Business hours

Monday to Friday (8.30AM - 5PM)

Weekend (Closed)

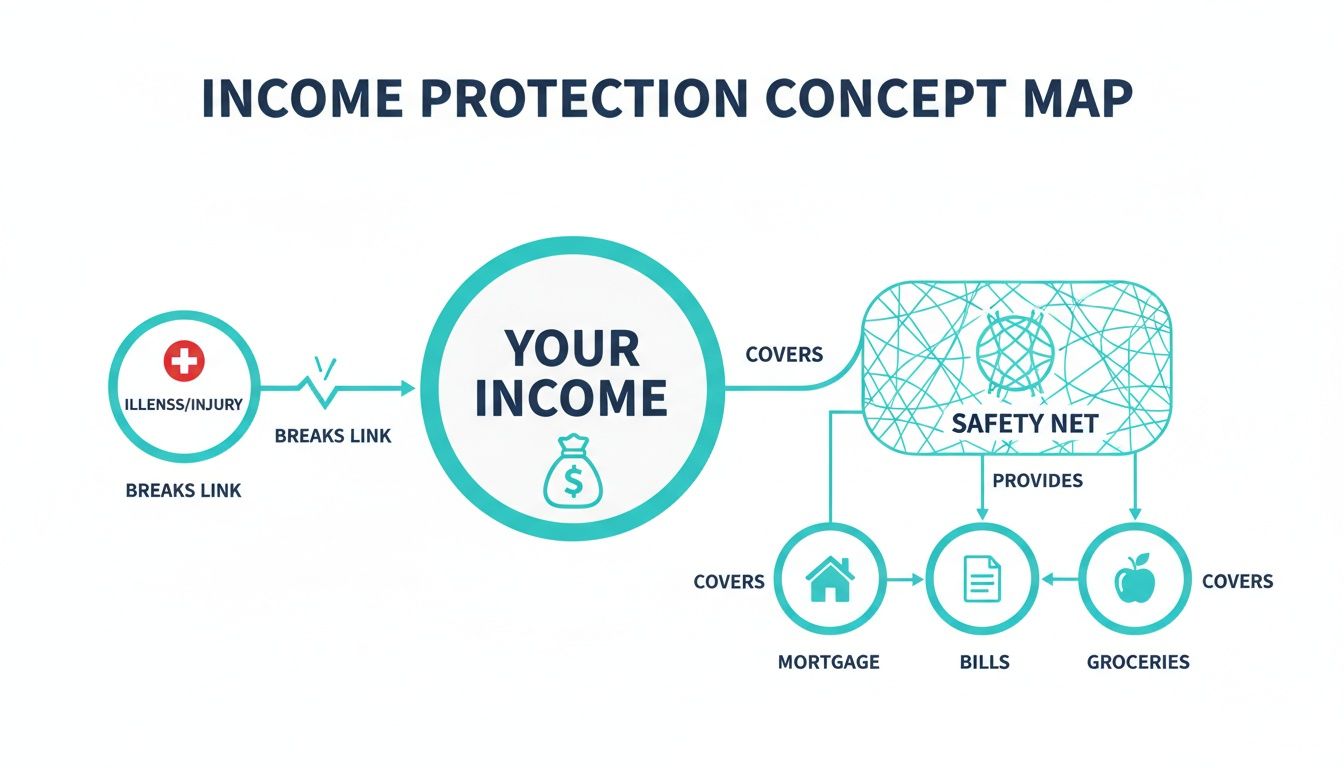

Let's be honest, your ability to get up and go to work each day is your single most valuable asset. Over your career, it’s worth millions. But what happens if that ability is suddenly taken away by a serious illness or injury?

Without that regular paycheque, how would you cover the mortgage, pay the bills, or even put food on the table? This is precisely where income protection insurance comes in. It’s designed to act as a financial safety net, replacing a chunk of your lost income so you can focus on getting better.

