Business hours

Monday to Friday (8.30AM - 5PM)

Weekend (Closed)

At its core, superannuation is Australia's system for ensuring we all save for retirement. Think of it as a long-term savings plan, but with a critical feature: your employer is legally required to contribute to it for you. This system, known as the Superannuation Guarantee (SG), is designed to build a nest egg to fund your life after work.

However, viewing super as just a mandatory saving scheme is a missed opportunity. To build real wealth, you need to see it for what it is: a powerful, tax-effective investment vehicle. Understanding how to manage it strategically is the first step towards securing the future you want.

Your Quick Guide to Superannuation in Australia

For many, super is just a line on a payslip—something that happens in the background. But over your working life, it can become your biggest asset, often growing to be worth more than your family home. Taking a hands-off approach means leaving your financial future to chance.

Getting to grips with what superannuation is marks the first step towards taking control. It’s not a locked savings account; it's a dynamic wealth-building tool.

That money your employer pays in—currently 12% of your ordinary time earnings—doesn't just sit there. It gets invested for you in a mix of assets like shares, property, and bonds, where it has decades to grow and compound. The right strategy can turn these automatic contributions into a substantial nest egg.

To break it down further, here are the essential components of the super system.

Superannuation at a Glance

| Component | Brief Explanation |

|---|---|

| Superannuation Guarantee (SG) | The compulsory contribution your employer must pay into your super fund. |

| Concessional Contributions | Pre-tax contributions, including the SG and any salary sacrifice you make. |

| Non-Concessional Contributions | Contributions made from your after-tax income. |

| Investment Options | The different portfolios (e.g., high growth, balanced) your super can be invested in. |

| Preservation Age | The specific age you must reach before you can legally access your super. |

| Tax Benefits | Super earnings and contributions are taxed at a lower rate than your personal income. |

This table gives you the terminology, but real progress comes from applying this knowledge with a clear plan.

Why You Need a Hands-On Strategy

Letting your super 'do its thing' is a massive missed opportunity. Without a clear strategy, you could be losing money to high fees, poor investment returns, or an unsuitable insurance setup. Getting actively involved means you can:

-

Align your fund’s investment strategy with your personal goals and risk tolerance.

-

Reduce fees by consolidating multiple super accounts into one high-performing fund.

-

Boost your balance by making strategic additional contributions.

Making smart choices about your super early in your career is one of the most powerful things you can do for your long-term wealth. It’s the difference between just 'getting by' in retirement and truly living the life you want.

Ultimately, your super is your money. Taking control turns it from a passive saving scheme into an active strategy for building wealth. This is where professional advice becomes invaluable, helping you cut through the complexity and map out a clear path forward.

To see how super fits into your bigger financial picture, explore our process for building your personal Retirement Roadmap.

How Superannuation Actually Builds Your Nest Egg

So, your super account is meant to grow over your working life, but where does the money really come from? Understanding the mechanics is the first step toward taking control of your financial journey. It’s not magic—it's a deliberate system of contributions all working together to build your wealth.

The main engine driving your super’s growth is the Superannuation Guarantee (SG). This is the amount your employer is required to contribute to your super fund by law, currently set at 12% of your ordinary time earnings. Think of it as the automatic, foundational layer of your retirement savings, quietly building up in the background with every pay cycle.

But your employer’s contribution is just the starting point. To truly accelerate your wealth creation, you can add your own money. These voluntary contributions are a powerful way to take an active role in shaping your financial future.

