Business hours

Monday to Friday (8.30AM - 5PM)

Weekend (Closed)

Trauma insurance is your financial safety net for a serious health crisis. If you’re diagnosed with a major medical condition like cancer, a heart attack, or a stroke, it pays you a one-off, tax-free lump sum. This isn't about replacing your weekly paycheque; it’s about providing a significant cash injection so you can focus on getting better, not on your bills.

At Wealth Collective, we see this as a vital part of building financial security. It’s designed to ensure a health problem doesn't become a wealth problem, giving you the resources to navigate recovery with confidence.

What Is Trauma Insurance and How Does It Protect You?

When a major health crisis hits, the last thing you need is financial stress. Trauma insurance, also known as critical illness cover, is specifically designed to prevent a medical event from derailing your financial stability.

Unlike income protection, which pays a monthly benefit, trauma cover delivers a crucial lump sum right when you need it most. That money is yours to use however you see fit—no strings attached. This flexibility is key to taking financial pressure off your shoulders, allowing you to make decisions based on your health, not your bank balance.

For a quick overview, here are the core features of trauma insurance.

Trauma Insurance at a Glance

| Feature | Description |

|---|---|

| Payment Type | A one-off, lump-sum payment made directly to you upon diagnosis of a specified condition. |

| Purpose | To provide immediate financial relief to cover medical bills, living costs, and debt reduction. |

| Tax Status | The payout is generally tax-free in Australia. |

| Flexibility | You have complete freedom to use the money as you see fit—no restrictions. |

| Trigger | A claim is triggered by the diagnosis of a defined medical event, not by your inability to work. |

This table shows just how powerful this type of cover can be in providing immediate, flexible support.

Creating Financial Breathing Room

A payout from a trauma policy gives you the resources to handle unexpected costs that arise after a serious diagnosis. This financial backstop provides options and a sense of control when everything else feels uncertain.

For instance, you could use the funds to:

- Cover medical expenses not covered by private health insurance, like experimental treatments or specialist fees.

- Reduce or eliminate major debts, such as your mortgage, to lower your monthly expenses.

- Allow your partner to take time off work to support you, without worrying about the loss of their income.

- Modify your home or car to accommodate new physical limitations, making your recovery journey smoother.

This isn't just about replacing income; it's about providing a powerful financial buffer that puts you back in control. It means your decisions can be driven by what’s best for your health, not by financial constraints.

The Wealth Collective process is built on creating financial resilience. Trauma insurance is a non-negotiable part of a solid plan, shielding your wealth and family from life's curveballs so one medical event doesn't derail your goals.

The Cost and Value of Early Protection

So, what does it cost? The premium depends on factors like your age and smoking status.

To give you a real-world idea, a 30-year-old non-smoker might pay around $50-$80 per month for $300,000 of cover. In contrast, a 50-year-old non-smoker could be looking at $150-$250 per month for the same protection. As premiums increase with age, it often makes sense for younger professionals and families to lock in cover sooner. You can always discover more insights about trauma insurance costs in Australia.

By putting this protection in place, you’re building an essential safety net. Our role at Wealth Collective is to help you determine the right amount of cover for your unique life. We analyse your finances and goals to ensure your plan is strong enough to protect your family's lifestyle, no matter what happens.

So, What Medical Conditions Are Actually Covered?

A common question is: "What do I actually get paid for?" While policy documents can seem daunting, they are built around a core idea: providing a financial buffer when a specific, serious health crisis hits.

At the centre of every trauma policy are the ‘big three’: cancer, heart attack, and stroke. These form the foundation of most claims in Australia because they are so common. However, a good policy doesn't stop there, often listing over 40 specific medical events that can trigger a lump-sum payment.

But here’s a critical detail: not all policies are created equal. How one insurer defines a "heart attack" or which types of "cancer" are included can differ significantly. This is where professional guidance is invaluable.

The ‘Big Three’ and Everything Else

The structure of trauma insurance reflects the health realities we face in Australia. Insurers build policies around the illnesses most likely to cause financial disruption, which is why cancer, heart conditions, and strokes always take centre stage.