Your Financial Safety Net Explained

Think of income protection as your backup salary. If you’re hit with a significant health issue that stops you from working for an extended period, this insurance kicks in to provide a monthly payment.

Typically, this can be up to 70% of your pre-tax income. It’s not for a common cold that has you off work for a couple of days, but for those serious events that could otherwise derail your entire financial life.

The Core Purpose of Income Protection

The whole point of this cover is to give you financial stability when you need it most. It means you won’t have to burn through your hard-earned savings, sell off investments, or lean on family just to stay afloat during your recovery.

It provides peace of mind and the breathing room to focus on what really matters: your health.

Income protection is the bedrock of any solid financial plan. It safeguards your ability to reach all your other goals—from paying off your home to building a retirement nest egg—by ensuring a health setback doesn't become a permanent financial disaster.

How It Aligns with Your Financial Plan

At Wealth Collective, we believe that protecting your financial world is just as important as growing it. This philosophy is at the heart of our ‘Protection Plus’ service, which is all about building a strong defence for your wealth and wellbeing.

Income protection is a critical tool in that defensive strategy. It ensures that your financial momentum isn't stopped dead in its tracks by something completely out of your control. It’s vital to understand how different covers work together, and income protection plays the unique role of protecting your day-to-day cash flow. You can learn more about the different types of life insurance in our detailed guide.

Getting the structure of your protection right is everything. It's not just about buying an off-the-shelf policy; it's about crafting a strategy that fits your occupation, income, and long-term goals. This is where our expert advice makes all the difference, turning a simple product into a powerful component of your overall financial plan. With that strong foundation in place, you can get on with life, knowing you’re prepared for whatever comes your way.

How An Income Protection Policy Actually Works

Getting your head around an income protection policy can feel a bit like learning a new language. You’ll hear terms like ‘waiting periods’ and ‘benefit periods’ thrown around, and it's easy to get lost. But these aren't just jargon; they're the dials and levers we help you adjust to build a financial safety net that’s a perfect fit for you.

Let's move past the theory and see how these pieces work together in the real world. Once you grasp these core ideas, you'll see your policy not just as a document, but as a carefully designed strategy to protect your lifestyle.

This visual map breaks it down nicely, showing how income protection acts as a financial bridge, covering essential costs like your mortgage, bills, and groceries if an illness or injury stops you from earning.

As you can see, the policy steps in to handle your non-negotiable financial commitments, making sure a health setback doesn't turn into a financial catastrophe.

The Waiting Period: Your Initial Buffer

The first key decision you’ll make is the waiting period. In simple terms, this is the amount of time you have to be off work due to sickness or injury before your insurance payments kick in. You'll typically see options for 30, 60, or 90 days.

Think of it like the excess on your car insurance. A shorter waiting period—say, 30 days—means you get financial help much faster. This is great if you have limited sick leave or savings to fall back on. The trade-off? This convenience comes with a higher premium.

On the flip side, opting for a longer waiting period, like 90 days, will bring your premium down. This can be a smart move if you've got a solid emergency fund or generous sick leave from your employer that can see you through the first few months. We can help you assess your personal financial situation to choose the right timeframe.

The Benefit Period: How Long Your Support Lasts

Next up is the benefit period. This is just as critical, as it defines the maximum length of time you can receive your monthly payments for a single claim.

Benefit periods can be set for a fixed term, like two or five years, or they can provide much longer-term cover, often right up until you turn 65 or 70.

A shorter benefit period might seem fine for temporary setbacks, but what if you suffered something more permanent? That’s where you’d be left exposed. A longer benefit period, stretching to age 65, offers the ultimate security. It guarantees your income is protected all the way to your planned retirement, which is a cornerstone of the comprehensive strategies we build for our clients at Wealth Collective.

The interplay between waiting and benefit periods is where we can truly customise your policy. It's a balancing act between affordability today (premiums) and the level of security you'll have tomorrow (coverage).

