Business hours

Monday to Friday (8.30AM - 5PM)

Weekend (Closed)

Defined benefit super funds are a bit of a throwback to a different era of retirement savings. Unlike modern funds where your final balance depends on market performance, a defined benefit super fund promises a retirement payout calculated by a set formula. This formula typically uses your final salary and years of service to determine a predictable, guaranteed benefit. For many long-serving public sector employees in Western Australia, understanding this unique asset is the first step toward a successful retirement.

Unlocking Your Defined Benefit Super in WA

Think of it like baking a cake with a trusted family recipe. You know if you follow the steps and use the right amount of flour, sugar, and eggs, you’ll get a perfect cake every time. A defined benefit super fund works on a similar principle.

The "ingredients" are your final average salary and your years of service. The "recipe" is a specific formula set by your fund, which turns those ingredients into a guaranteed retirement benefit.

This structure provides a level of certainty that is almost unheard of in modern superannuation. Unlike standard accumulation funds where your final balance is at the mercy of investment returns, a defined benefit scheme promises a specific outcome. This is a massive advantage for retirement planning, as it removes a huge amount of guesswork.

Key Schemes for Western Australians

While these funds are now quite rare across Australia, they are still a significant feature of the retirement landscape for many Western Australians. If you've had a long career with the state government, a university, or certain public utilities, there's a good chance you're a member of one of these valuable schemes.

Some of the most common defined benefit schemes in WA include:

- GESB Gold State Super: A major scheme for WA Government employees. Critically, it's an untaxed fund until you take the benefit out, which opens up some powerful planning opportunities.

- UniSuper Defined Benefit Division (DBD): Many long-serving employees of Western Australia’s universities are members of this scheme, which is designed to provide a lifetime pension.

- Public Sector Superannuation Scheme (PSS): Although it's a Commonwealth scheme, many federal public servants based in WA are members.

It’s also common for GESB members to have a GESB West State Super account alongside their Gold State fund. While West State is technically an accumulation fund, its unique constitutionally protected and untaxed status creates some fantastic strategic possibilities when managed alongside a defined benefit interest.

To get a refresher on the basics, you can check out our guide on what super is in Australia.

Because these funds operate so differently from the norm, generic financial advice often fails to capture their true value. A specialised approach is required to correctly value the benefit, understand its unique rules, and integrate it into a cohesive retirement plan.

Navigating the complexities of these schemes is crucial. The decisions you make—when to access your benefit, whether to take a lump sum or pension, and how to manage the tax—can have a massive impact on your financial future. This is why a service like Wealth Collective’s Retirement Roadmap is so important. We specialise in helping WA members understand and maximise these unique assets, turning a complex entitlement into the cornerstone of a successful retirement.

How Your Defined Benefit Is Calculated

It’s one thing to know your defined benefit super gives you a guaranteed retirement payout; it's another thing entirely to understand how that number is actually worked out. Unlike your typical accumulation fund, where the balance bobs up and down with the market, a defined benefit is calculated using a very precise, pre-set formula.

Think of it as a retirement recipe. The formula takes three key ingredients and combines them to bake your final benefit.

At its core, the formula usually looks something like this:

Final Average Salary x Accrual Rate x Years of Service = Your Retirement Benefit

Each of these elements is crucial, and getting your head around them is the first step to really understanding what you'll have in retirement.

This simple flowchart shows how the ingredients come together.

As you can see, your salary and how long you've worked are the main inputs that create that guaranteed final payout.

Breaking Down The Formula

Let's take a closer look at each ingredient in this "retirement recipe." The exact definition of each part will depend on the specific rules of your scheme, whether that's GESB, UniSuper, or PSS.

-

Final Average Salary (FAS): This usually isn't just your salary from your last year of work. Most schemes average out your salary over a set period—often the last three to five years before retirement. This helps to smooth out any last-minute pay rises or dips, giving a fairer and more stable base for the calculation.

-

Years of Service: This one is pretty straightforward. It's simply the number of years you've been a contributing member of the fund. Each year you work adds another building block to your final benefit, directly increasing the end result.

-

Accrual Rate: This is the special sauce in the recipe. It's a percentage figure set by your fund, and it determines how much of your salary you "bank" for each year of service. For example, if your accrual rate is 2.0%, it means for every year you work, you earn a benefit equal to 2.0% of your final average salary.

It's the way these three factors work together that makes a defined benefit so powerful. A long career, solid salary growth, and a decent accrual rate can create a seriously substantial and reliable retirement income.