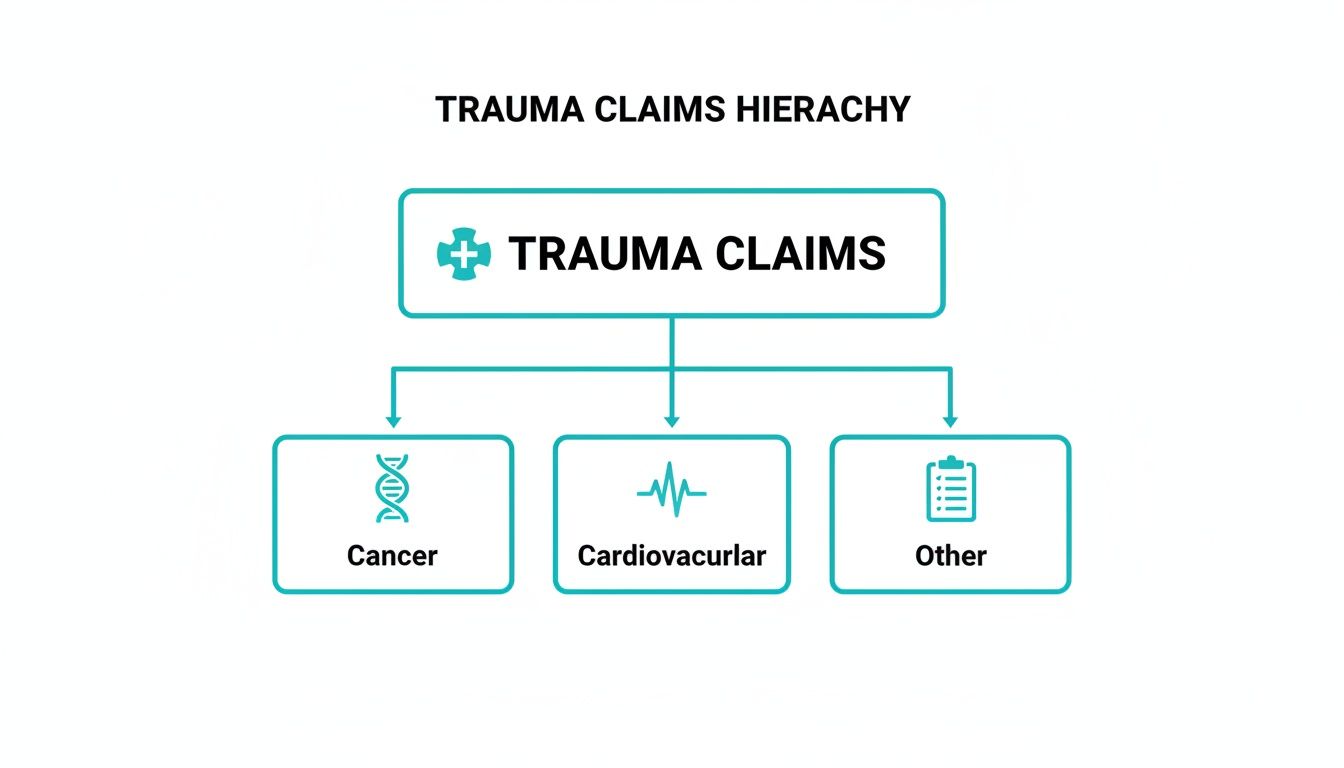

The statistics tell a stark story. Industry-wide, cancer is behind a massive 48% of all trauma insurance claims. Cardiovascular conditions, like heart attacks, make up another 20%. These aren't just numbers; they represent real people facing immense challenges. As you can learn more about Australian trauma claim statistics, the data makes a powerful case for this type of cover.

This is exactly why digging into policy specifics is so important. One insurer might pay out for an early-stage cancer diagnosis, giving you funds for immediate treatment. Another might only pay if the cancer is deemed life-threatening. Those small differences in wording can make a world of difference at claim time.

At Wealth Collective, our process involves getting into the fine print of the Product Disclosure Statement (PDS). We dissect the medical definitions to ensure the policy you choose will stand up and protect you when you need it most.

Standard vs. Comprehensive Cover

To provide more choice, insurers usually offer different levels of cover, such as 'standard' and 'comprehensive' (or 'plus').

A standard policy is your baseline, typically covering the most frequent critical illnesses—usually a list of around 40 conditions.

A comprehensive policy goes further. It covers a longer list of medical events and often includes partial payments for less severe conditions. For instance, you might get a partial benefit for an early-stage skin cancer removal, which wouldn't trigger a full payout but still comes with medical bills and time off work. It’s designed to provide a financial cushion for those serious-but-not-catastrophic health events.

Why Every Single Word in the PDS Matters

The Product Disclosure Statement (PDS) is your policy's rulebook. It contains the precise medical definitions an insurer will use to assess your claim.

