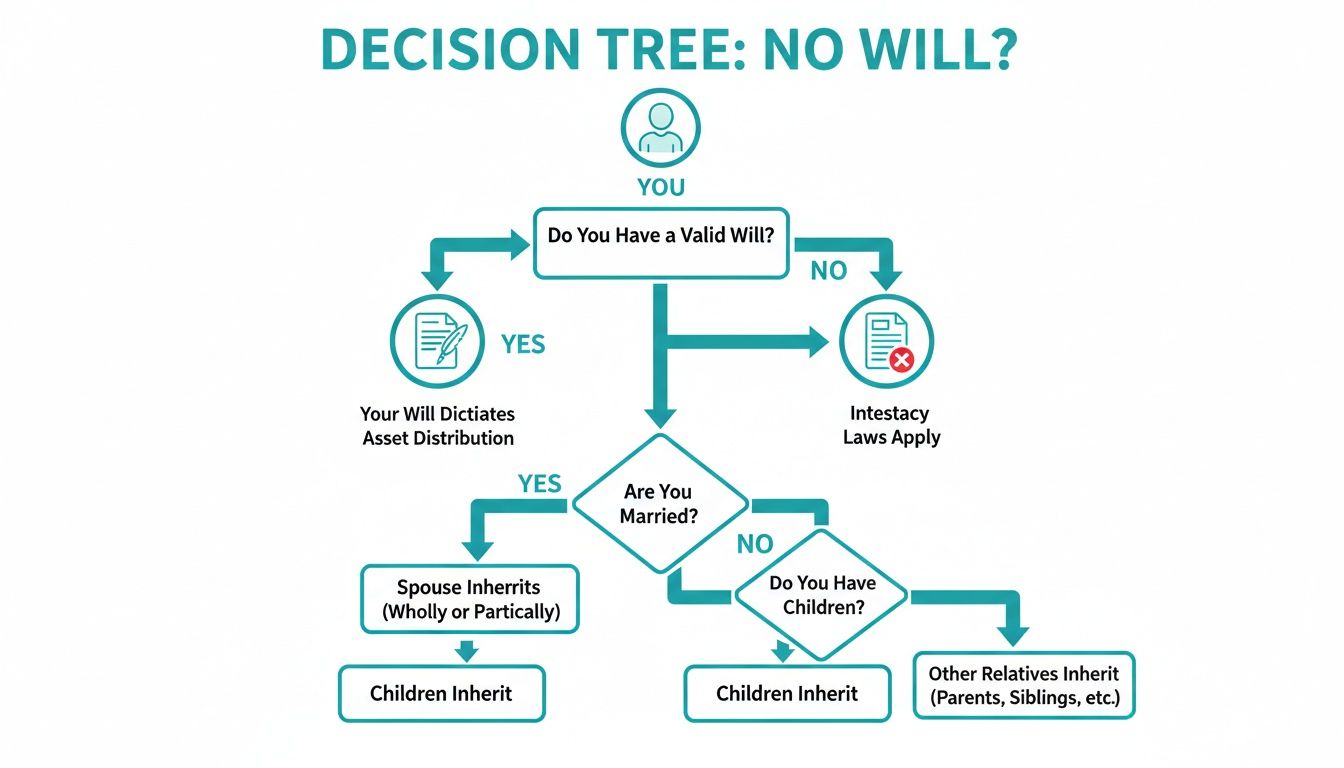

When you die without a will, the government doesn't sit down and try to figure out what you might have wanted. Instead, a strict, one-size-fits-all formula kicks in. These are called intestacy laws, and in Western Australia, they act like a rigid instruction manual for dividing up your assets, with no room for your family’s unique circumstances or your personal relationships.

This legal framework prioritises certain relatives in a strict pecking order. While the goal is a technically "fair" distribution, the outcome often feels anything but personal. It can leave your loved ones navigating a cold, impersonal system that has no idea what you truly intended.

To really grasp what happens if you don’t have a will, you need to see how this hierarchy works. The rules are surprisingly specific and can lead to results you would never have chosen yourself.

This flowchart gives a clear visual overview of the legal decision-making process, showing how your family structure dictates where your inheritance goes when you haven't made your own choices clear.

As you can see, not having a will effectively removes you from the equation. Your estate is forced down a predetermined path that might be completely at odds with what you wanted.

The Rules for Spouses and Children

The rules for married or de facto partners saw a significant update in March 2022, when the surviving spouse's initial entitlement—often called the statutory legacy—was increased.

If you pass away with a spouse but no children, it's pretty straightforward: your spouse is entitled to your entire estate.