A Couple of WA Examples

To see how this plays out in the real world, let's look at two hypothetical West Australians. Their schemes have different rules, but the outcomes are just as predictable.

Example 1: The GESB Gold State Member

Imagine a long-serving WA government employee who is getting close to retirement. Their numbers might look like this:

- Final Average Salary: $100,000

- Years of Service: 30 years

- Accrual Rate: 2.0%

The calculation is: $100,000 x 30 x 0.02 = a $600,000 lump sum benefit. That's a predictable, solid foundation for their entire retirement plan.

Example 2: The UniSuper Professor

Now, consider a professor with a UniSuper Defined Benefit Division membership. Their formula might be designed to produce a lifetime pension instead. While the inputs are similar (salary, service years), the final output is a guaranteed income stream, not just a lump sum.

This predictability is the standout advantage of a defined benefit fund. But—and this is a big but—valuing it correctly and making it work with your other assets, like a GESB West State account, takes specialist knowledge. Generic advice often misses the crucial details that can unlock a huge amount of extra value.

This is exactly where the Wealth Collective Retirement Roadmap process comes in. We specialise in these WA-specific schemes. We can help you understand the true value of your benefit and, more importantly, how to strategically fit it into the rest of your financial life. The best first step is to book a brief introductory call to get some immediate clarity.

The Pros And Cons Of Defined Benefit Super

In the modern Australian retirement landscape, a defined benefit fund is a bit like a rare and valuable classic car. They just don't make them like this anymore. For members of schemes like GESB Gold State or UniSuper, understanding the unique strengths and weaknesses of what you've got is crucial to making smart decisions for your future.

The single biggest advantage, and the reason these funds are so sought-after, is certainty. Your final payout is worked out using a set formula, which means your nest egg is largely shielded from the wild ups and downs of the share market. That’s a level of predictability that standard accumulation funds simply can't offer.

This stability is a huge source of comfort, especially as you get closer to retirement. You don't have to lie awake at night worrying that a sudden market crash could shave a huge chunk off your balance right before you plan to stop working. This protection from what we call 'sequencing risk'—the danger of bad investment returns in early retirement—is an incredibly valuable feature.

The Upside: Certainty And Security

The appeal of this structure is pretty clear. It offers a kind of peace of mind that's hard to put a price on.

- Guaranteed Outcome: Your benefit is locked to your salary and how long you've worked, not the whims of the market. This makes planning for retirement much more straightforward.

- Employer Backing: Most of these schemes, especially public sector ones like GESB, are backed by a major employer (like the WA Government). This gives your benefit an exceptionally high level of security.

- Simplicity for You: You don't have to become an investment guru. The fund's trustees handle all the complex investment decisions, leaving you to focus on your career.

- Valuable Insurance: Many defined benefit schemes come with generous, built-in insurance for death and disability, often at a much better rate than you could get on your own.

At its heart, a defined benefit fund is a promise. It's a commitment from your employer to deliver a specific retirement outcome, shielding you from the investment risks every other super fund member in Australia has to manage themselves.

But all this security and stability comes at a price. The very things that make these funds so safe also introduce a fair bit of rigidity and can seriously limit your options.

The Downside: Inflexibility And Lack Of Control

While the predictability is a massive plus, it's just as important to understand the trade-offs that come with a defined benefit account.

The most glaring drawback is the lack of investment choice. In a standard accumulation fund, you can pick your investment flavour—conservative, balanced, or high-growth. With a defined benefit account, your money is typically pooled into one large fund, and you get no say in how it's invested.

This rigidity also applies to contributions. You generally can't just tip in extra money to boost your defined benefit balance, and if you change jobs, getting your hands on your money or moving it can be a surprisingly complex and restrictive process.

- No Investment Control: You can't adjust the investment strategy to suit your personal risk appetite or financial goals.

- Limited Contribution Options: The formula is king. You can't top up your balance with extra contributions the way you can with an accumulation fund.

- Complex Portability: If you leave your employer, trying to move your benefit (a process known as 'commutation') can be tricky and isn't always the smartest financial move.

- One-Size-Fits-All Approach: These funds were built for a different era, for the long-serving employee. The structure might not be the best fit if your career or retirement plans don't fit that traditional mould.

These funds are a relic of a time when jobs-for-life were the norm. The fact that fewer than 5% of member accounts in Australia now hold any defined benefit component speaks volumes. With almost all schemes now closed to new members, they are a unique asset that requires careful, expert handling. You can learn more about this shift by reading about Australia's pension system and its implications on InternationalBanker.com.