Waiting Period vs. Benefit Period At a Glance

This table breaks down the typical trade-offs, helping you see how different choices might align with your personal circumstances.

| Policy Feature | Shorter Period (e.g., 30-day wait, 2-year benefit) | Longer Period (e.g., 90-day wait, to age 65 benefit) | Best Suited For |

|---|---|---|---|

| Premium Cost | Higher | Lower | Those wanting to balance immediate affordability with long-term protection. |

| Financial Buffer | Requires less personal savings or sick leave. | Requires a larger emergency fund or generous employer sick leave. | Individuals with varying levels of personal savings and employment benefits. |

| Claim Payout | Begins sooner after injury/illness. | Begins later, after the waiting period is met. | People with different capacities to self-fund the initial period off work. |

| Coverage Duration | Limited to the specified term (e.g., 2 years). | Provides cover for long-term or permanent disabilities until retirement. | Those seeking protection for either short-term interruptions or lifelong career-ending events. |

Ultimately, choosing the right combination is about understanding your own financial resilience and long-term goals.

Indemnity vs. Agreed Value Policies

In the past, you could choose between two types of policies: indemnity value and agreed value. An agreed value policy was great for people with fluctuating incomes because it locked in your benefit amount when you first took out the cover.

However, the industry has since changed. Today, nearly all new income protection policies sold in Australia are indemnity value. This means your monthly benefit is calculated based on your actual, provable income in the 12-24 months leading up to your claim. This shift makes it absolutely vital to regularly review your policy to ensure your cover level keeps pace with your earnings.

Partial Disability Cover: Getting You Back on Your Feet

One of the most valuable—and often overlooked—features is partial disability cover. A serious illness or injury doesn't always mean you can never work again. Often, the path to recovery involves returning to work gradually, perhaps with reduced hours or in a different role.

This is where a partial disability benefit is a lifesaver. If you go back to work but are earning less than you were before you got sick, the policy can top up your income with a partial payment. It provides critical financial support while you ease back into the workforce, ensuring you aren't financially penalised for making the effort to recover.

Understanding these mechanics shows that income protection isn't a rigid, one-size-fits-all product. It’s a flexible tool that, with expert guidance, can be precisely calibrated to your needs. This is the value of the Wealth Collective process—we translate these options into a clear, personalised strategy, so you can feel confident your financial future is secure.

Who Actually Needs Income Protection in Australia?

Figuring out if you need income protection insurance isn't about ticking boxes on a generic checklist. It's a deeply personal question, and the right answer hinges entirely on your life, your responsibilities, and where you're headed financially. For some, it’s a smart safety net; for others, it’s the absolute bedrock of their financial plan.

The simplest way to cut through the noise is to ask yourself one question: "If my income suddenly stopped tomorrow because I was sick or injured, what would happen?"

For most of us, the honest answer is pretty confronting. Relying on a few weeks of sick leave or hoping workers' compensation will cover you is a massive gamble, especially since those options rarely stretch to cover a long-term recovery.

Let's walk through a few common scenarios we see every day at Wealth Collective. See if any of these sound familiar.

The Young Professional With a New Mortgage

You're kicking goals in your career and have just signed the papers for your first home—an exciting, but massive, commitment. Your earning potential is on the up, but your savings have likely taken a hit from the deposit and moving costs.

If you were suddenly unable to work, it could be financially devastating. The mortgage repayments don't just stop because you're recovering. The pressure could force you to sell your new home or, even worse, dip into your super, setting your financial goals back by years. For young professionals, income protection is really about protecting the future you’re working so hard to create.

The Dual-Income Family Juggling It All

For many Aussie families, two incomes aren't a luxury; they're the engine that keeps the household running. Between school fees, groceries, car loans, and kids' sport, both salaries are usually spoken for before they even hit the bank.

If one partner is suddenly out of action, the financial weight on the other can be crushing. It often means having to make drastic changes to the family's lifestyle, creating a whole new layer of stress when the focus should be on getting better.