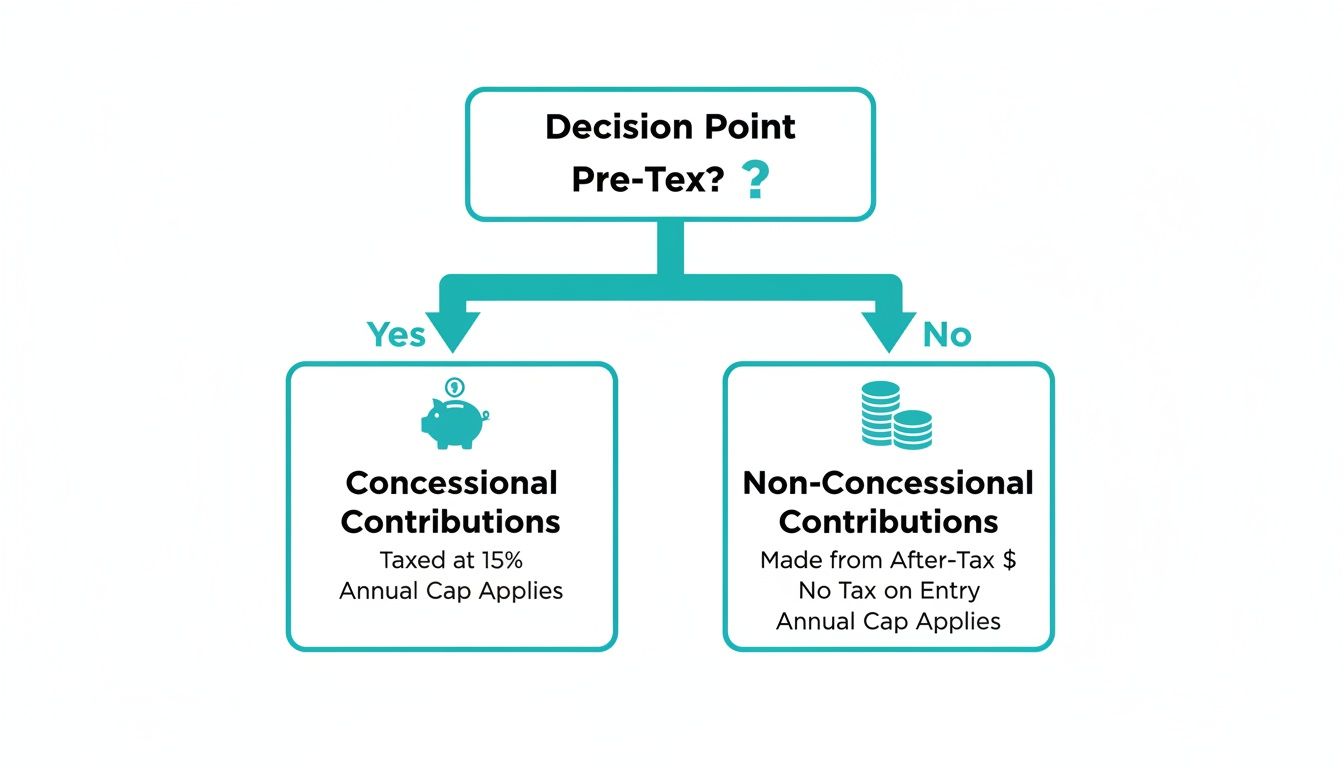

The Two Types of Voluntary Contributions

Making extra contributions is one of the smartest financial decisions you can make. There are two main ways to do this, each with distinct tax advantages.

-

Concessional (Pre-Tax) Contributions: This is money that goes into your super from your income before it's taxed at your marginal rate. The most common method is salary sacrificing, where you arrange for your employer to direct a portion of your pre-tax pay straight into your super. This strategy not only grows your retirement savings faster but can also reduce your taxable income for the year.

-

Non-Concessional (Post-Tax) Contributions: These are contributions you make from your take-home pay—money that you've already paid tax on. You might contribute a lump sum from savings, an inheritance, or the sale of an asset. While you don't get an immediate tax deduction, investment earnings on this money inside super are taxed at a low 15%.

Additionally, if you're a low-to-middle income earner and make a post-tax contribution, you may be eligible for a government co-contribution, where the government adds extra money to your super as a reward for saving.

A common misconception is that super is your employer's responsibility alone. The reality is, making strategic voluntary contributions is what separates an average retirement from a truly comfortable one. It’s about turning a passive savings account into an active wealth-building machine.

A Practical Example of Salary Sacrificing

Let's look at a professional named Alex, who earns $120,000 a year. Alex decides to salary sacrifice an extra $10,000 into their super.

Instead of that $10,000 being taxed at their personal income tax rate (34.5% including the Medicare levy), it's only taxed at the super rate of 15%. This simple move saves Alex on tax now while giving their retirement savings a massive boost. Compounded over several decades, this could add hundreds of thousands of dollars to their final balance. Understanding and applying these mechanics is a core part of our Guided Growth service, where we help clients build effective and personalised wealth strategies.

Why Your Money Is Locked Away

A key feature of Australia's super system is that your money is "preserved." This means you can't withdraw it whenever you like. You must wait until you reach your preservation age (between 55 and 60, depending on your birth date) and meet a condition of release.

This rule exists to protect your future self. By keeping the funds locked away, the system ensures your savings have maximum time to grow through compound interest and will be there for you in retirement. It enforces the long-term discipline that is the cornerstone of building lasting wealth.