For many WA members, especially those juggling a GESB Gold State and a West State account, the real challenge isn't just weighing these pros and cons. The key is to build a strategy that uses the rock-solid certainty of the defined benefit as a foundation, while using your other assets to chase growth and maintain flexibility. This is precisely where Wealth Collective’s Guided Growth service comes in, helping you integrate this unique asset into a powerful and balanced financial plan.

Getting the Most Out of Your GESB Gold State and West State Super

If you've spent time working in the Western Australian public sector, the names GESB Gold State Super and GESB West State Super will likely sound very familiar. These aren't just any super funds; they're unique to WA government employees and come with a set of rules and opportunities you simply won't find anywhere else in Australia.

Understanding how to make these two funds work together is the secret to unlocking a far better retirement than you might expect.

This is where generic, one-size-fits-all financial advice falls short. A typical planner might see two separate pots of money, but a specialist sees two pieces of a powerful puzzle. The unique structure of these Government Employees Superannuation Board (GESB) funds opens the door to powerful strategies, especially around tax, that can dramatically improve your final nest egg.

Putting the Gold State and West State Puzzle Together

First, let's be clear: these two funds are completely different beasts. It's crucial to understand what you're dealing with.

- GESB Gold State Super is a classic defined benefit scheme. As we've discussed, your final payout is calculated using a set formula based on your salary and how long you've worked. It’s a legacy fund that’s now closed to new members, making it a particularly valuable asset if you have one.

- GESB West State Super is what’s known as a constitutionally protected accumulation fund. This means it operates more like a standard super fund—your balance grows with contributions and investment returns—but with a huge advantage. Just like Gold State, the investment earnings within West State are untaxed.

Many WA public servants find themselves members of both. Your defined benefit might be building up in Gold State, while your compulsory employer contributions go into West State. Having this combination is where the real planning magic can happen.

The Unique Planning Edge for WA Members

Having an untaxed defined benefit scheme (Gold State) alongside an untaxed accumulation fund (West State) gives you a strategic advantage that super members in other states can only dream of. The main game is to structure your retirement savings to be as tax-efficient as possible.

Because both funds are untaxed while your money is in them, the whole balance is treated differently when you finally take it out. A significant chunk of your money can often be converted into a tax-free component. Getting this part right is the absolute cornerstone of smart GESB planning.

The ability to combine and roll over these funds at retirement allows for strategies that can significantly increase the tax-free portion of your superannuation, potentially saving you tens of thousands of dollars in tax over the course of your retirement.

This isn’t just about dodging tax, though. It's about giving yourself more control and flexibility over your income in retirement. Nailing the strategy requires a deep dive into the specific rules around contribution splitting, rollovers, and benefit payments that are exclusive to GESB members.

Why Specialist Advice Is a Must-Have

Trying to navigate the maze of Gold State and West State rules on your own is not a great idea. The regulations are incredibly complex, and the decisions you make can have a massive, and often permanent, impact on your financial future.

We constantly help GESB members find answers to critical questions like:

- How is my Gold State benefit actually valued, and what’s the best time to access it?

- What are the specific rules for rolling my West State and Gold State money into a regular, taxed super fund?

- How can I structure that rollover to get the biggest possible tax-free component?

- Is it better to take my Gold State benefit as a lump sum or turn it into a pension?

Answering these properly takes genuine specialist knowledge. At Wealth Collective, our Retirement Roadmap process is specifically designed to unpack your situation and build a plan that unlocks the true potential of your WA public sector super.

Don't leave one of your most valuable assets to guesswork. A quick, no-obligation introductory call with our team can bring immediate clarity and get you on the right track to making the most of your Gold State and West State Super.

Understanding Tax, Rollovers, and Retirement Rules

Deciding what to do with your defined benefit payout is easily one of the biggest financial calls you'll ever make. The choice you make here will echo throughout your retirement, so getting a handle on the practicalities—from tax hits to rollover rules—is non-negotiable. It’s about securing the future you’ve spent a lifetime building.

The first thing to wrap your head around is how your benefit gets taxed. This isn't like a standard accumulation fund where tax is chipped away on contributions and earnings as you go. Many defined benefit schemes, especially older WA-based ones like GESB Gold State, are untaxed. This simply means the tax bill is put on hold until the day you finally access your money.

When that day comes, your benefit is split into tax-free and taxable portions. A key goal of any smart retirement strategy is to maximise that tax-free component, as it means more money ends up in your pocket, not with the ATO.