For dual-income families, income protection acts as a financial shock absorber. It ensures one person's health crisis doesn't become a financial crisis for everyone, allowing life to carry on with as little disruption as possible.

The Self-Employed Business Owner

When you work for yourself, you are the business. There’s no paid sick leave, no annual leave, and no one to cover for you. If you can't show up to work, the income stops. But the bills—both for the business and at home—certainly don't.

For consultants, tradies, and small business owners, income protection is basically non-negotiable. It’s the cash flow that keeps the lights on for your business and your family while you’re out of commission, protecting everything you've built.

The High-Income Earner Protecting Their Lifestyle

When you earn a significant income, you and your family naturally get used to a certain standard of living. That lifestyle—the home you live in, the schools your kids go to, the holidays you take—is built on your ability to keep earning.

A high income often goes hand-in-hand with high financial commitments. Income protection is what stands between a period of illness and a forced, unwelcome change to the life you've carefully built for your family.

It's Not Just About Physical Injuries

The risks we face are changing. It's no longer just about a bad back or a broken leg. Mental health is now one of the leading reasons Australians need to claim on their income protection.

Insurers recently paid out over AUD $887 million for mental health-related claims, which now make up one in five income protection claims. This points to a much bigger picture, with mental ill-health costing the Australian economy up to AUD $220 billion a year. You can learn more about the rising impact of mental health on insurance claims.

At Wealth Collective, our job is to understand what makes you vulnerable. We help you look past the obvious and build a protection plan that covers the real risks you face, ensuring your financial life stays on track, no matter what curveballs life throws your way.

Understanding The Costs And Tax Benefits Of Your Policy

When looking into income protection, two questions always pop up first: "How much will it cost?" and "Is it really worth it?" Let's pull back the curtain on what actually drives the price of your policy and explore a huge financial perk that makes it much more affordable than you might think.

The cost of your policy, known as the premium, is really just a reflection of risk. Insurers look at a handful of key personal factors to work out the likelihood of you needing to make a claim. The higher they think that risk is, the higher your premium will be.

What Drives Your Premium Costs?

A few core elements go into the insurer's calculation to land on your final premium. While each company has its own secret sauce, the main ingredients are pretty much the same everywhere.

- Your Age: It’s no surprise that younger people tend to get lower premiums. Statistically, the chance of a serious illness or injury is just lower when you're younger.

- Your Occupation: Your job makes a huge difference. An electrician on a busy construction site has a very different risk profile to an accountant in a quiet office, and the premiums will reflect that reality.

- Your Health and Lifestyle: Insurers will want to know about your medical history, your current health, and whether you smoke. All of this feeds directly into the price.

- Policy Structure: The choices you make when setting up your policy, like opting for a shorter waiting period or a longer benefit period, will also move the needle on cost.

The good news? This vital cover has become more affordable lately. We've seen advised premiums for income protection in Australia fall, with year-on-year drops of 7% for policies with a 30-day wait and 5% for those with a 90-day wait. You can read more about these premium trends and what they mean for you. It’s a great time to lock in that financial safety net.

The Big Advantage: Tax Deductibility

Now for the best part. When you hold your income protection policy outside of your super fund, the premiums you pay are generally tax-deductible in Australia.

This is a game-changer. It means you can claim the full cost of your premiums on your annual tax return, significantly cutting the real, out-of-pocket cost. Suddenly, your cover isn't just another bill—it's a smart, tax-effective piece of your financial puzzle.

Think about it this way: if your marginal tax rate is 32.5%, a policy that costs $2,000 a year really only costs you $1,350 after you claim that deduction at tax time. That makes getting proper protection much more achievable.

Inside Or Outside Superannuation?

You do have the option to hold your income protection policy inside your super fund. Paying the premiums directly from your super balance can definitely help with day-to-day cash flow, which is a big plus for some. However, it's not always the best move.

Policies held inside super often have more restrictive definitions and terms, and they might not pack in all the comprehensive features you'd get with a standalone policy. The way the benefits are taxed if you claim can also be different. The right choice really comes down to a careful look at your personal circumstances. If you're weighing this up, our guide on understanding superannuation and income protection dives into more detail.