For example, a policy might define a "stroke" as an event where neurological symptoms last for more than 24 hours. If you have a transient ischaemic attack ("mini-stroke") and your symptoms resolve within a few hours, you might not be covered under that specific wording.

Exclusions can also catch people out, especially if a condition is linked to a pre-existing health issue. This is why being completely upfront with your medical history is non-negotiable. This is where an adviser's expertise becomes essential, helping you navigate the complexities to find a policy that offers genuine security. At Wealth Collective, we do this detailed work for our clients to ensure there are no nasty surprises, only the confidence of a robust financial safety net.

How Trauma Insurance Compares to Other Personal Cover

It's easy to get lost in the world of personal insurance. Understanding the key differences between cover types is the first step to building a financial safety net that truly works for you.

Trauma insurance holds a unique place in any protection plan. Unlike other policies that trigger on death, permanent disability, or temporary inability to work, trauma cover provides immediate financial help right after a serious medical diagnosis. That distinction is crucial.

Life Insurance vs Trauma Insurance

The simplest comparison is with Life Insurance (or death cover). This policy pays a lump sum to your beneficiaries when you pass away. Its main job is to look after your loved ones after you’re gone, helping them pay off debts and cover future living expenses.

Trauma insurance, on the other hand, is a ‘living insurance’. It’s designed to protect you, while you’re alive, by providing funds to manage the immediate financial pressures of a serious diagnosis without draining your savings or super.

TPD Insurance vs Trauma Insurance

This is where the lines can feel blurry, but the difference is massive. Total and Permanent Disability (TPD) Insurance pays a lump sum if an illness or injury leaves you permanently unable to work again in a qualified occupation. The key word is permanent. The assessment process can be long and requires medical proof that your working life is over.

In contrast, trauma insurance pays out based on a diagnosis of a specific condition, regardless of your long-term ability to work. You could have a heart attack, receive your payout, make a full recovery, and return to work. The benefit supports you through treatment and recovery, not just in a worst-case, permanent disability scenario.

Within the Wealth Collective process, we position these as distinct layers of protection. TPD is your safety net for a catastrophic, career-ending event. Trauma insurance is your financial first responder for a serious—but potentially recoverable—health crisis.

The infographic below shows the most common reasons for trauma claims, highlighting why this cover is vital for events that don't necessarily lead to permanent disability.

As you can see, the vast majority of claims are for major illnesses like cancer and cardiovascular events—conditions from which many people recover and eventually return to work.

Income Protection vs Trauma Insurance

Finally, let's look at Income Protection. This cover replaces a portion of your monthly income (usually up to 70%) if you're temporarily unable to work due to illness or injury. It pays a regular benefit, like a salary, to cover day-to-day living costs until you can get back on your feet.

The purpose is completely different from trauma insurance. While income protection provides an ongoing cash flow for bills, trauma insurance delivers a large, one-off lump sum for big-ticket items a monthly benefit can’t cover—like clearing your mortgage, funding specialist treatments, or allowing your partner to take unpaid leave.

If you'd like to dive deeper, you can learn more about the different types of life insurance and how they fit together.

To make it even clearer, here's a simple table breaking down the core differences.

Comparing Personal Insurance Types

| Insurance Type | What Triggers a Payout | How It Pays Out | Primary Purpose |

|---|---|---|---|

| Trauma Insurance | Diagnosis of a specific serious medical condition (e.g., cancer, stroke). | One-off lump sum. | Cover immediate costs like medical bills, debt reduction, and lifestyle changes. |

| Life Insurance | Your death or diagnosis of a terminal illness. | One-off lump sum. | Provide for your dependents and clear debts after you're gone. |

| TPD Insurance | An illness or injury that leaves you permanently unable to work. | One-off lump sum. | Fund your long-term living and care costs when you can no longer earn an income. |

| Income Protection | An illness or injury that temporarily stops you from working. | Ongoing monthly payments. | Replace a portion of your lost monthly income to cover regular living expenses. |

As you can see, each policy plays a distinct role. This is the foundation of the 'Protection Plus' service we deliver at Wealth Collective—ensuring you have the right kind of financial support for the right situation, with no dangerous gaps in your plan.

Do You Need Trauma Insurance and How Much Is Enough?

Understanding what trauma insurance is and knowing if you need it are two different things. The real value of this cover becomes clear when you ask the tough 'what if' questions about your own life.

A serious medical diagnosis can create a significant financial gap overnight. Trauma insurance is designed to fill that gap. The need for it is directly tied to the life you’re building and the people you want to protect. The core question to ask is: what would happen to my finances if I couldn't work for six months or a year, all while medical bills were rising?