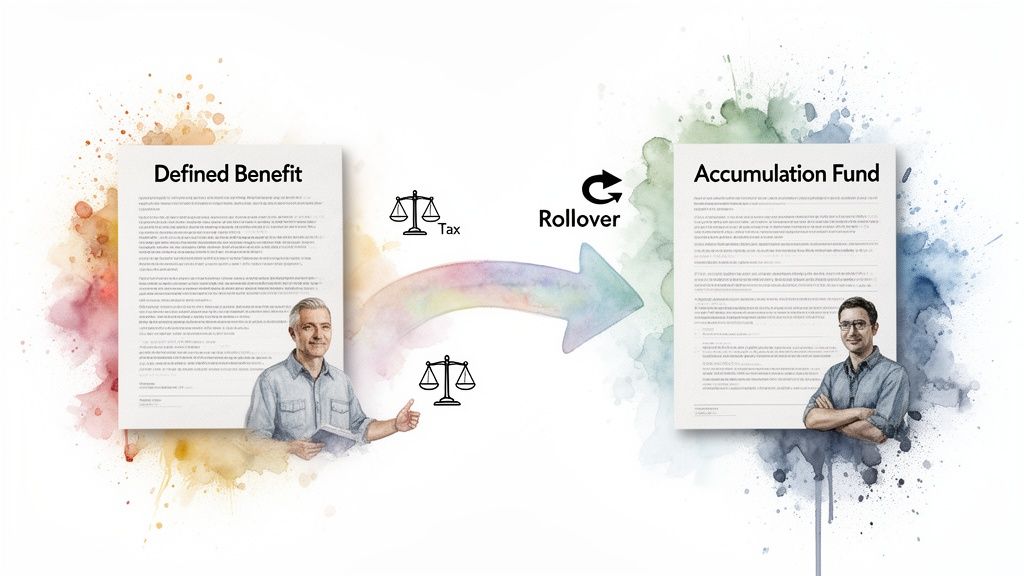

To Commute or Not to Commute?

This is the million-dollar question for many members: should you commute your benefit? In simple terms, this means working out the lump sum value of your defined benefit and rolling it over into a regular accumulation super fund.

On the face of it, the move offers a lot more flexibility. An accumulation fund puts you in the driver's seat of your investments and makes it easier to pass your super on to your beneficiaries. For many, that freedom is incredibly appealing.

But, and this is a big but, commuting your benefit is a one-way street. It’s an irreversible decision with some serious trade-offs to consider.

- You take on market risk: By rolling over, you’re saying goodbye to the guaranteed, predictable income stream of your defined benefit. Your nest egg is now tied to the rollercoaster of investment markets.

- You lose priceless certainty: That peace of mind that comes with a defined benefit? It’s gone. You're now solely responsible for making sure your money lasts for your entire retirement.

- Complex tax rules kick in: The rollover process isn't always straightforward and can trigger unexpected tax liabilities if you're not careful. The rules for specific schemes like GESB can be particularly tricky to navigate.

Commuting your defined benefit means swapping a guaranteed outcome for greater control and potential growth. This isn't inherently a good or bad move, but it must be a deliberate one, based on a clear understanding of what you are gaining and what you are giving up.

Making the Right Call for Your Future

Ultimately, whether you decide to take a pension, a lump sum, or commute your benefit into an accumulation fund comes down to you—your personal situation, your comfort with risk, and your long-term goals. There's no one-size-fits-all answer here.

For some, the rock-solid stability of a lifetime pension is what they value most. For others, the flexibility and control of an accumulation account is the priority.

This is a decision more and more Australians are facing. According to APRA, total benefit payments from super funds surged 12.8% to $132.5 billion in the year to June 2025. Within that, defined benefit pension payments rose 11% to $59.2 billion. You can learn more about these superannuation trends from APRA's latest statistics.

Properly managing these funds also means thinking about what happens when you're gone. Estate planning is a crucial piece of the puzzle that often gets overlooked. To get a better grasp, it's worth reading our guide on what happens to your super when you die.

This is precisely where getting expert guidance is not just helpful—it’s essential. The Wealth Collective Retirement Roadmap service is designed specifically for these kinds of complex scenarios. We give you the professional, personalised advice you need to make tax-effective decisions and turn your defined benefit super into the bedrock of a secure and successful retirement.

Planning Your Next Steps With Your Defined Benefit Super

Knowing the theory behind your defined benefit super is one thing, but turning that knowledge into a real-world retirement plan is where the magic happens. Think of your defined benefit super as a unique and powerful asset. It requires a specialist's touch to get the most out of it, especially if you're in a WA-based scheme like GESB, UniSuper, or the PSS.