This is exactly where we come in. At Wealth Collective, our process is designed to help you navigate these complexities. We'll help you weigh up all the pros and cons, making sure your policy is structured perfectly for your needs—both in terms of the cover you get and the cost. Booking an introductory call is the first step toward building a plan that not only protects your income but also works intelligently for your financial life.

So, What Happens When You Actually Need to Claim?

The real test of any insurance policy isn't the glossy brochure or the policy document – it's how it performs when you’re in a tough spot. When an illness or injury stops you from working, the last thing you need is a mountain of paperwork and a stressful, confusing claims process. This is the moment of truth, and understanding what to expect can make a world of difference.

While it might sound intimidating, lodging an income protection claim is usually more straightforward than people imagine. The insurer's goal is simply to verify your situation so they can get your payments started, allowing you to focus on what truly matters: your recovery.

The Typical Steps in Making a Claim

Every insurance company has its own process, but they generally follow the same core steps. Knowing the path ahead can take a lot of the anxiety out of the equation.

- First Contact: Your first move is simple: get in touch with your insurer or, even better, your financial adviser. You should do this as soon as it becomes clear you won't be able to work beyond your waiting period.

- The Paperwork: The insurer will then send you the required claim forms. These will include sections for you, your doctor, and sometimes your employer to complete.

- Medical Evidence: This is crucial. Your doctor will need to supply reports confirming your diagnosis, explaining how it prevents you from working, and giving an estimated timeline for your recovery.

- Proof of Earnings: Because the benefit is a percentage of what you were earning, you'll need to provide proof of income. This usually means recent payslips, tax returns, or business financial statements.

- Assessment and Payment: The insurer’s claims team reviews everything you’ve submitted. Once your claim is approved, your monthly payments will kick in as soon as your waiting period is over.

Don’t Worry, Claims Do Get Paid

A common fear is, "Will the insurer actually pay up?" It's a fair question, but the statistics for income protection in Australia are incredibly reassuring. This is a safety net you can rely on.

Data from the government's MoneySmart Life Insurance Claims Comparison tool shows that income protection claims have acceptance rates of between 94% and 96%. Specifically for policies arranged through a financial adviser (known as 'advised' or 'retail' policies), the approval rate is 94.4%. You can dig deeper into the strong performance of life insurance claims. These high approval rates should give you real confidence that your policy will be there for you when you need it most.

The Wealth Collective Advantage: Your Advocate in a Time of Need

This is where having an adviser from Wealth Collective in your corner really shows its value. When you’re sick or injured, the last thing you want to be doing is chasing forms, waiting on hold, or playing coordinator between your doctor and the insurance company.

As your financial adviser, we become your personal claims manager. We step in and handle the entire process for you – from lodging the initial paperwork to liaising with the insurer and making sure everything stays on track. Our job is to lift that administrative weight off your shoulders so your only job is to get better.

This hands-on support is a key part of our ‘Protection Plus’ service. We don't just find you the right policy; we’re there to make sure it delivers on its promise.

Common Exclusions to Be Aware Of

While claim rates are excellent, no policy covers absolutely everything. It’s important to understand the standard "exclusions," which are situations where a claim won't be paid. These typically include:

- Intentionally self-inflicted injuries.

- Injuries that happen while you're committing a criminal act.

- Issues arising from a normal, uncomplicated pregnancy.

- Pre-existing conditions that you didn't tell the insurer about when you first applied.

That last point is absolutely vital. Being completely honest and thorough about your medical history during the application is the single best way to guarantee a smooth claims process later on. Working with an adviser helps ensure nothing is missed, setting you up for success right from the start.

What's the Next Step?

You've done the hard part – you now understand what income protection is all about. It’s not just another bill to pay; it’s the bedrock of your entire financial plan, safeguarding everything from your mortgage repayments to your long-term retirement goals.