The Tax Advantages & Contribution Rules You Need to Know

While tax isn't the most exciting topic, understanding the rules for super is the secret to unlocking its true power. The tax savings alone can add hundreds of thousands of dollars to your retirement nest egg. It's not just about putting money away; it’s about doing it in the most tax-efficient way possible.

The entire super system is designed to encourage retirement saving by offering a massive tax advantage: money inside super is taxed at a much lower rate than your regular income.

The Magic Number: 15%

If there’s one number to remember with super, it’s 15%. This is the flat tax rate applied to concessional contributions (like your employer’s payments and salary sacrifice) and investment earnings within your fund.

Now, compare that to your personal income tax rate, which could be 30%, 37%, or even 45% (plus the Medicare levy). The difference between paying 15% tax on super contributions versus up to 47% on your take-home pay is enormous. Every dollar not paid in tax is a dollar invested and working for you.

This tax differential is the engine room of your super. It creates a protected, low-tax environment where your savings can grow much faster than they could elsewhere.

At Wealth Collective, helping our clients leverage this structure is a cornerstone of building real, long-term wealth.

Staying Within the Lines: Your Contribution Caps

To ensure the system is fair, the government sets annual limits—or 'caps'—on how much you can contribute to your super. It’s crucial to monitor these, as exceeding the caps can result in significant tax penalties.

There are two main caps to know:

-

Concessional (Before-Tax) Contributions Cap: This applies to all contributions from your pre-tax salary, including your employer's SG, salary sacrifice, and any personal contributions you claim a tax deduction for. The cap is currently $30,000 per financial year.

-

Non-Concessional (After-Tax) Contributions Cap: This is for contributions made with money you’ve already paid tax on. The annual limit here is much higher, at $120,000.

Keeping track of these caps is essential, especially for high-income earners or those receiving bonuses. A little planning can prevent an expensive mistake.

A Smart Way to Catch Up: The Carry-Forward Rule

What if you haven't used your full before-tax cap in recent years? The Australian Taxation Office (ATO) allows you to 'carry forward' unused amounts for up to five years, provided your total super balance was under $500,000 at the start of the financial year.

This is a fantastic strategy for those with fluctuating incomes, like small business owners. After a successful year, they can use the 'missed' cap space from previous leaner years to make a larger, tax-deductible contribution. This not only injects a significant amount into their retirement savings but can also reduce their business's taxable income.

Yes, the rules around tax, caps, and carry-forward provisions can seem complex. But they are also filled with opportunity. With the right advice, you can turn these rules from a headache into a powerful tool for building wealth. This is where a clear financial plan pays for itself.

Choosing the Right Super Fund for Your Goals

Deciding where your super is invested isn't a small decision; it's one of the most important financial calls you'll ever make. The right fund can be the difference between a comfortable retirement and one filled with financial stress, as it impacts everything from fees to investment returns.

Think of it like choosing a vehicle for a long road trip. You need the right one for the journey ahead. In Australia, we have several distinct types of super funds, each with its own structure and philosophy.

The Main Types of Super Funds

Your super will generally be held in one of four main fund types. They all aim to grow your retirement savings but differ in their costs, investment options, and level of member involvement.

-

Industry Funds: Originally for specific industries but now mostly open to all, these funds are run to profit their members, not shareholders. Some have a more limited range of investment options and a lack of transparency (unlisted investment holdings) can be a concern for some.

-

Retail Funds: Owned by financial institutions or investment managers, these are run to generate a profit for shareholders. They often offer a wider range of investment options, such as direct shares, ETF's, low-cost index options or more specialised options geared investment managers.

-

Public Sector Funds: Created for government employees, these funds often have features tailored to their original membership base, though some are now open to the public.

-

Self-Managed Super Funds (SMSFs): An SMSF is your own private super fund that you manage yourself. It offers ultimate control over your investments but comes with significant legal and administrative responsibilities. An SMSF is generally best for those with a large balance and a deep understanding of financial markets.

The decision isn't just about chasing the lowest fees. It's about finding the right balance of cost, long-term performance, investment options, and insurance cover that makes sense for you and your family.

The flowchart below gives a simple visual of how different types of contributions flow into your super—a key concept that your chosen fund will manage on your behalf.

As you can see, both pre-tax and after-tax contributions are crucial for building your super balance. Your choice of fund will play a big role in how effectively that money is put to work.