Your first priority should be getting absolute clarity on exactly what you're entitled to and what all your options are. While these funds offer incredible security, they don't play by the same rules as the standard accumulation funds most Australians are familiar with.

In fact, employer contributions to these defined benefit funds hit $4,751 million in a recent quarter alone—a massive flow of retirement funding that sits completely outside the regular super guarantee system. You can see just how significant these schemes still are by looking at the data from the Association of Superannuation Funds of Australia. This unique status means every move you make needs to be deliberate and well-thought-out.

Your Action Checklist

Let's start by figuring out what you know and, more importantly, what you don't know. A quick self-audit is the best way to pinpoint any gaps in your understanding and get you ready for a productive chat with a financial adviser.

Grab your latest statement and ask yourself these questions:

- Benefit Statement: When did I last properly read my benefit statement? Do I actually understand what all those numbers mean?

- Scheme Rules: Am I 100% clear on my fund's specific rules, like my preservation age (when I can access my money) or what happens if I change jobs?

- Vesting Conditions: Do I know the vesting rules? These are critical, as they dictate when the employer-sponsored part of your benefit officially becomes yours.

- Pension vs Lump Sum: Have I really weighed up the pros and cons of taking my benefit as a guaranteed income for life versus a one-off lump sum?

Taking control starts with asking the right questions. The answers will form the foundation of a retirement strategy that is built around your specific circumstances and goals, not generic assumptions.

The Most Important Next Step

Let’s be honest: trying to navigate the maze of a WA defined benefit scheme on your own is not a great idea. The single most important step you can take right now is to speak with a financial adviser who has genuine, hands-on experience with these specific funds.

Making the right call on rollovers, tax components, and the timing of your benefit can literally add tens of thousands of dollars to your final retirement balance. It’s that critical.

This is exactly what we specialise in at Wealth Collective. Our Retirement Roadmap service was designed from the ground up to make sense of complex schemes like GESB Gold State and West State. We provide clear, actionable advice to help you slot your defined benefit super into a wider financial plan, potentially alongside strategies like a transition to retirement pension, to build the future you want.

The easiest way to get started is with a simple chat. We offer a free, 10-minute introductory call so you can get immediate clarity on your situation without any pressure or obligation. It's the first step toward moving forward with complete confidence.

Got Questions? We've Got Answers

Defined benefit schemes can feel like a bit of a puzzle, especially when you're dealing with older, closed funds like those in WA. It's only natural to have questions. Here are some of the most common ones we hear from clients.

Can I Top Up My Defined Benefit Fund?

For most closed schemes, like GESB's Gold State Super, the answer is generally no – you can't make extra personal contributions directly into the defined benefit part of your account. The growth of your benefit is locked into that set formula based on your salary and how long you've worked there.

That doesn't mean you can't save more for retirement, though. You can often open a separate accumulation account, either within the same fund (like a GESB West State account) or with a completely different super fund, and contribute to that instead. It's a smart way to boost your overall retirement nest egg, and an adviser can help you work out the best approach.

What Happens If I Leave My Job?

This is a big one, and the answer really hinges on the specific rules of your fund. When you leave the employer who sponsors your defined benefit scheme, you'll usually be presented with a few choices.

- Leave it there: You can often choose to become a 'deferred member', which simply means your accrued benefit stays put in the fund, waiting for you to reach retirement age.

- Roll it over: You have the option to 'commute' your benefit, which means converting it into a lump sum value. You can then roll this amount into another super fund, like a standard accumulation account.

- Cash it out: This is rare and usually only possible under very specific circumstances. Be warned, taking the cash often comes with a hefty tax bill.

Each of these paths can dramatically change your financial future, so it's not a decision to take lightly. Getting professional advice here is absolutely critical.

Is My Defined Benefit Super Guaranteed?

When you're in a public sector fund like GESB, PSS, or even UniSuper, your benefits are generally backed by the government or the employer that sponsors the scheme. This makes them incredibly secure.

It is important to understand, however, that this isn't the same as the formal Australian Government Guarantee Scheme that protects your money in the bank. The security of a defined benefit fund comes from the solid financial and legal backing of its sponsor, which is still one of the strongest safety nets you can have for your retirement savings.

Getting your head around the details of your defined benefit super is the first real step to making it work for you. At Wealth Collective, our award-winning advisers live and breathe this stuff. We specialise in taking these complex, often confusing assets and building them into clear, powerful retirement plans.

Ready to see what's possible? Take the next step and book your free, no-obligation introductory chat with our team today at https://wealthcollective.co.