But the moment children are in the picture, things get a lot more complicated.

If you have a surviving spouse and children, your spouse does not automatically inherit everything. Instead, they receive the first $472,000 of your estate, plus one-third of whatever is left. The remaining two-thirds of the balance is divided equally among your children.

This can create huge financial problems. Imagine your family home is valued at more than this threshold and is only in your name. Your spouse could be forced to sell the house just to pay out your children's share.

The government's formula is designed for legal simplicity, not for real-world family dynamics. It doesn't care if a child is already financially independent or if your spouse needs the family home for their own security.

A Look at Other Common Scenarios

The following table breaks down how your estate would be distributed in Western Australia based on your surviving relatives. It really highlights how easily your assets can end up in unexpected hands.

Western Australian Intestacy Distribution Scenarios

| Surviving Relatives | How Your Estate is Distributed |

|---|---|

| Spouse, but no children | Your spouse inherits 100% of your estate. |

| Spouse and children | Your spouse gets the first $472,000 plus one-third of the remainder. Your children share the other two-thirds of the remainder. |

| Children, but no spouse | Your entire estate is divided equally among your children. |

| No spouse or children | Your estate goes to your parents. If they are not alive, it is divided among your siblings. |

| No immediate family | The law searches for more distant relatives like grandparents, then aunts and uncles, and then first cousins. |

| No traceable living relatives | Your entire estate goes to the Crown (the WA government). |

As the table shows, the law follows a rigid cascade, searching for ever-more-distant blood relatives to inherit your wealth.

What Happens If No Relatives Can Be Found?

This is the scenario that shocks most people. If the legal system exhausts all avenues and cannot find any eligible relatives, your entire estate goes to the Crown. That’s right—the Western Australian government inherits everything you’ve worked so hard for.

Which Assets Are Actually Covered by These Rules?

It’s also crucial to understand that not all your assets fall under the intestacy umbrella. These rules generally only apply to assets owned solely in your name, such as:

- Bank accounts in your name only

- Property registered solely to you

- Shares and investments under your individual name

Some of your biggest assets might bypass this process entirely. For instance, property owned as joint tenants automatically passes to the surviving owner. Superannuation is another massive exception—its distribution is governed by the fund's rules and any binding death benefit nomination you’ve made, not by a will or intestacy laws. For a deeper dive, check out our guide on what happens to super when you die.

Relying on intestacy leaves your family’s future to chance. At Wealth Collective, our process integrates estate planning into your complete financial picture, ensuring every piece works together to transfer your wealth exactly as you intend. The only way to guarantee your assets go where you want them to is to take control.

The Hidden Costs of Dying Intestate

When you die without a will, the consequences go far beyond the cold, legal formulas for dividing assets. The real damage is the hidden costs—the practical, financial, and emotional weight that lands squarely on your family’s shoulders. These are the unforeseen expenses and delays that can start to unravel the very financial security you worked so hard to build.

Without a will, you haven't named an executor to take charge. This forces your loved ones to apply to the Supreme Court for ‘Letters of Administration’. This process is almost always longer, more complicated, and more expensive than standard probate, leaving your family stuck in a kind of financial limbo.

The Financial Drain of Delays and Fees

One of the first things that happens is that your assets get frozen. Bank accounts become inaccessible, properties can't be sold, and investments are left unmanaged. This can drag on for months, forcing your family to cover ongoing expenses like mortgage payments or household bills without access to the very funds you intended for them.

And this delay comes with a hefty price tag. The administrative process for an intestate estate involves more court filings and more legal time spent proving who the rightful heirs are. Every dollar spent on these increased legal fees is a dollar taken directly from your estate, which means less inheritance for your family.

The tragedy of intestacy isn't just that the wrong people might inherit; it's that the value of your legacy can be significantly eroded by unnecessary costs and legal battles, leaving everyone with less.

Even in a well-planned estate, fees can eat up 5-10% of the total value. Without a will, those costs can spiral as court-appointed strangers sort everything out. With the national intestacy rate around 58-60%, thousands of Australian families are forced to navigate this complex and costly mess each year.

Fuelling Family Disputes and Emotional Strain

Money can be a stressful topic at the best of times. But when you mix it with grief and the rigid application of intestacy laws, you have the perfect storm for family conflict. The government's formula doesn't care about your family's unique dynamics, any promises you made, or the specific needs of each person you love.

This lack of clarity often pushes relatives into difficult, and sometimes adversarial, positions. Common triggers for disputes include:

- Contesting the Distribution: A dependent who was left out by the strict formula might be forced to make a Family Provision Claim against the estate—an expensive and emotionally draining court battle.