To help clarify the differences, here’s a quick comparison of the main fund types.

Comparing Super Fund Types

| Fund Type | Best For | Key Features | Considerations |

|---|---|---|---|

| Industry Funds | Most people, especially those seeking a simple, low-touch, "set and forget" approach. | Member-owned, generally more simple product features and investment choices. | Can have fewer investment options and less personalised service compared to retail funds. |

| Retail Funds | Individuals who want a wider range of investment options or need more tailored advice on their situation. | Owned by financial companies, extensive investment menus, often integrated with other banking/insurance products. | Fees can depend heavily on your chosen investment options, and they operate to profit shareholders, which can create a perceived conflict of interest. |

| Public Sector Funds | Government employees who can access specific benefits tailored to their employment. | Often have defined benefit options, tailored insurance, and a deep understanding of public sector work. | May not be open to the general public or may have features that aren't relevant to non-government workers. |

| Self-Managed Super Funds (SMSFs) | Experienced investors with a large super balance (typically $500,000+) who want maximum control. | Complete control over investments (including direct property), flexibility, and can hold up to six members. | High responsibility, complex compliance rules, and significant time and cost to administer. Mistakes can be costly. |

This table provides a high-level overview, but the best fit for you depends entirely on your personal circumstances and what you want to achieve.

Making a Strategic Choice for Your Future

Choosing a super fund is not a one-time decision. A young professional might start with a low-cost industry fund focused on growth. Decades later, as their balance grows and their goals evolve, their needs may change.

This is where personalised financial advice proves its worth. At Wealth Collective, our process starts with a deep dive into your personal situation, career path, risk tolerance, and retirement goals. We don't just look at performance charts; we determine which fund structure is the right strategic vehicle for your unique financial journey. By carefully weighing your options, you can ensure your super fund is a powerful tool actively building the future you want.

Actionable Strategies to Grow Your Superannuation

Having a super account is just the beginning. The goal is to make that money work as hard as you did to earn it. The difference between an average retirement and an exceptional one often comes down to shifting from being a passive saver to an active manager of your super.

A few smart, practical moves can dramatically boost your final balance.

Consolidate and Conquer High Fees

One of the easiest yet most powerful actions is to consolidate all your super accounts into one. If you've had multiple jobs, you've likely collected multiple accounts, each charging you separate administration and insurance fees.

These fees, even if small, erode your balance year after year. By rolling everything into a single, well-chosen fund, you pay only one set of fees, meaning more of your money stays invested and compounding for your future.

Review Your Investment Options

Your super is invested across a mix of assets like shares, property, and bonds. Most funds offer a menu of investment options, from conservative (lower risk, lower potential returns) to high growth (higher risk, higher potential returns).

The right mix depends on your age and risk tolerance.

-

Early Career (20s-30s): With decades to retirement, you can generally afford more risk for higher long-term returns. A 'Growth' or 'High Growth' option is often suitable.

-

Mid-Career (40s-50s): You might start moving toward a 'Growth' or 'Balanced' option that still aims for growth but with less volatility.

-

Nearing Retirement (60s+): The priority shifts to capital preservation. A 'Conservative' or 'Capital Stable' option reduces risk as you prepare to draw an income, although making sure inflation does not erode the value of your retirement savings is also critical, so well-managed growth exposure may still be appropriate with professional advice.

It’s a mistake to set and forget your investment option. A 25-year-old in a conservative option is missing out on decades of powerful growth, while a 62-year-old in a high-growth fund could see their balance drop right when they need it.

Make Voluntary Contributions to Accelerate Growth

Your employer's contributions are the foundation, but adding your own money hits the accelerator. As mentioned, making voluntary contributions—either before or after tax—is one of the most effective ways to build your super balance faster.

Even small, regular contributions can make an enormous difference over the long term, thanks to the power of compounding. For high-income earners and executives, this is a crucial strategy. This is a core part of the Guided Growth process at Wealth Collective, where we design a contribution strategy that fits your income and helps you reach your goals sooner.

The Overlooked Power of Insurance Within Super

Super is more than a savings account; it’s also one of the most cost-effective places to hold personal insurance. Most funds offer default cover for:

-

Life Insurance (or Death Cover): Pays a lump sum to your beneficiaries if you pass away.

-

Total and Permanent Disablement (TPD): Provides a payout if you become seriously disabled and are unlikely to work again.

-

Income Protection: Pays a portion of your income if you’re temporarily unable to work due to illness or injury.