So, what now? The next logical move is to turn that understanding into a concrete plan. While the theory makes sense, tailoring it to your specific circumstances is where the real value lies. This is where we come in, making the process straightforward and taking the guesswork out of it for you.

How We Help

Getting expert financial advice shouldn't be complicated or intimidating. We start with a simple, complimentary 10-minute introductory call. It's just a chat, really. A chance for us to hear about your situation and for you to see if we're the right people to help.

If we move forward, our job is to cut through the jargon and the fine print. We'll look at your job, your income, and what you want to achieve, then map out a strategy that gives you solid protection without you paying for things you don't need.

At Wealth Collective, we see ourselves as your advocate. We simplify the complex world of insurance, handle the paperwork, and make sure your financial safety net is properly set up to protect the life you’re building.

Lock in a Time for a Chat

Protecting your income is genuinely one of the most critical financial decisions you'll make. It’s what ensures a curveball like an injury or illness doesn't completely throw your life off track. It's a key part of any solid financial strategy, just as important as knowing how to switch super funds to get the best outcome for your retirement.

Taking that next step is easy. Booking a call with our team is the best way to move from simply knowing to actually doing. Let us help you put the right protection in place, so you can get back to building your future with confidence.

Got Questions? We've Got Answers

When you start digging into the details of income protection insurance, it's natural for a few questions to pop up. To make sure you're feeling confident and clear, we’ve put together answers to the queries we hear most often from our clients.

Is Income Protection the Same as TPD or Trauma Insurance?

That's a great question, and the short answer is no. Think of them as different tools for different jobs, each playing a unique role in protecting your financial wellbeing.

Income protection is all about replacing your paycheque. It provides a steady, month-to-month payment if an illness or injury temporarily takes you out of the workforce.

On the other hand, Total and Permanent Disability (TPD) insurance pays out a single lump sum if it's medically determined you'll likely never work again in a suitable job. Trauma insurance (or critical illness cover) also pays a lump sum, but it's triggered by the diagnosis of a specific major illness, like cancer or a heart attack. This money is designed to help with immediate costs, whether you can work or not. A really solid financial plan often layers these different types of cover together.

Can I Get Income Protection If I'm Self-Employed?

Absolutely. In fact, if you're self-employed, it’s arguably even more crucial. When you're the boss, there's no sick leave to fall back on—your ability to work is your ability to earn. Income protection acts as your personal safety net.

When you apply, insurers will want to see proof of your earnings to figure out the right monthly benefit. This usually means providing your business financials and personal tax returns. A good adviser can walk you through exactly what's needed and find an insurer who understands the income fluctuations that can come with running your own business.

What Happens If My Income Changes After I Get a Policy?

It's vital to check in on your policy whenever your income takes a significant jump or dip. Land a big promotion? Your business has a stellar year? If you don't update your cover, you could be underinsured, meaning the monthly benefit wouldn't be enough to keep up with your new lifestyle.

The opposite is also true. If your income drops, you might be overpaying for a level of cover you wouldn't even be able to claim. Regular reviews are a key part of our service at Wealth Collective. We make sure your policy stays perfectly aligned with your real-world financial situation, so you're always properly protected.

Is Holding Income Protection Inside Super a Good Idea?

It can be, but it’s a trade-off. Paying premiums from your superannuation balance is a handy way to manage your day-to-day cash flow. It feels "out of sight, out of mind." However, this convenience comes with some serious strings attached.

Policies held inside super often have more restrictive definitions of disability and might lack the more comprehensive features you’d find in a policy held in your own name. Benefit payments are also treated differently from a tax perspective.

There’s no one-size-fits-all answer here. The right structure depends entirely on your personal circumstances. We can help you weigh up the pros and cons to make sure your choice fits perfectly with your overall financial strategy.

At Wealth Collective, our job is to cut through the complexity and give you clear, straightforward advice that works for you. If you're ready to secure your income and your future, the next step is simple. Book your complimentary introductory call today.