- Disagreements Over Assets: Family members might argue over items with sentimental value or clash over who should have the right to buy the family home.

- Choosing an Administrator: If several relatives have an equal right to manage the estate, they must first agree on who should take on the job, which can cause friction from the start.

These conflicts put immense emotional strain on a family that is already grieving and can permanently damage relationships.

At Wealth Collective, our process is designed to prevent these scenarios. We don't just look at your will in isolation; we integrate your estate plan with your broader financial strategy, including key pieces like insurance and super. Proper planning does more than just direct your assets—it protects your family. To get a complete view, learn more about how superannuation and income protection fit into your defensive financial strategy.

Common Myths About Wills That Put You at Risk

It’s easy to put off estate planning by relying on common assumptions. But these myths are dangerous, leaving your family exposed to the exact problems you’d want to avoid.

Let's get clear on the facts. Understanding the truth is the first step to taking control and ensuring your loved ones are truly looked after.

Myth 1: My Partner Automatically Gets Everything

This is the most common and damaging myth. It feels right that your spouse or de facto partner would inherit everything, but under Western Australian law, that’s not always how it works—especially if you have children.

As we covered, if you have kids, your partner is only guaranteed the first $472,000 of your estate, plus one-third of what's left. The law dictates that the rest must be split among your children. Imagine the fallout: your partner could be forced to sell the family home just to pay out the children's legal entitlement.

Thinking your partner is automatically protected without a will is a massive gamble on their future. The law's one-size-fits-all formula has no idea what your family actually needs, creating a perfect storm for financial stress.

A will is the only way to make sure your partner is looked after exactly as you intend.

Myth 2: I’m Too Young to Need a Will

Many younger professionals and new families think of wills as something for their parents. This is a huge mistake. A will isn’t just about money; it’s a crucial safety net for your family right now.

If you have young children, the most powerful part of your will has nothing to do with assets. It's the only legal document where you can name a guardian to care for them if the unthinkable happens. Without that instruction, the decision of who raises your kids is left up to the courts. That’s a situation no parent would ever choose.

Even if you think your estate is small, dying without a will creates a mountain of administrative work for your family. A simple will can save them time, money, and stress when they’re already grieving.

Myth 3: My Super Is Covered Without One

This is a massive and costly misunderstanding. Superannuation is one of your biggest assets, but it does not automatically become part of your estate. It isn't covered by your will, and it certainly isn't covered by intestacy rules.

Your super is held in trust. To control where it goes, you need to fill out a Binding Death Benefit Nomination (BDBN) with your super provider.

- Without a BDBN: The fund's trustee decides who receives your super balance. They'll follow their own internal rules, which might not match your wishes.

- With a BDBN: This is a clear, legally binding instruction telling the trustee exactly who to pay your super out to.

At Wealth Collective, our process ensures your superannuation is properly integrated with your overall estate plan, leaving no gaps. We help you build a plan where every asset is accounted for, giving you complete peace of mind. Getting started is simple; a quick call is all it takes.

Why Your Unique Situation Needs a Custom Plan

When it comes to your family's future, a one-size-fits-all approach doesn't cut it. The law of intestacy is a blunt, impersonal instrument that can't account for the unique threads of your life. Thinking about what happens if you don't have a will isn't just a legal exercise; it's a deeply personal question.

A generic legal formula will never understand your family's dynamics or your long-term goals. Your estate plan must be as individual as you are. This is where the Wealth Collective process makes all the difference, moving beyond generic advice to build a strategy that fits your life.

For Families with Young Children

If you're a parent, a will is one of the most important documents you'll ever sign. Its most critical job has nothing to do with money. It’s the only place you can legally appoint a guardian to care for your children.

Without that vital instruction, the decision of who raises your kids is left to the Family Court. It can be a slow, stressful process for everyone and might end with a result you never wanted.

Appointing a guardian is an act of profound care. It ensures your children are raised by someone you trust, guided by the values you hold dear. Intestacy laws completely ignore this, leaving the most important decision imaginable in the hands of a stranger in a courtroom.

At Wealth Collective, our process helps young families put these fundamental protections in place, ensuring their financial plan provides security in every possible way.

For Small Business Owners

For a business owner, dying without a will is a recipe for chaos. Your ownership stake becomes just another asset in the estate, ready to be carved up according to a rigid legal formula, with no consideration for business continuity or your legacy.

The fallout can be disastrous:

- Operational Paralysis: With no clear successor, business can grind to a halt while the courts figure out who is in charge.