Holding insurance inside super means premiums are paid from your super balance, not your household budget. The key is to ensure you have the right amount of cover for your situation—enough to protect your family without eroding your retirement savings.

Address the Gender Super Gap

Data consistently shows a significant gap between the super balances of men and women, often due to career breaks for family and historical pay inequality. This impacts a family's total retirement wealth. For example, data from June 2023 showed that for Australians aged 60-64, men had a median super balance of $219,773, while women had just $163,218. You can learn more about these superannuation gender disparities and their effects on Australian households.

A simple but powerful strategy to tackle this is making spouse contributions. If one partner earns less or is out of the workforce, the higher-earning partner can contribute to their super account. This not only boosts the lower balance but can also provide a tax offset, strengthening the couple's combined financial future.

Putting these strategies into action turns your super from a forgotten account into an active wealth-building engine. With a clear plan, you can take control and ensure your money is working as hard as possible to fund the future you deserve.

Accessing Your Super and Planning Your Retirement

After decades of hard work and saving, it's time to turn your superannuation balance into a reliable income stream to fund your retirement. This is where you'll face some of your biggest financial decisions.

Before you can access your super, you must meet a 'condition of release'. For most people, this means reaching their preservation age and permanently retiring.

Your preservation age depends on when you were born but is likely between 58 and 60. Once you meet this condition, you have two main options for your money.

Lump Sum or Pension: The Big Decision

You have two primary ways to access your savings, and the best choice depends on your personal circumstances and retirement goals.

-

Take a Lump Sum: You can withdraw some or all of your super as a tax-free cash payment. This can be tempting for paying off a mortgage, buying a car, or funding a holiday. However, once that money is spent, it’s no longer invested and earning returns.

-

Start an Account-Based Pension: This is the most common strategy. You move your super from the 'accumulation' phase into a 'retirement' phase account, from which you draw a regular income. The huge advantage is that the remaining balance stays invested in a completely tax-free environment, allowing it to continue growing.

For most retirees, a combination of the two is ideal. An account-based pension provides a stable income for daily living expenses, while a smaller lump sum can be used for larger purchases.

Understanding the Transfer Balance Cap

To ensure the tax-free benefits of the retirement phase are used fairly, the government introduced the transfer balance cap. This is a lifetime limit on the total amount you can move into a tax-free pension account, currently set at $1.9 million.

This doesn't cap your total super balance, only the amount you can shield from tax in the pension phase. Any amount over $1.9 million remains in your accumulation account, where investment earnings are still taxed at the highly concessional rate of 15%.

These decisions can feel overwhelming, but you don't have to navigate them alone. This is exactly what our Retirement Roadmap service is designed for. We help you build a clear, stress-free plan to convert your super savings into a secure and sustainable income stream for the years ahead.

It’s Time to Take Control of Your Financial Future

Understanding what superannuation is in Australia is the first step, but the real power comes from actively managing it. See it less as a forgotten savings account and more as one of the most powerful wealth-building tools you have.

The details around contributions, tax, and investments can seem complex, but grasping the fundamentals unlocks its true potential to build a comfortable—or even exceptional—retirement.

This is where a clear strategy makes all the difference. At Wealth Collective, our advisers are experts at cutting through the complexity to create an actionable plan that fits your life and your ambitions. We’re here to help you make decisions with confidence, ensuring your super is working as hard as it possibly can for you.

Start Building Your Financial Clarity

Getting to grips with Australia’s super system isn’t just a good idea; it’s essential for your future. As of September 2025, total assets in superannuation reached a staggering $4.5 trillion. That figure alone shows how central it is to the financial wellbeing of Australians.

With these assets now representing about 185% of GDP, optimising your slice of the pie has never been more critical. You can dive deeper into APRA's latest superannuation statistics and their implications to see the full picture.

For high-income earners and small business owners, in particular, a generic approach is not enough. A tailored strategy is what maximises growth, protects you from unnecessary risk, and ultimately paves the way for a stress-free retirement. Your financial future is too important to leave to chance.

The most effective way to secure the retirement you deserve is to move from passive saving to active planning. A clear, personalised strategy transforms your super from a simple nest egg into your most powerful wealth-building asset.

Let us help you build that strategy.

Ready to take that next step and gain complete clarity on your financial future? The team at Wealth Collective invites you to book a complimentary 10-minute introductory call. We’ll help you understand your options and start building the successful retirement you deserve. Book your introductory call with Wealth Collective today.