Who Should Consider Trauma Insurance?

While everyone's circumstances are different, certain life stages and responsibilities make trauma insurance a particularly smart move. Let's walk through a few common scenarios.

Scenario 1: The Young Couple with a New Mortgage

Sarah and Tom, in their early 30s, have just bought their first home. If Sarah were diagnosed with a serious illness, their two incomes would drop to one just as extra medical costs appear. A trauma payout could help them pay off a large portion of their mortgage, reducing their biggest monthly expense. This would give Tom the flexibility to reduce his work hours to care for Sarah, without the stress of losing their home.

Scenario 2: The Self-Employed Business Owner

David, a 45-year-old graphic designer, runs his own business. His income is tied directly to his work. If he had a stroke, it would mean no work and no money coming in. A lump-sum payment would be a business lifeline. He could hire a temporary replacement to keep the business running while covering his personal living expenses, allowing him to focus on recovery.

Scenario 3: The Single Parent

Emily is a single mum with two young kids. Her income is the only thing keeping the household afloat. If she were diagnosed with cancer, the financial fallout would be immediate. A trauma benefit would give her breathing room. She could use the money to cover childcare, pay for help around the house, and ensure her children's lives remain as stable as possible, removing the choice between her health and her family's financial security.

How to Calculate Your Ideal Coverage Amount

Working out how much trauma insurance you need isn’t guesswork. A good starting point is to aim for a financial buffer that would last at least one to two years, giving you time to recover without financial pressure.

At Wealth Collective, our 'Protection Plus' service dives deep into your specific needs, but you can get started by thinking through these key components:

- Debt Reduction: How much would it take to significantly reduce or clear your major debts? This includes your mortgage, car loans, and personal loans.

- Income Replacement: If you had to stop work, how much of your income would your family need? A common rule of thumb is to cover 50% of your annual salary for two years to maintain your lifestyle.

- Medical and Recovery Costs: Think about expenses private health insurance doesn't cover, such as out-of-pocket specialist fees, alternative therapies, or home modifications. A buffer of $50,000 to $100,000 is a sensible start.

- Ongoing Living Expenses: Add up your essential monthly costs—groceries, utilities, school fees. Multiply that by 12 or 24 to ensure your family’s lifestyle can be maintained.

Calculating your trauma insurance needs is a foundational step in building financial resilience. It’s about ensuring a health crisis doesn’t force you into impossible financial decisions, giving you the power to prioritise your recovery.

Thinking through these elements prepares you for a productive conversation with an adviser, shifting the focus from a generic product to a specific solution for your life. To gain clarity on your personal situation, book a complimentary 10-minute call with one of our advisers today.

Why Trauma Insurance Almost Always Sits Outside of Super

A common—and dangerous—assumption is that superannuation has all your insurance needs covered. While your super fund can be a cost-effective place for Life and TPD insurance, it’s a different story for trauma cover.

This isn't a minor technicality; it's a critical distinction that can leave you dangerously exposed.

The simple fact is, you can’t get comprehensive trauma insurance inside your super fund. Government regulations, known as ‘conditions of release’, strictly limit insurance within super. These rules dictate that benefits can only be accessed under specific circumstances like death, terminal illness, or permanent disablement.

A trauma insurance claim is triggered by a medical diagnosis. You could have a heart attack, receive a lump sum to aid your recovery, and be back at work in a few months. That scenario doesn't meet the strict "permanent" definition required by super law, which is why proper trauma cover is held separately.

The Problem with 'Default' Cover

Some super funds offer a basic, stripped-back version of "critical illness" cover. Relying on this is a huge gamble, as it often creates a false sense of security.

These limited, super-based policies typically have serious drawbacks:

- Smaller Payouts: Benefit amounts are often capped at a much lower level than a standalone policy.

- Tougher Definitions: The medical definitions used are often more rigid, making a successful claim harder.

- A Very Short List of Illnesses: The policy might only cover a handful of conditions, compared to the 40+ medical events a comprehensive standalone policy includes.

For most people, this type of default cover offers no meaningful protection. It creates a massive gap for millions of Australians who believe they are adequately insured. For more detail, read our guide on insurance inside your superannuation.

Believing you have proper trauma cover inside super is a common and costly mistake. For this specific protection, you need to look outside the super system to get the robust cover your family deserves.

The Stark Reality of Payout Differences

The gap between a default policy inside super and a professionally arranged standalone policy is a chasm. The data shows that claims paid from advised policies are substantially higher than those from group insurance inside super.