- Forced Sale or Liquidation: To distribute the estate's value, the administrator might be forced to sell the business quickly, rarely achieving its true worth.

- Loss of Value: The uncertainty can shatter client confidence and employee morale, quickly eroding the value of the business you poured your life into.

A proper estate plan includes a business succession plan, ensuring a smooth transition of leadership and ownership.

For Pre-Retirees and High-Income Earners

As you approach retirement or manage a more complex portfolio, a simple will is rarely enough. You might have significant superannuation, investment properties, or even a Self-Managed Super Fund (SMSF).

A will must be just one part of a wider, integrated estate plan that works with your overall financial strategy. The goal isn't just to get wealth to the right people, but to do it in the most tax-effective way. A custom plan answers key questions that intestacy ignores, like how to minimise capital gains tax for your beneficiaries. You can find more on this in our complete guide on how to plan retirement.

Each of these scenarios points to one truth: your life isn't generic, so your estate plan shouldn't be either. Our process at Wealth Collective is built around creating a plan that delivers genuine peace of mind. The first step is a simple conversation.

Ready to Take Control of Your Legacy?

Knowing the risks of dying without a will is one thing; taking action is what truly matters. Securing your legacy and gaining that peace of mind is more straightforward than you imagine. It’s time to move from understanding the problem to putting a real solution in place—one that protects everything you’ve worked for.

Your First Steps to a Solid Estate Plan

Making a will doesn't have to be an intimidating task. It starts with getting your thoughts in order. A well-thought-out plan ensures your wishes are legally binding instructions.

Here’s a simple checklist to get started:

- List Your Key Assets: Jot down your major assets – property, bank accounts, investments, and superannuation.

- Choose Your Beneficiaries: Decide exactly who you want to inherit your assets and how you want to provide for them.

- Appoint Your Executor: This is the person you trust to make sure your will is followed. Pick someone organised and reliable.

Building a secure future is about making clear, intentional decisions. This process is the foundation of a 'wildly successful financial life'—one where you are in complete control of your legacy.

The Power of Professional Guidance

While these first steps are a great start, getting professional advice ensures your will is legally sound, tax-effective, and connected to the rest of your financial world, especially your superannuation.

At Wealth Collective, we specialise in giving you clarity and confidence. Our process translates complex financial and legal ideas into simple, actionable steps that protect your family and preserve your wealth. The journey to securing your legacy starts with a simple conversation.

Book a complimentary 10-minute call with our team today. It's an easy first step toward creating a plan that gives you complete peace of mind and lasting security for your family.

Your Questions Answered

Wills and estate planning can feel like a maze of legal terms. To help clear things up, here are some straight answers to the questions we hear most often from our clients in Western Australia.

How Much Does It Cost to Create a Will?

The price for a will in WA can vary. A straightforward situation might cost a few hundred dollars with a solicitor. For those with more complex financial lives involving business assets or trusts, the cost will be higher.

At Wealth Collective, we don't just see this as a legal task. Our process weaves your estate plan directly into your overall financial strategy. We help you get the structure right from the start, making it as effective as possible. Then, we connect you with trusted legal experts to draft the documents, ensuring everything works together seamlessly.

What Does an Executor Do, and Who Should I Pick?

Your executor is the person you trust to see your wishes through. They manage your assets, settle any debts, and make sure your inheritance gets to the right people as instructed in your will.

It's a big job, so choose someone trustworthy, organised, and able to handle important financial admin. This could be your spouse, an adult child, or a professional trustee. The most important step? Ask them first to make sure they're willing and able to take on the responsibility.

How Often Should I Update My Will?

A will isn't something you "set and forget." Life changes, and your will needs to keep up. A good rule of thumb is to review it every 3-5 years, and immediately after any major life event.

What kind of events?

- Getting married or divorced

- The birth of a child or grandchild

- The death of a beneficiary or your executor

- A major shift in your financial position

Keeping your will current ensures it reflects what you truly want, saving your family from confusion later on.

Is My Superannuation Part of My Will?

No, it isn't—a crucial detail that catches many people out. Your super is handled completely separately from your will.

To control where your super benefit goes, you need a valid Binding Death Benefit Nomination (BDBN) with your super fund. Without one, the decision falls to the fund's trustee. As part of our integrated process, we make sure your superannuation strategy is perfectly aligned with your wider estate plan, leaving no loose ends.

At Wealth Collective, our entire process is designed to give you clarity and confidence. We help you build a plan that not only protects your legacy but also gives your family lasting peace of mind.

Book a complimentary 10-minute introductory call to start the conversation.