This highlights a major protection problem in Australia. Fewer than 4% of Australians hold any trauma insurance. For those who think they are covered by super, the numbers are sobering.

In 2024, the average life insurance claim paid from a super fund was just $134,000. In contrast, advised policies paid out nearly four times that amount, averaging $510,000. When it comes to trauma insurance, where most super funds offer nothing, members are left with zero protection. Meanwhile, advised trauma policies paid an average benefit of $258,000. You can learn more about the national insurance protection gap.

This isn't just about numbers; it's about what that money can do. A small default payout might cover a few bills. A properly structured benefit can clear your mortgage, replace lost income, and give you the breathing room to recover without financial stress. This is where our 'Protection Plus' service comes in—to ensure our clients have a strategy that truly delivers.

Secure Your Future with a Clear Protection Plan

Understanding trauma insurance is one thing; putting that knowledge into action is what builds a real financial buffer for you and your family. We've covered what this insurance is—a lump-sum payment for breathing room—the conditions it covers, and its crucial role in your financial plan.

For many Australians, trauma insurance is a non-negotiable part of financial security. It’s the safety net that stops a serious health crisis from becoming a financial disaster, so you can focus on what matters: getting better.

From Understanding to Action

You now have the 'what' and the 'why'. The next logical question is 'how'? How does this fit with your life, mortgage, family, and goals? This is where professional advice makes all the difference, turning general concepts into a concrete plan that works for you.

At Wealth Collective, our ‘Protection Plus’ service is designed to do just that. We work with you to build a clear, effective protection strategy aligned with your personal circumstances. We take a close look at your situation to ensure your cover is robust, reliable, and right for you. If you'd like to dive deeper, you can also read our guide on finding the best trauma insurance in Australia.

A well-structured protection plan is the foundation upon which wealth is built and secured. It provides the confidence to pursue your financial goals, knowing you are prepared for life’s unexpected challenges.

The most powerful financial move you can make is shifting from learning to proactive planning. When you get clarity on your personal insurance needs, uncertainty is replaced with confidence and peace of mind.

It’s time to take the next simple, effective step. We invite you to book a complimentary 10-minute introductory call with one of our award-winning advisers. It’s a straightforward, no-obligation chat to help you understand your options and start building the financial resilience you and your family deserve. Don't leave your future to chance—secure it with a clear plan today.

Answering Your Top Questions About Trauma Insurance

Once the basics of trauma insurance click into place, it's natural for more practical questions to surface. These are the details that matter when it comes to how a policy works in the real world.

Let's walk through some of the most common questions we get from clients.

Are the Premiums Tax-Deductible?

This is a common question. The short answer is no. When you own a trauma policy personally, the premiums you pay cannot be claimed as a tax deduction.

However, there's a significant upside: the lump-sum benefit you receive from a claim is paid to you completely tax-free. This is a critical feature, as it means every dollar is yours to use for your recovery, without needing to set aside a portion for the ATO.

Is There a Waiting Period Before a Payout?

Yes, and this is an important part of how these policies are structured. Every trauma policy has a ‘survival period’—a set timeframe that must pass between your official diagnosis and when the insurer pays the benefit.

The survival period is a standard industry condition, typically between 14 and 90 days, depending on the insurer and specific illness. Its purpose is to confirm the severity and ongoing nature of the condition.

The exact details will be laid out in your policy's Product Disclosure Statement (PDS). It’s worth knowing this upfront to set realistic expectations for when you can access the funds after a claim.

What if I Have a Pre-Existing Medical Condition?

Having a health issue in your past doesn't automatically disqualify you from getting cover. It simply means the insurer will need to take a closer look at your application.

Generally, the outcome will be one of these three:

- Standard Cover: For minor or well-controlled conditions, you may be offered a policy on standard terms.

- An Exclusion: More commonly, the insurer will offer you cover but specifically exclude your pre-existing condition and any related health events.

- A Premium Loading: Sometimes, they'll agree to cover the condition but will charge a higher premium to account for the increased risk.

Full transparency during your application is vital. A Wealth Collective adviser is invaluable in this situation, helping you frame your medical history accurately to find an insurer who can offer the best possible terms.

Navigating these nuances is precisely where good advice makes all the difference. Our 'Protection Plus' service at Wealth Collective is designed to cut through the complexity and find a policy that genuinely works for you.

Ready to get clarity on your own situation? Book a complimentary 10-minute introductory call with our team and let's start the conversation.